America's stock market is having a rough week.

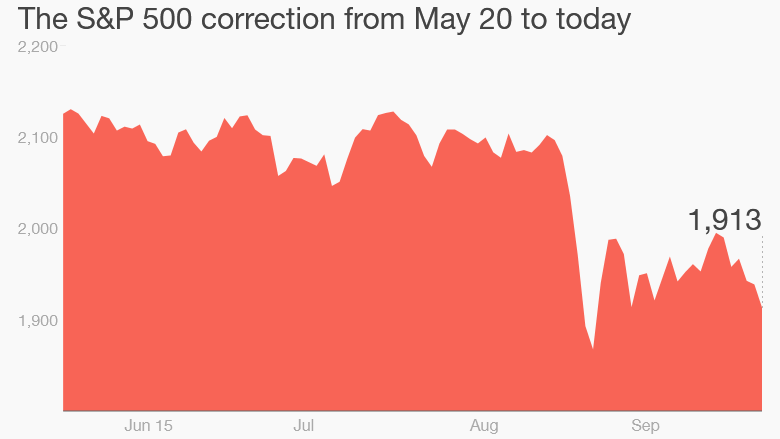

Before bouncing back from the lows Thursday afternoon, the S&P 500 briefly fell into correction, dropping 10% below its most recent intraday high set on May 20.

The markets have had a bad week on a slew of confusing and negative news. The S&P 500 has suffered losses every day this week while the Dow has lost 600 points since last Thursday. The Nasdaq, which also rallied after going into correction territory, has erased all its gains for the year.

Several members of the Federal Reserve's committee spoke publicly earlier this week to clarify why the central bank didn't raise its key interest rate last week. But their comments only confused investors more.

Investors could get more clarity when Fed Chair Janet Yellen speaks Thursday evening in Amherst, Mass.

Negative news dominated headlines. China's manufacturing index dropped to a 78-month low. It's another sign that China's economy, the world's second largest, could be slowing down more than previously. That would weaken the global economic outlook even further.

Related: BMW stocks plunges on pollution report

Corporate news has also been a downer. The Volkswagen emissions scandal has led to the resignation of its CEO, Martin Winterkorn, and its stock has plunged 30% since the news broke.

On Thursday, another report found that BMW too was cheating on its emissions standards.

And in the U.S., one of America's largest companies Caterpillar announced it was lowering its sales outlook and that it will cut more than 10,000 jobs by 2018.

It's still important to note that most Wall Street experts believe the S&P 500 will finish this year with gains. That's looking like a tough target now -- the S&P 500 is down 6% so far this year.