President Trump's tax plan is light on detail and may never happen but it's certainly dramatic.

The proposal to slash tax on businesses to 15% would -- with one fell swoop -- give the United States the lowest headline corporate tax rate of any major economy in the world.

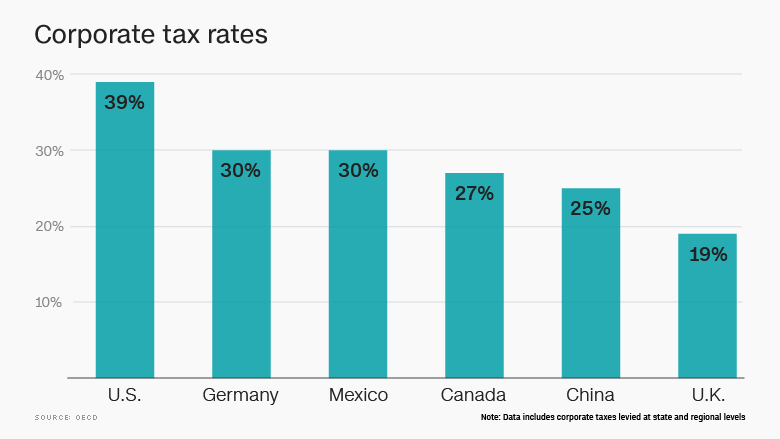

According to the Paris-based Organisation for Economic Co-operation and Development, America's corporate tax rate of 35% is currently the highest rate levied by any of its 35 member countries. That rate rises to nearly 39% if taxes levied at state level are included.

A review of taxes in the G20, which groups the biggest developed and emerging market economies, tells the same story: U.S. businesses face the highest top rate.

In a report released in March, the Congressional Budget Office cited data from 2012 showing that the comparable rates then for Mexico and Canada were 30% and 26% respectively.

But most American companies pay nothing like those rates for two key reasons: they can take advantage of a host of tax breaks, and profits earned overseas remain untaxed as long as the cash isn't brought home.

Actual tax rate is much lower

The CBO report showed that the effective rate of corporate tax in America was just under 19%, similar to the amount paid by British companies and slightly lower than firms in Argentina and Japan.

That was still far higher than most countries in the G20, including major trading partners such as China (10%) and Canada (8.5%).

Trump is hoping that a huge tax cut will spur economic growth and make U.S. businesses more competitive internationally. He also wants a low, one-time tax on $2.6 trillion of profits earned overseas that have never been repatriated with the aim of encouraging U.S. multinationals to invest some of that cash in America.

Related: The U.S. collects just 26% of GDP in taxes. That's pretty low

The tax plan outlined Wednesday leaves many questions unanswered and faces skepticism among lawmakers, even though Republicans control Congress, because it's far from clear how Trump plans to pay for the tax cuts.

Few OECD members have an overall corporate tax rate of 15% or less, and those that do tend to be smaller countries such as Latvia, Ireland and Hungary.

Ireland set its rate at 12.5% to attract big companies to the country, and it's a strategy that paid off handsomely for many years. Apple (AAPL), Google (GOOGL), Facebook (FB), eBay (EBAY), and Twitter (TWTR) have all set up their EU headquarters in the country.

Related: These are the world's worst tax havens

But recently Ireland has come under fire from the European Union for arrangements that allowed Apple to dodge more than $14 billion in taxes, and the country was ranked the 6th worst tax haven in the world by Oxfam in a report late last year.

Race to the bottom?

The charity warned in December that governments around the world were slashing corporate tax in a race to the bottom that risked "starving countries out of billions of dollars needed to tackle poverty and inequality."

Ordinary people were paying the price through higher personal taxation and cuts to services such as healthcare and education, Oxfam said.

Corporate tax in the U.K. was cut to 19% this month, and the government plans to bring it down to 17% by 2020.

Related: Brexit has just begun and jobs are already leaving

If Britain crashes out of the EU without a new trade deal with its biggest export market, politicians have hinted that it could cut taxes on businesses even lower to boost investment.

"We would have the freedom to set the competitive tax rates and embrace the policies that would attract the world's best companies and biggest investors to Britain," Prime Minister Theresa May said in January.

-- Alanna Petroff and Heather Long contributed to this article.