Nancy Jackson does not want to be put back in a high-risk pool.

The violin teacher had to enroll in Illinois' high-risk pool in 2003 after no insurer would take her because she had broken her hip.

Her premiums were as high as $850 a month, plus there was no cap on what she'd have to pay out of pocket.

After she was diagnosed with ovarian cancer in 2006, she had to pay thousands of dollars for her treatment. Her insurer wouldn't cover the $5,000 scan that discovered her tumor.

"It has taken me years to recover financially from that illness," said Jackson, 59, who lives in Aurora.

Now covered under Obamacare, she pays $550 a month for a plan that covers much more, including preventative screenings.

The Republicans' efforts to repeal and replace Obamacare has left Jackson worried that her big medical bills will return.

"As someone with a pre-existing condition, I'll be charged twice as much as I am now or I'll be thrown in this high-risk pool," she said of the GOP plan.

High-risk pools are playing a central role in the Republican health care strategy. The House GOP plan would likely lower premiums for healthy people, but could leave many folks with pre-existing conditions on the hook for higher premiums and out-of-pocket costs.

The bill would weaken Obamacare's protections for those with pre-existing conditions, giving states the power to decide whether to let insurers charge higher premiums to sick consumers who let their coverage lapse and to offer less comprehensive coverage.

Paired with this provision would be a so-called State Stability Fund, which would provide $138 billion through 2026 to help states and insurers deal with high-cost patients. States can use part of the funding to create high-risk pools, which would provide coverage for those with expensive conditions, such as cancer, diabetes and heart failure.

High-risk pools have a very mixed track record, experts say. Some 35 states ran these pools prior to Obamacare. A few states successfully insured their sick residents through these pools, but most programs charged higher premiums, had caps on how much they would cover and limited their enrollment.

Related: High-risk pools won't match Obamacare's protections for pre-existing conditions

Most were also severely underfunded. In 2011, they covered 226,000 people, who racked up $2.6 billion in claims. Premiums covered only about half that amount, forcing states to kick in $1.2 billion to make up the difference, usually through assessments on insurers or various taxes.

"What differentiated a good high-risk pool from a bad high-risk pool was luck," said Chris Sloan, senior manager at Avalere, a consulting firm. "If you get three people with advanced cancer, it destroyed your budget."

Obamacare established a temporary national high-risk pool in 2010 to cover those with pre-existing conditions until the exchanges opened in 2014. The program received a total of $5 billion in federal funding. Enrollees also paid premiums, though the pool couldn't charge them more than insurers would charge those without prior health issues.

Premiums didn't come close to covering the cost of enrollees' care. In 2012, participants racked up $32,108 in average annual claims -- roughly six times what the pool was collecting in premiums, according to the Kaiser Family Foundation.

Related: Anthem says Obamacare business doing 'significantly better'

Enrollment peaked at about 115,000 in early 2013. But losses mounted and sign ups had to be suspended that March to ensure enough money remained to cover those in the program.

The Republican bill sets aside $23 billion of the stability fund over several years specifically for high-risk pools, but this is nowhere near enough, experts say.

Covering the estimated 2.2 million Obamacare enrollees with pre-existing chronic conditions would cost $67 billion a year, Sloan estimates.

Researchers at the Urban Institute found that the high-risk pools would need between $359 billion and $656 billion in funding over 10 years if all states set them up.

Much depends on how many states opt out of the protections Obamacare put in place and how the states design their programs.

"Risk pools should be looked at as a small step to make health insurance a little bit more affordable for most of the 20 million people who buy their own coverage," said Jeff Smedsrud, a health industry consultant who helped set up high-risk pools prior to Obamacare. They create "a way for insurers and the government to 'pool' the cost of the few who need extremely expensive care,"

However, "funding could be a problem if too many states opt out and choose to create their own state-based programs and if the definitions of what constitutes a pre-existing condition are too broad," he continued.

Cost is a major concern for consumers, even among those who had decent experiences with high-risk pools in the past.

Carol Lokey entered Washington's high-risk pool several years ago after leaving her job at a hedge fund. She found the coverage sufficient and the premiums reasonable.

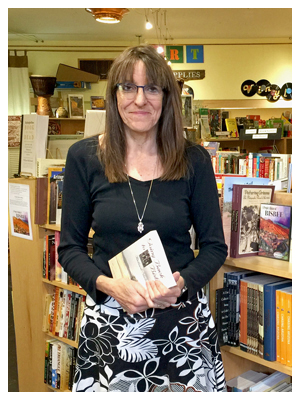

Lokey, who has multiple sclerosis, now lives in Bisbee, Arizona, where she owns a bookstore and is covered by Obamacare. She fears that Congress will not give states enough money to operate high-risk pools properly, and that Arizona will not set up a program that works well.

"I do not trust the legislators in this state to provide me with good coverage at affordable rates," said Lokey, 59.

After John Davis was laid off from a job in the auto industry in 2008, he had to enter South Carolina's high-risk pool. No other insurer would take him because he has coronary artery disease.

The monthly premium was $1,000, and he had to shell out another $400 a month to buy his wife and son coverage on the individual market. While he could afford it and found the benefits comparable to his employer-based plan, he knew former colleagues with pre-existing conditions who were left uninsured because they couldn't pay the premium.

"You definitely notice it when you write that check," said Davis, 60, who is now covered under Obamacare and is concerned about how much coverage in the high-risk pool would cost if the GOP plan becomes law.

Some consumers, however, had better experiences with high-risk pools. Take Gregory Bondzeit, 40, president of an outdoor advertising signage firm.

The Asheville, North Carolina, resident was uninsured until five years ago, when he developed a blood condition. He joined the temporary federal high-risk pool, paying $280 a month for a policy that covered his medical care. He didn't have to wait 12 months for it to cover his illness or pay 150% of the standard rate, like he would have in the state high-risk pool.

Related: Who could be at risk for higher premiums under GOP health care bill

Bondzeit is waiting for more details about the Republican legislation, but he supports efforts to dismantle Obamacare. He now pays $1,700 a month to cover himself and his three children, which he calls "exorbitant."