Many Americans are still waiting to see a bigger paycheck. They may have to keep waiting.

The government said that average hourly earnings -- another way of saying wages -- rose 2.4% over the past 12 months.

That's a slip from the 2.9% increase reported in September. And it remains below the 3% to 3.5% range that many agree is normal in a truly healthy economy.

The last time wages were up more than 3% year-over-year was in April 2009, just as the economy was emerging from the depths of the global banking crisis that fueled the Great Recession.

It's a bit puzzling though. Why have wages remained stagnant even though many other indicators of the job market and broader economy look healthy? Unemployment continues to drop. The housing market is vibrant. And stocks continue to soar.

John Bellows, a portfolio manager at Western Asset, thinks there a couple of things at play.

Bellows argues that the impact of globalization, more automation and an increased number of people working part-time (the so-called gig economy) are keeping wages in check.

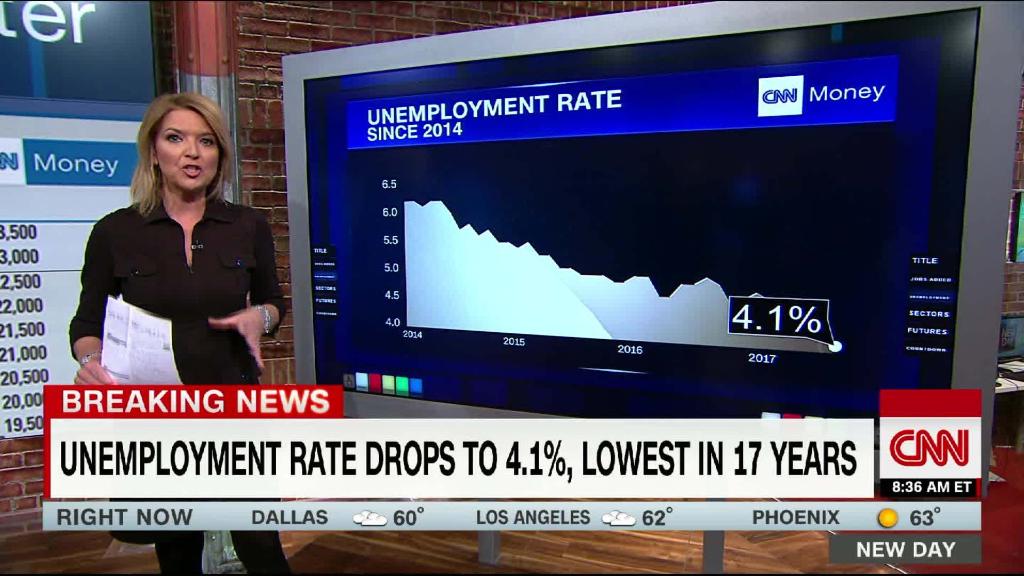

Related: U.S. unemployment rate drops to lowest level in 17 years

He adds that this isn't something that the Federal Reserve can solve. The U.S. economy is already at what most would consider to be "full employment."

And the Fed is now actually raising rates -- something that will likely continue if Jerome Powell, President Trump's nominee to replace Fed chair Janet Yellen early next year, is confirmed by the Senate.

That's why Bellows and others think lawmakers and President Trump need to take action to improve American wages.

"I'm not sure how much the Fed can do to increase wages," Bellows said. "But we shouldn't be defeatist about it. It's now just mostly up to Congress."

Erik Weisman, chief economist at MFS, says that if tax reform passes and leads to lower corporate tax rates, big multinational U.S. companies may bring back to the U.S. cash that's sitting overseas, and use it to boost salaries and hire more workers.

Related: Here's what's in the House Republican tax bill for businesses

"Lower taxes could incentivize companies to keep profits onshore and invest more domestically," Weisman said. "If multinationals felt they had better visibility for U.S. demand, then they would have a greater need for building out capacity, and that might necessitate higher wages."

Just look at Apple, (AAPL) for example. The iPhone maker reported Thursday it has nearly $269 billion in cash. CFO Luca Maestri said during the company's earnings call that $252 billion -- 94% of it -- is stashed overseas.

But Weisman conceded that there is a bit of a chicken versus egg problem that lower taxes may not solve. Global growth will need to keep rebounding in order for companies to feel more confident and do more with their cash than just hoard it.

Many companies may also choose to reward shareholders with bigger stock buybacks and dividend increases instead of investing in labor.

Still, Matt Schreiber, president and chief investment strategist of WBI Investments, thinks there's another problem. Now that companies are hiring again, people who had been unemployed or underemployed may be returning to the workforce for lower salaries simply because they're excited to have a job.

"More people are getting jobs that underpay and are not making what they used to," Schreiber said.

Related: Inequality among America's seniors is getting worse

He added that businesses are still waiting to see if recent signs of U.S. economic improvement -- two consecutive quarters of annualized growth of at least 3% -- is sustainable.

"The real issue for companies is that we've still had relatively anemic growth. That makes it difficult to increase overhead," Schreiber said, adding that he is also hoping "corporate tax cuts could turbocharge the economy and wage growth."

There are some hopeful signs though.

Matt Toms, chief investment officer of fixed income for Voya Investment Management, said it is good to see that more states and cities are raising their minimum wages, as are giant American employers like Walmart (WMT) and McDonald's (MCD).

But the average hourly workweek has remained relatively flat over the past few months, stuck around 34.4 hours. Toms suggests that some employers could be limiting worker hours in light of wage increases in order to keep labor costs in check.

"We'd be more encouraged if there was even more wage growth. It's needed at this part of the economic cycle," Toms said.