The International Monetary Fund isn't just trying to solve Greece's woes, it's also doling out a lot of advice to America's Federal Reserve.

IMF head Christine Lagarde has already told the Fed it should wait until 2016 to raise interest rates. Now, the IMF recommends that the Fed ditch its famous "dot plot."

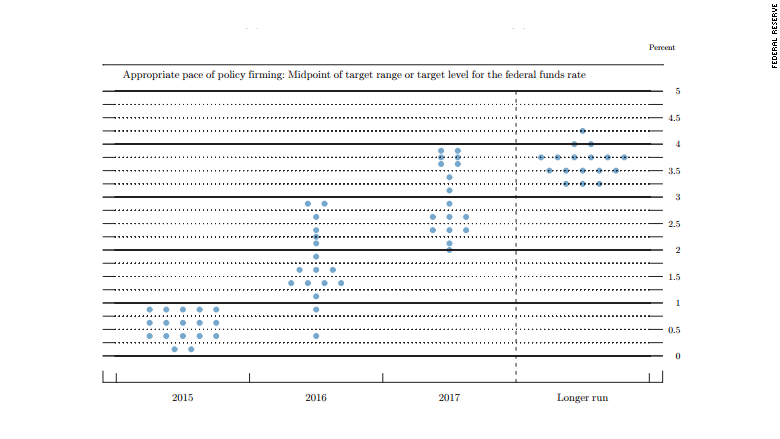

The dot plot is supposed to give the public more clarity on what the Fed is likely to do on interest rates, but the IMF calls it "awkward."

The plot is a chart with 17 little blue dots. Think of them like votes. Each of the 17 Fed officials get to place a dot on what number he or she thinks U.S. interest rates will be at by the end of 2015, the end of 2016, and the end of 2017.

There's a lot of variation in the dots. They range from close to 0 to close to 1% for the end of 2015. And there are no names attached to the dots, so it's guesswork to figure out what each member thinks.

Related: IMF: Fed shouldn't raise rates until 2016

"The public cannot identify which dots belong to which individual and the median of the dots may be far from internally consistent with the median of the marcroeconomic forecast," IMF staff wrote in a working paper released this week.

The IMF staff recommend replacing the dot plot with something more straightforward such as just showing one dot or line that represents the majority's opinion. The IMF says that would be a better indicator of where interest rates are likely going than trying to figure out 17 different dots.

Why it matters: It sounds like a wonky debate for economic nerds, but the Fed's every word and projection has a large impact on the markets and economy in the U.S. -- and around the world.

The Fed is trying to decide when to lift interest rates off of their historic lows near zero. The Fed cut rates so low to try to stimulate the economy after the 2008 financial crisis. The question now is whether the economy is strong enough for the Fed to raise rates.

The dots are meant to give an indicator of whether Fed members think the economy is healthy enough for a rate hike (or even two rate hikes) in 2015, but the IMF thinks the Fed can do better.