A troubled Chinese company says it has turned to police to help it try to find a senior executive with whom it lost contact days before its stock suddenly plunged as much as 91%.

China Huishan Dairy has lodged a missing person's report for Ge Kun, who oversaw the company's treasury, it said in a stock exchange filing late Friday.

Huishan said it took the step "out of a concern for her whereabouts." The report was filed in Hong Kong, which was her last known location, it added.

Hong Kong police said they can't give details on missing person's reports without more identifying information, which Huishan declined to provide to CNNMoney.

Related: Chinese firm 'lost contact' with top exec days before 90% stock plunge

Ge's disappearance has left Huishan under heavy pressure from creditors as it scrambles to figure out what state its finances are in.

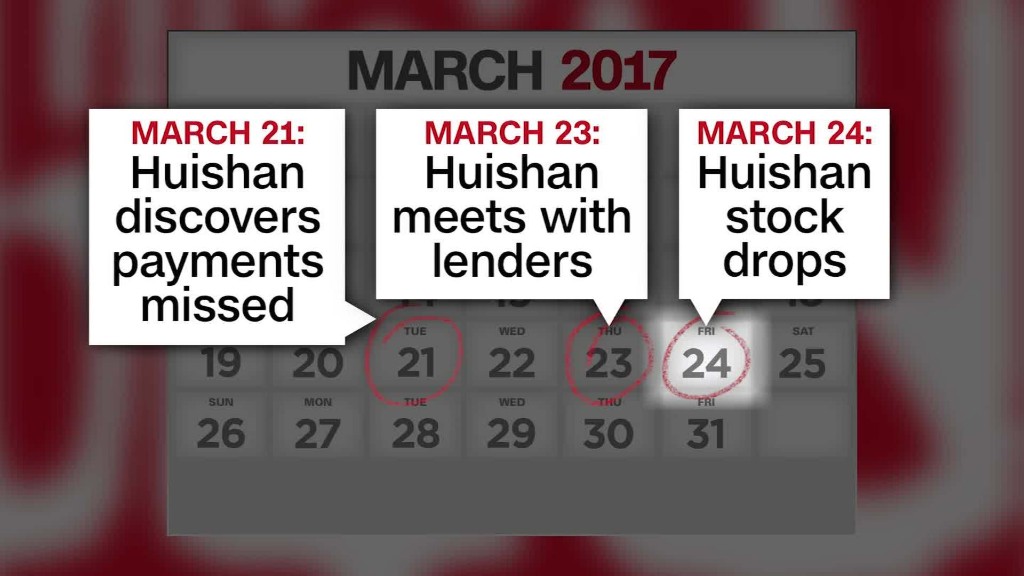

Huishan says it has been unable to contact Ge since March 21. That's the same day, according to the company, that its chairman and controlling shareholder, Yang Kai, learned that Huishan had failed to make some of its bank payments.

Ge and Yang are married, according to respected Chinese financial news outlet Caixin.

Huishan revealed late Friday that other problems are mounting. It said that all four of its independent directors have resigned, citing other commitments.

And it's facing legal action from an asset management firm, which applied to a Hong Kong court to freeze the assets of the dairy company, Yang and his wife. The Hong Kong court rejected the application, Huishan said.

Related: Wells Fargo still faces over a dozen probes tied to fake account

Trading in Huishan's shares in Hong Kong was halted on March 24, the day of their huge drop. The stock was down 85% at the time of the suspension.

The shares will remain on hold until the company's financial review is finished, it said.

The massive plunge came more than three months after U.S. investment research firm Muddy Waters slammed Huishan in a lengthy report. It accused the company of engaging in fraud and reporting fake profits.

Huishan rejected the Muddy Waters report when it was published in December, calling the allegations "groundless" and saying the report contained "obvious factual errors."