President Obama is on a mission to remind America of the economic U-turn that's occurred since he took office.

In January 2009, the economy was in free fall. Millions of Americans were losing jobs -- and their homes. Businesses were going bankrupt. The all powerful American banking system and the invincible U.S. auto companies needed government bailouts.

The United States hadn't seen anything that bad since the Great Depression.

Today, the nation has come a long way.

"The strides we've made the last eight years are pretty amazing," hedge fund manager Jim Chanos told CNN's Poppy Harlow in October.

In Obama's first few months in office, unemployment hit 10.3% (it would later be revised to 10%). Today it's down to 5% -- what most economists consider normal and healthy.

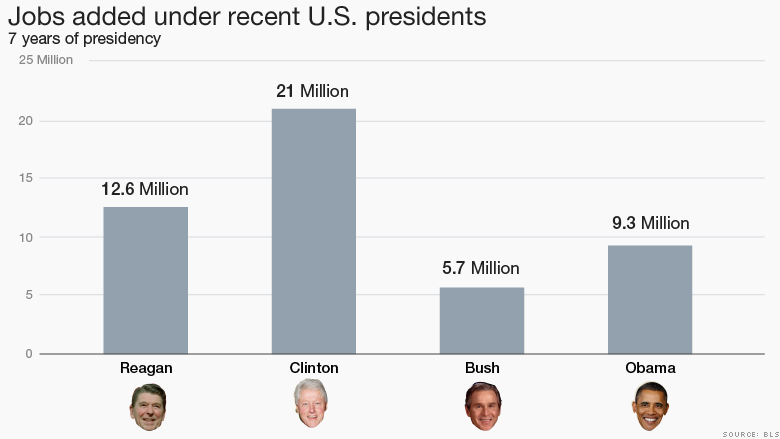

To put it another way, America has added almost 9.3 million new jobs since Obama took office. That's after subtracting all the job losses from the recession.

Obama still falls well short of the employment gains under Presidents Reagan and Clinton, but he's done a lot better than George W. Bush.

Why Obama isn't taking a big victory lap

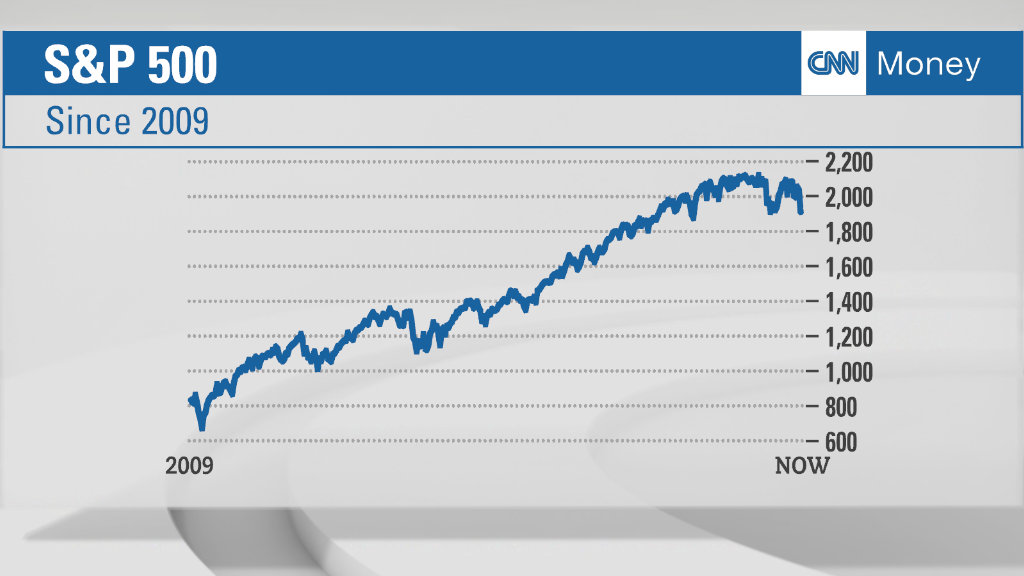

The president has plenty of economic successes to tout as he shapes his legacy in his final year in office: the country is nearing full employment, the stock market is near all-time highs (despite the recent pullback), corporate profits have shattered records, there's (nearly) universal health care, gas prices are at $2 a gallon, and the federal deficit has shrunk.

But Obama's victory lap has pot holes.

The economy just isn't that robust, and wages for average Americans aren't going up.

People might not be having the heart attacks they did during the Great Recession, but they're still worried. Nearly three in five say they are "sometimes" or "frequently" anxious about their financial situation.

Related: Obama's economy in 10 charts

Salaries aren't going up

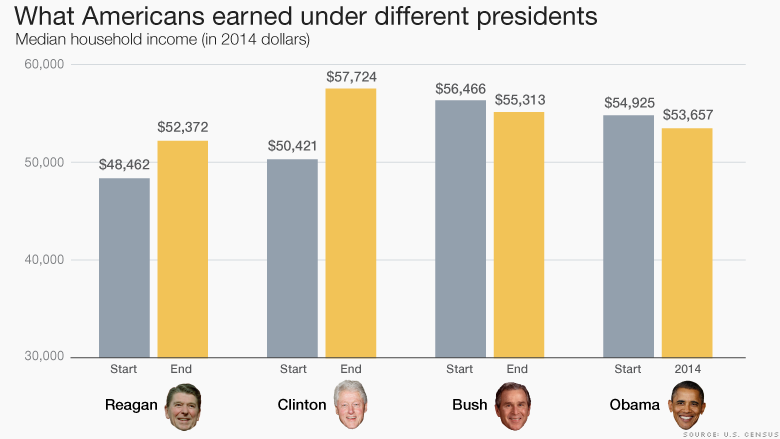

The biggest flaw in the Obama economy is wages. People are making less money today than they did when the president took office (after adjusting for inflation).

Labor Secretary Tom Perez, an Obama appointee, calls it the "unfinished business" of the recovery. The president has advocated for raising the minimum wage. But the problems run deeper than that.

Middle class incomes aren't rising either. The median household income has actually fallen under both President Obama and President George W. Bush. It's an alarming trend that means the middle class is earning about the same today as in the mid-1990s.

There's "palpable disappointment" about the economy, says Mark Hamrick, Washington Bureau Chief for Bankrate.com. "Hailing headline unemployment at 5% misses the point if wage data doesn't look much better."

Related: China will hold global economy back in 2016

Growth is good but not great

Growth has also disappointed.

Ed Yardeni, president of Yardeni Research, says America's economy is stuck in the "Twilight Zone." It's not in recession anymore, but it's not a boom time, either.

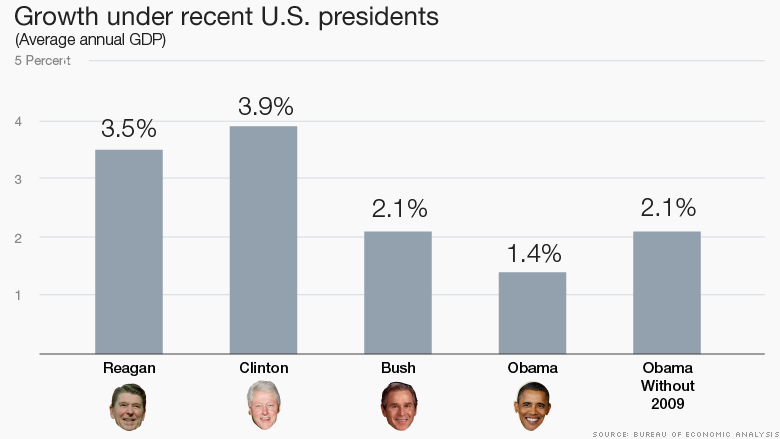

America averaged over 3% growth a year from 1969 to 2007. Lately, the U.S. has found it hard to grow GDP at much over 2% a year.

Even excluding 2009 (President Obama's first year in office), the economy has only grown 2.1% on average under his tenure. That's the same as under President Geroge W. Bush. And it looks sluggish next to the Reagan and Clinton eras.

Related: Obama is the best gun salesman in America

Debt has skyrocketed

The Obama legacy will also be one of debt. The government has spent far more money than it brought in every year during his tenure.

Some of that was spent on wars. And some on trying to stimulate the moribund economy.

Lately, the deficit has come down. For 2015, the deficit is $439 billion. That's the lowest since 2007.

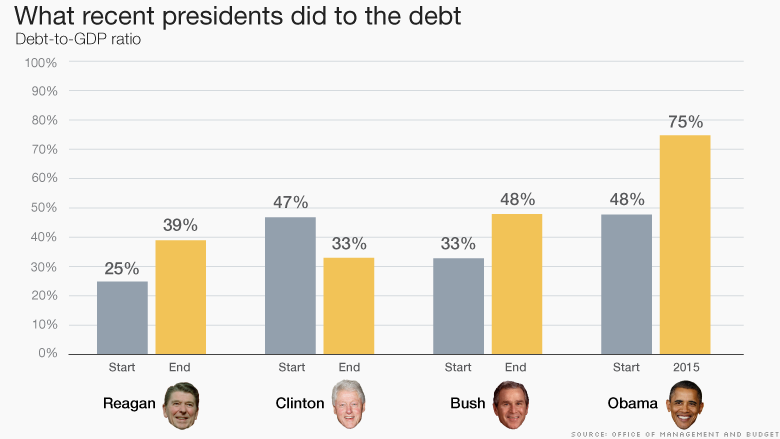

But years of overspending add up. One measure of the size of America's debt -- the debt-to-GDP ratio -- has increased from 48% the year Obama took office to 75% now.

That's not anywhere near Greece levels, but with Baby Boomers retiring, it's enough to raise concern about America's debt load going forward. Standard & Poor's downgraded the U.S. debt rating in 2011.

That said, the only president in recent history to end his tenure with a lower debt-to-GDP ratio than when he started was Clinton.