Reality Check: Clinton on jobs her economic plan would create

By Patrick Gillespie, CNNMoney

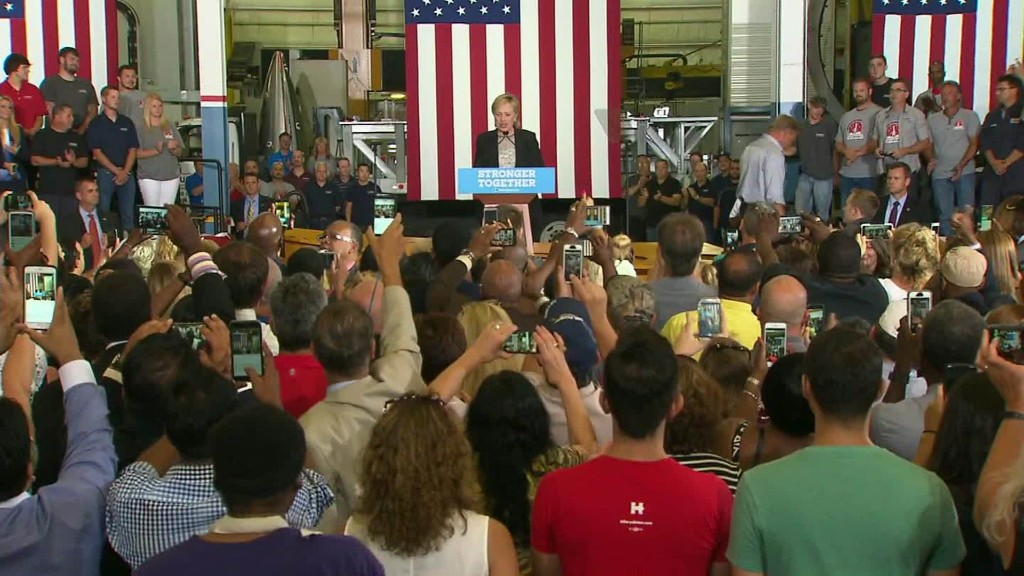

Hillary Clinton said in a Thursday economic speech in Warren, Michigan, that the nation would create more than 10 million new jobs under her tenure, while it would lose 3.4 million under Donald Trump.

"According to an independent analysis by a former economic advisor to Senator John McCain, if you add up all of Trump's ideas...the result would be a loss of 3.4 million jobs," she said in Detroit. "By contrast, that same analyst found that with my plans, the economy would create more than 10 million new jobs."

Clinton is referring to Moody's economist Mark Zandi. He reviewed each candidate's plan and issued reports that said Trump's policies would cause a net loss of 3.4 million jobs, while there would be 10.4 million jobs created under a Clinton presidency.

Related: Moody's: Trump's plans would cost 3.5 million jobs

However, when contacted by CNNMoney, Zandi said a more accurate comparison to the 10 million jobs created under Clinton would be 400,000 jobs lost under Trump, not 3.4 million. The difference stems from a change in the time frame. It appears Clinton chose one time frame from Zandi's report on the number of jobs she claims she would create and another time frame for when she said Trump's policy would lose jobs.

Also, Clinton is exaggerating the number of jobs her policies would create. If neither candidates' agendas were implemented - essentially if nothing changed - the economy would add 7.2 million jobs on its own, Zandi says.

So Clinton's policies would only add an extra 3.2 million jobs on top of what would already be created.

Related: Moody's: Clinton economy would create 10 million jobs

While Clinton calls Zandi's analysis "independent," it's important to note that Zandi has donated to Clinton's campaign and Trump's staff has heavily criticized Zandi's analysis of the Republican nominee's plans.

Therefore, we rate this claim as TRUE BUT MISLEADING.

Reality Check: Jobs and college degrees in 2020

By Eve Bower, CNN

Speaking to a crowd gathered at a tool manufacturing plant in Michigan, Hillary Clinton called for a national campaign to address the changing job climate facing many American factory workers.

"I think we have to reverse what has become a commonplace view, which is that everybody needs to go to college," she said. "In fact half of the jobs that are going to be available by 2020 do not require a college four-year degree."

"Let's get the word out that there are really good jobs for people right now and there will be more in the future if you get the skills in high school, at community college, in an apprenticeship, or other training program," she said.

A recent study supports this claim for the year 2020.

The report, by Georgetown University's Center on Education and the Workforce, found that, through the year 2020, of the 55 million jobs that will become available in the United States, only 35% will require a bachelor's degree or more.

The same study found that 65% of all jobs in 2020 will require "post-secondary education and training beyond high school." The center also said that "individuals that only possess a high school diploma will have fewer employment options" than those who have more education.

Secretary Clinton's statistics were roughly accurate. For this reason, we rate Clinton's claim as TRUE.

Related: College grads are getting nearly all the jobs

Reality Check: Clinton on Trump Loophole

By Jeanne Sahadi, CNNMoney

In contrasting her economic vision with Donald Trump's on Thursday, Hillary Clinton slammed what she termed the "Trump Loophole."

"It would allow him to pay less than half the current tax rate on income from many of his companies. He'd pay a lower rate than millions of middle class families," Clinton said during her speech in Warren, Michigan.

Here's what she is referring to: Under his tax reform proposal, Trump would slash the income tax rate on all business income to 15%. That includes business entities such as limited partnerships (LPs), limited liability corporations (LLCs) and S Corps.

They're known as pass-throughs entities, because the entity itself isn't subject to income tax. Instead, its profits are passed along to its shareholders and partners, who then report them on their individual tax returns.

Today, those profits are taxed at a top rate of 39.6%. Under Trump's proposal, they would be taxed at just 15%.

Related: Hillary Clinton slams "Trump Loophole"

Trump's financial disclosure documents -- which list all of his assets and businesses interests -- are chock-full of LLCs and LPs.

Therefore, we rate Clinton's claim as TRUE.

Reality Check: Clinton on Affordable College

By Amy Gallagher, CNN

In her speech on the economy, Clinton spoke to a deep concern for many working parents - how they'll afford college for their kids.

"It's crucial that every American has access to the education and skills they need to get the jobs of the future. So we will fight to make college tuition-free for the middle class and debt-free for everyone."

Some context here: Clinton's final plan is the direct result of the push and pull between her and Senator Bernie Sanders during the Democratic primary. Sanders touted his plan for "tuition-free college for all" - defining this as free tuition at public universities in a student's home state. Clinton at first countered that she would make community college tuition-free. When it was clear that Clinton was losing younger voters to Sanders, she shifted her position and offered a new proposal for free tuition at public colleges, but she was clear "I don't want to make college free for Donald Trump's kids."

Related: Would you get free tuition under Hillary Clinton?

According to her campaign website, her proposed plan does not cover families with household incomes over $125,000 a year. That means her plan does cover about 80% of American families. What constitutes "middle class" is debatable, but if you accept her definition of the middle class, the math checks out, so we rate the tuition portion of her claim: TRUE.

But what about "debt-free for everyone"? Her tuition plan would not cover room and board, fees, books or supplies and these are often a significant portion of the cost of college. Even families that can afford tuition may still have to take out loans to cover all the other costs of college, so we rate this portion of her claim FALSE.

Reality Check: Clinton on Trump's child care plan

By Tami Luhby and Jeanne Sahadi, CNNMoney

Hillary Clinton blasted Donald Trump's plan to exclude child care costs from people's income, saying "it's transparently designed for rich people."

"He would give wealthy families 30 or 40 cents on the dollar for their nannies, and little or nothing for millions of hard-working families trying to afford child care so they can get to work and hold the job," she said.

Here's what Trump said he would do:

"My plan will ... help reduce the cost of child care by allowing parents to fully deduct the average cost of child care spending from their taxes," Trump said in a speech in Michigan on Monday.

There has been confusion among tax and child care experts as to how the break would work, because the candidate, the campaign and an outside economic adviser each described the break very differently.

Related: What Clinton and Trump would do for parents

The Trump campaign tried to clarify the issue to CNNMoney. While details are still being finalized, a spokesman confirmed the following:

-- Parents could write off the average cost of child care in their state for their child's age. Anyone with child care expenses who ends up owing income tax could take this benefit, even if they don't itemize their deductions.

-- Low-income filers, who often end up owing nothing in income tax, could instead take their deduction against their payroll taxes for Social Security and Medicare.

Still, tax experts said the break as described may not benefit lower income parents very much for at least two reasons. First, they have to pay child care costs throughout the year, so waiting until tax time for relief may be "too late to be much help for needy families," said Elaine Maag, a senior research associate at the Tax Policy Center.

Second, what low-income filers pay in payroll taxes is typically much lower than what they owe in child care costs. "If you earned $20,000 in a year, your share of payroll taxes would be about $1,500. That would be the maximum amount of money that could be delivered through a payroll tax deduction," Maag said.

It could be even less -- just $750 -- if an earlier statement from the campaign applies, she noted. That statement promised that parents could "exclude child care expenses from half of their payroll taxes."

As for how much wealthy families would save, it would depend on how the credit is structured. But the top tax rate is 39.6%, so excluding child care costs from income could save the wealthy nearly 40 cents on the dollar.

We rate Clinton's claim as TRUE.

Reality Check: Clinton on undocumented workers paying Social Security

By Kate Grise, CNN

During a speech on the economy, Hillary Clinton laid out parts of her immigration reform plan and said that moving toward reform would help all Americans and the economy.

"We already have millions of people working in the economy and paying $12 billion a year to Social Security even though they are undocumented," she said.

The Clinton camp told Politifact that she was referring to a 2013 actuarial note from the Social Security Administration.

According to the report, the $12 billion figure included contributions from both undocumented workers and their employers into Social Security.

The Office of the Chief Actuary estimates that there were 3.1 million undocumented immigrants who worked and paid Social Security taxes in 2010. It estimated that a worker earned about $34,000 a year and that both employee and employer paid a 6.2% tax rate, which resulted in a $13 billion contribution to Social Security. These workers may have had a work permit and overstayed their visa, used fake birth certificates to get a Social Security number or used a Social Security number that did not actually belong to them.

The report said that some of those workers could have drawn benefits totaling an estimated $1 billion, which leaves us with $12 billion in the Social Security fund.

The Heritage Foundation, a conservative think-tank, estimates that the total paid into the Social Security trust by undocumented workers is closer to $7 billion but does not include contributions from the employer.

Both of these figures are, of course, rough estimates. Each report had to narrow down the population of non-permanent residents or citizens to come up with the number of undocumented workers who were actually paying into Social Security.

We rate Clinton's claim as MOSTLY TRUE because at the end of the day, these figures are estimates based on the best numbers we have to go off of, but they are not exact figures. Also, the figure is from 2010 and is likely to have changed in the last six years.

Reality Check: Clinton on Trump's estate tax plan

By Kate Grise & Tami Luhby

In her economic policy speech, Hillary Clinton painted Donald Trump's tax plans as a gift to him and his wealthy friends.

She made note that he would be a big beneficiary of his plan to eliminate the estate tax.

"If you believe that he's as wealthy as he says, that alone would save the Trump family $4 billion. But it would do nothing for 99.8% of Americans," she said in Warren, Michigan Thursday.

Very few people who die are subject to estate taxes. Americans who pass away in 2016 can bequeath $5.45 million to heirs free of the federal estate tax. Married couples can give $10.9 million tax free. Anything over that is subject to tax. The top rate is 40%.

Donald Trump says that he is worth $10 billion. We'll go with his numbers, though it is worth pointing out that other estimates put Trump's net worth around $4.5 billion. Trump falls into the top tax bracket and would owe 40% on his assets above the $5.45 million lifetime exemption, which leaves his estate with a $3.997 billion tax liability.

However, there are many loopholes and deductions that Trump's team of lawyers could help him navigate. The Tax Policy Center estimated in 2013 that for all taxable estates worth more than $20 million, they are paying an average 18.8% rate. For Trump's family, this would bring their tax liability down to about $1.8 billion.

As for the rest of America: Of the 2.6 million Americans who died in 2015, only about 5,000 estates paid the federal estate tax, according to the non-partisan Tax Policy Center. That's only 0.2% of the Americans who died last year.

So it's TRUE that 99.8% of Americans would not benefit from the elimination of the estate tax. It is also TRUE that Trump's family could owe just less than $4 billion in estate taxes if the family does not use any loopholes or exemptions.