IRS audits of individuals are at their lowest level in more than a decade. But for two people in the United States, their chance of being audited is 100%.

For the U.S. president and vice president, an audit is guaranteed every year.

The practice of doing a "mandatory examination" of the presidential and vice presidential tax returns has been in the Internal Revenue Manual since the Watergate era, according to the IRS.

Both President Nixon and Vice President Spiro Agnew became embroiled in personal tax controversies around the same time that the Watergate scandal was unfolding. Agnew ended up resigning after admitting to tax evasion.

Related: What we'd learn if Trump would just release his tax returns

The process for auditing the return of the president and vice president is very precisely spelled out in the manual, including the instruction that their returns must be filed in an orange folder.

Only specified personnel may see the returns. And they must be locked in a secure drawer or cabinet whenever the appointed IRS examiner won't be present.

Their audits also must be handled relatively quickly. "The returns require expeditious handling at all levels to ensure prompt completion of the examinations," according to the manual.

The IRS didn't offer a formal rationale for auditing the president and vice president every year. Part of it may be to make sure the highest officers in the government are adhering to the law, tax historian Joseph Thorndike surmised.

And making the audits automatic may have been intended to bolster public confidence that the IRS will audit presidents of both parties and not let it become something the agency does at its discretion, according to tax lawyer Steven Rosenthal, a senior fellow at the Tax Policy Center.

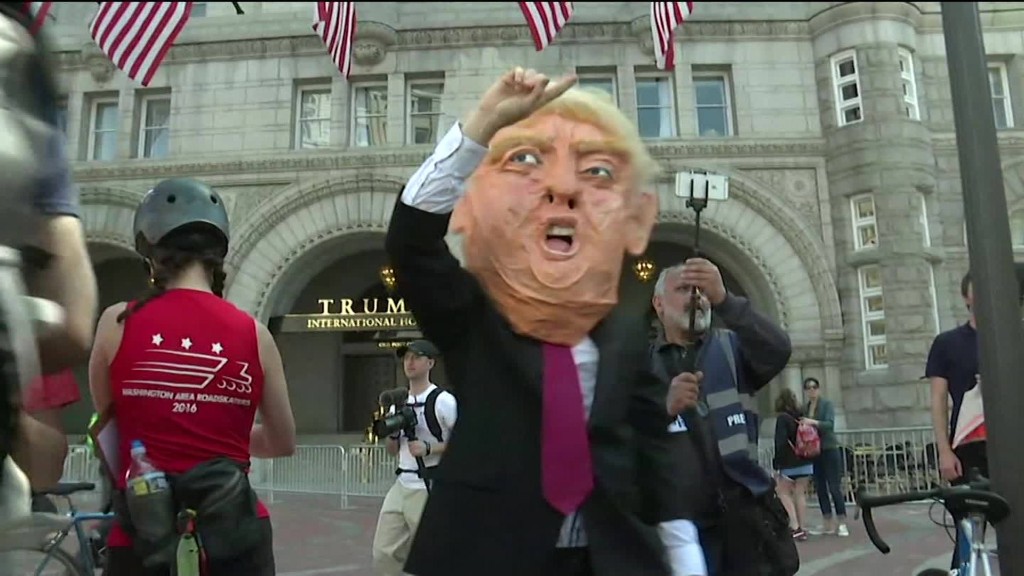

Related: Protesters around country call for Trump to release tax returns

Of course, there's no telling how rigorous the audits are.

As always, the IRS will keep all information about Trump's and Pence's returns and the audits of them confidential.

Unless the agency finds evidence of a tax crime such as evasion and prosecutes the case, the only way the public may learn anything of what's in Trump's and Pence's returns is if they choose to voluntarily release them, which has become a tradition for the past 40 years.

Voluntary release seems highly unlikely in President Trump's case. He has frequently used the audits of his tax returns to date as an excuse not to release them publicly -- even though nothing prevents him from doing so except his personal preference.

And though he and his surrogates have said often that he would release them when the audits were complete, there's no way to independently verify that the audits of his returns from years past are still ongoing.

Nor is there any way to verify when the IRS will finish the audit of President Trump's 2016 return.

White House spokesman Sean Spicer on Monday gave a non-answer at a press briefing when asked whether Trump would authorize the IRS to confirm that he is under audit and for which years. "I think the president's view on this has been very clear," Spicer said.