It's hard to believe, but people care more about the veteran iPod than the brand new Apple Watch.

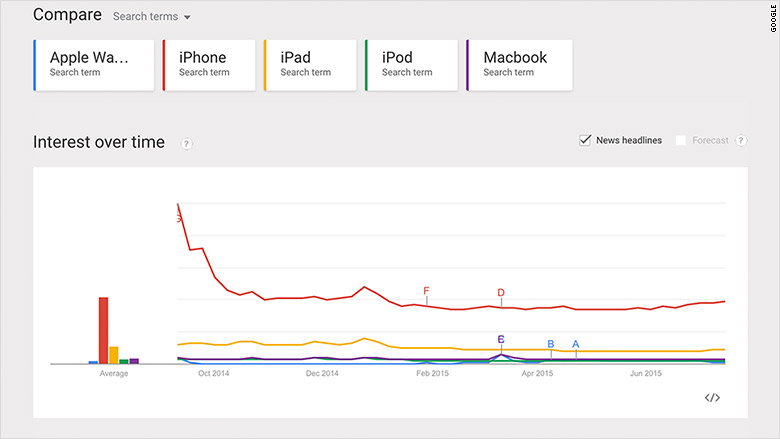

A search on Google (GOOG) Trends comparing five of Apple's products-- iPod, Macbook, iPhone, iPad and Apple Watch-- reveals that people are searching for the Watch far less than any of the other Apple products.

The iPhone is by far Apple's most-searched product, followed the iPad. The Mac and iPod trail the iPad by a sizeable margin. And then there's the Watch, generating about half the search traffic of the iPod and 1/16 that of the iPhone.

The Apple Watch was announced in September 2014, made available online on April 10 this year and it debuted in stores in mid-June. To consumers, each of these milestones look like non-events if we judge by Google's real-time data.

Where a 100 on the scale signifies peak popularity (obviously reached by the iPhone), the Apple Watch has barely ever touched two digits.

The company's first new gadget in five years-- the first since Steve Jobs died-- could turn out to be a bad apple (excuse the pun).

What's the demand actually like?

With Apple keeping mum about Watch sales figures, Google Trends and e-receipt data is the little hard evidence we have to judge performance.

Just last week, Slice Intelligence reported a 90% decline in Apple Watch orders since its launch from a snapshot of 2.5 million online U.S. users' e-mail receipts.

Wall Street analysts aren't sure what to make of that.

Related: The Apple Watch will flop. Here's why

Slightly over 20 million watches will sell this year, according to Creative Strategies analyst Ben Banjarin. His estimates are based on supply chain volume output and surveys researching consumer demand and interest to buy the Apple Watch.

"We continue to see strong demand and interest in large markets like China, and expect Watch demand to grow even stronger by the end of the year," Banjarin wrote.

Pacific Crest Securities analyst Andy Hargreaves, however, sees a slump. He wrote in a note to clients: 'Anecdotal evidence suggests Apple Watch demand is slowing quickly.' He slashed his sales prediction for 2015 to 10.5 million - 500,000 less than his initial estimates.

Trip Chowdhry, Managing Director of Global Equities Research, has a more positive outlook. He estimates 5 million Apple Watch sales for this quarter alone.

"They've definitely sold over 2.5 million," he says, referring to over 1 million orders placed on the launch date and the backorders until June.

"What is happening right now is people are evaluating. The real catalyst will come after September," Chowdhry told CNNMoney. He estimates that 40-45 million Apple watches could be sold by the end of the year, as people see others using it.

Apple's silence doesn't help

Talking heads about Apple Watch sales are plenty but Apple remains mum. Its figures are the only accurate figures out there and it won't release Apple Watch sales any time soon.

Now whether that's to avoid competitors getting access to sales figures, as CEO Tim Cook claims, or because Apple too has low expectations is a mystery.

It's unlikely that the guessing game will cease on July 21, when Apple reports its third fiscal quarter because it already said Apple Watch sales will be reported under the category of "other" products, along with Apple TV, Beats Electronics and Apple-branded third-party accessories.

Morgan Stanley analyst Katy Huberty agrees that the response to the Watch is lukewarm. Yet she writes that Watch's debut has been more successful than the iPhone's in 2007.

Huberty wrote: "Both products had limited distribution at the beginning — iPhone at AT&T and Watch on the Apple online store — but the Watch has seen more supply constraints due to some component issues and we believe likely conservative demand forecasts by Apple."

Mixed expectations

What's behind the low interest? People may just not be so interested in wearables, which is a tiny market compared to smartphones, PCs, tablets and other more established gadgets.

"With wearables ... the segment is still a nice to have vs. a must have," Carolina Milanesi, research chief at Kantar Worldpanel. "Those two phases will not follow seamlessly but you will likely see a drop and then an increase."