Even Frank Underwood would be impressed by Netflix's meteoric rise.

Just a month after the streaming service cracked the $500 level, it's celebrating another milestone. Netflix (NFLX) zoomed above $600 the threshold for the first time ever on Friday as Wall Street salivates over signs it may be close to cracking the tantalizing Chinese market.

Netflix has moved beyond being merely "on fire" to whatever comes next. "White hot" more aptly describes the performance for the company behind House of Cards, the drama about Underwood's incredible rise through politics.

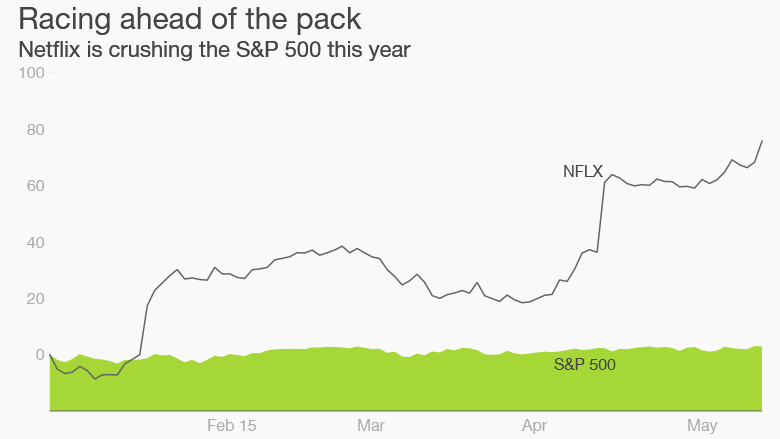

Shares of Netflix rose nearly 5% to $614 on Friday, and are up an eye-popping 77% this year alone. That makes the stock the best performer in both the S&P 500 and the Nasdaq 100. It's not even a close contest. Netflix has a 29 percentage point lead on its nearest competitor, Dutch telco VimpelCom (VIP).

So why are investors falling all over themselves to get a piece of Netflix? After stumbling late last year, the online movie and TV show service looks to be back on track.

"Globally there is a huge appetite to view programming on a binge basis. Right now, Netflix owns that business," said Jeff Wlodarczak, an analyst at Pivotal Research Group who covers the stock.

Related: Is Netflix going to $900 a share?

China = Icing on the cake: That appetite could grow meaningfully if Netflix finds a way to get a piece of the fast-growing online video market in China.

Netflix is in talks to partner with a Chinese company backed by Alibaba founder Jack Ma, Bloomberg News reported.

No deal has been announced with that company, Wasu Media Holdings, and Western companies have found this market difficult to figure out. Netflix did not respond to a request for comment.

But tapping into China's explosive growth would be huge for Netflix. It would also largely be icing on the cake. Wlodarczak said he's not currently forecasting Netflix to add any subscribers in China at this point.

Related: Remake fever! 'Full House' the latest to get second life

"Historically that's been a fairly tough nut to crack. But partnering with Jack Ma maybe makes it a lot more realistic," Wlodarczak said.

China could be the next growth engine for Netflix's valuation, which spiked to $37 billion on Friday. That means it's now significantly larger than traditional media companies Viacom (VIA) and CBS (CBS). It's also about half the size of 21st Century Fox (FOXA), Rupert Murdoch's film and TV empire.

Is Netflix too pricey? Yet unconfirmed reports about China will do little to quiet the skeptics who argue that Netflix is overvalued.

Netflix is currently trading at an enormous multiple of 426 times this year's projected earnings. That's the richest price-to-earnings ratio of any company in the S&P 500 -- aside from Amazon.com (AMZN) -- according to FactSet Research data.

Next stop, $900? Netflix bulls say the focus on multiples is misguided because the company is spending heavily to drive subscriber growth, hurting profits. Wlodarczak compared it with people who felt satellite TV company stocks were expensive 15 years ago, forgetting that their heavy spending was adding meaningful value to the company.

Last month FBR Capital Markets raised eyebrows by saying Netflix could race to $900 by next year. Crazy talk, right? Maybe not.

"If everything breaks right I don't think that's a huge stretch or crazy," said Wlodarczak.