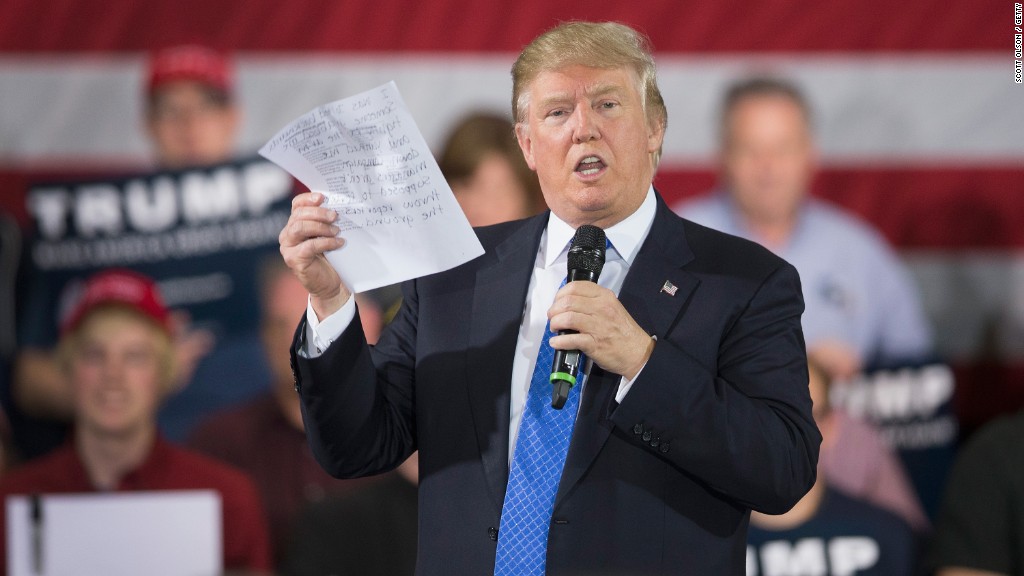

Donald Trump dubs himself the "king of debt." Experts say he doesn't have a clue -- at least when it comes to U.S. government debt.

Only a few weeks ago, Trump said he could eliminate federal debt in just eight years, a nearly impossible task. Trump's own tax plan would add trillions to the debt.

Now he says the U.S. should just borrow more and renegotiate the terms later.

"I would borrow, knowing that if the economy crashed, you could make a deal," Trump said on CNBC last week.

The reaction on Wall Street and in Washington was that Trump can't be serious. U.S. bonds are seen as one of the safest (if not THE safest) places to put your money in the world. Tinkering with that would almost certainly hurt America for years to come.

"Mr. Trump doesn't have a coherent idea of what he's talking about," says Michael Strain, an economic policy expert at the American Enterprise Institute, a conservative think tank. "This is the bond market equivalent of 'we're going to build a wall and have Mexico pay for it.'"

Related: Donald Trump: 'I'm the king of debt'

Trump tries to clarify his debt plan

Paying creditors back anything less than the full amount calls into question the "full faith and credit" of the United States.

"People would read this as a default," says Maya MacGuineas, president of the Committee for a Responsible Federal Budget. "It's saying we're not repaying you what you're owed."

On Monday, Trump walked away from those comments. He told CNN's Chris Cuomo he was misquoted.

"First of all, you never have to default because you print the money," he said on CNN's "New Day."

Trump says what he really wants to do is have the government find a way to buy some bonds back at a cheaper price. It's a fairly common practice for companies with "junk bonds" that are in financial duress.

But Strain, MacGuineas and many others say it would be a disastrous tactic for the United States government.

Related: Donald Trump won't bail out Puerto Rico

The problems with Trump's debt buyback plan

First of all, businesses typically buy back debt when they are in trouble. It's seen as a red flag. Investors agree to accept less money because they would rather get 80 cents on the dollar than nothing. The U.S. would have to be in terrible economic shape for this scenario to be an appealing idea.

Second, it would alarm investors in the U.S. and around the world to see the trusted U.S. Treasury playing games in the bond market. It could cause huge uncertainty, and possibly raise U.S. borrowing costs for years as investors demand higher interest payments. Other nations like China might even retaliate with trade sanctions or other economic tactics.

Third, if Trump buys back bonds at a lower price, it doesn't just hurt the Chinese and Japanese who hold the debt. It would also harm millions of Americans who hold U.S. bonds in their retirement and savings accounts.

Fourth, the federal government doesn't have any money to buy debt back with. The U.S. already has $19 trillion in debt. Trump's plan would require the U.S. Treasury to issue new debt to buy old debt.

Or it would require the Federal Reserve (America's central bank) to buy the debt. That can cause inflation (or even hyperinflation), and send prices of everything from food to rent skyrocketing.

And that's to say nothing of the fact that the president doesn't control the Fed, so it's unclear how Trump could even get more money into the economy that way.

"Trump's recklessness has no limits, even to the point of suggesting Treasury debt restructuring. He's playing with matches in a very arid forest," wrote Greg Valliere, chief investment strategist at Horizon Investments, in his morning note Monday.

Related: Trump's latest wild claim: He'll fix the debt in 8 years

Wall Street dismisses the latest idea

Trump's full quote from CNN on Monday morning is below:

"I said if we can buy back government debt at a discount, in other words, if interest rates go up and we can buy bonds back at a discount -- if we are liquid enough as a country, we should do that," he said. "In other words, we can buy back debt at a discount."

Many on Wall Street shrugged off this latest proposal as so out there it isn't even worth considering.

"The U.S. is not falling off a cliff any time soon," says Guy LeBas, chief fixed income strategist at investment firm Janney. LeBas thinks it would take a worse disaster than the Great Recession to make Trump's plan remotely worth considering.