McDonald's (MCD) is fighting -- and losing -- a burger war on two fronts.

Burger King is stealing away low end customers with hot-selling items like chicken fries and extra-long pulled pork sandwiches.

At the same time Wendy's (WEN) is luring customers with higher-priced favorites like the bacon portabella melt on brioche.

"Wendy's has repositioned themselves towards the higher end -- and it's worked. McDonald's is losing share at both ends," said Nick Setyan, an analyst who covers restaurant stocks at Wedbush Securities.

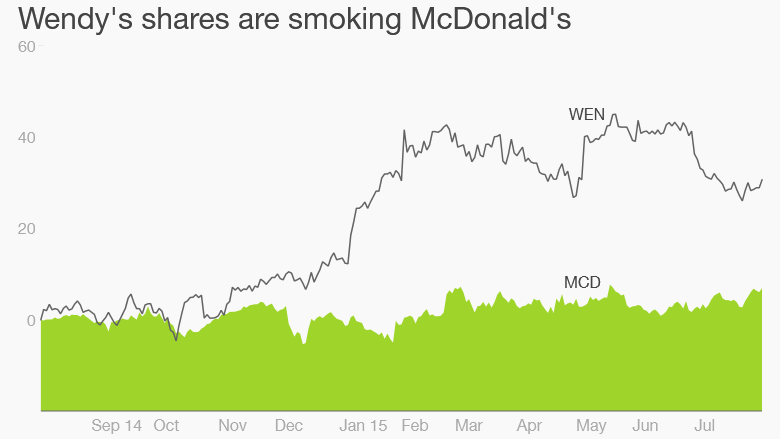

Wall Street thinks it's working too. Shares of Wendy's rose 1% after reporting quarterly results on Wednesday, leaving them up 30% over the past year. McDonald's is up just 7% from a year ago.

Related: Burger King is winning burger wars...thanks to chicken fries

McDonald's would kill for this growth: While McDonald's sales are shrinking, Wendy's is firmly in growth mode. Wendy's North American same-restaurant sales increased 2.4% in the second quarter from the year before.

Burger King is growing at an even faster pace. Its same-restaurant sales soared nearly 7% last quarter thanks to enthusiasm for its new menu items. Shares of Restaurant Brands International (QSR), the company that owns both Burger King and Tim Hortons, have rallied over 13% year-to-date.

Life is more depressing for McDonald's. U.S. sales dipped 2% last quarter at the Golden Arches. McDonald's, the largest fast-food chain in the world, is trying lots of new things to lure in customers, including adding burgers with lettuce "buns" and testing all-day breakfast service.

Related: Not loving it: McDonald's franchisees are depressed

Mixed fortunes for franchisees: Burger King can take on McDonald's at the cheaper end of the menu because many of its restaurants are owned by franchisees. That means the company makes most of its money off of royalty payments, not profits from individual restaurants.

Wendy's still owns many of its restaurants, although that's changing. Wendy's sold its stores in Canada in the second quarter and it's moving ahead with the sale of 540 domestic locations to franchisees. These restaurants have generated "extremely strong" interest from potential franchisees, Wendy's said.

That's a big differences from McDonald's. A recent survey by Janney Capital shows McDonald's franchisees are deeply pessimistic. Some fear they may be stuck with weak-performing restaurants that nobody wants to buy.