Walmart is trying to attract a new kind of customer — wealthier people who love to shop online and may never set foot in an actual Walmart store.

But the company is still playing catchup to Amazon, despite a slew of digital plays.

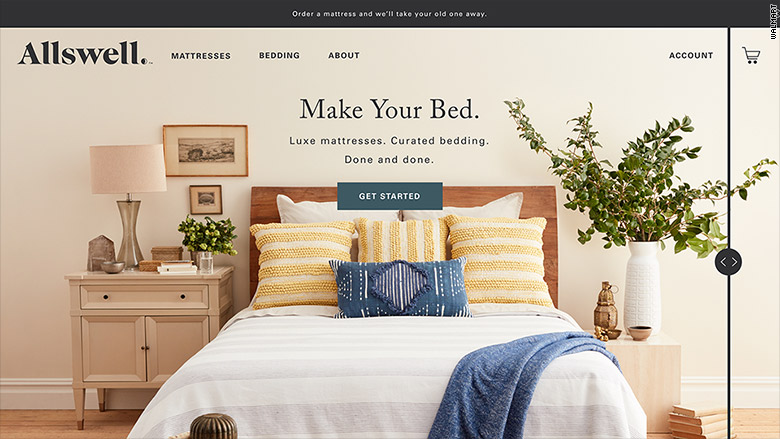

The latest came Wednesday, when Walmart unveiled a line of mattresses and bedding called Allswell. Walmart said it will sell the products online and is targeting women. It even named its king-sized mattresses Supreme Queen.

Walmart is advertising Allswell as a "luxe collection of mattresses and curated bedding." It could be a way for Walmart to steal some thunder from the red-hot online bedding startup Casper, which got an investment from Walmart rival Target (TGT) last year.

But it's also the latest effort by Walmart (WMT) to show customers it's more than a big-box retailer.

The company has increased its digital presence over the past few years with a series of acquisitions. Walmart bought online retailer Jet for $3.3 billion in 2016, then purchased the specialty online retailers ModCloth, Bonobos and Moosejaw.

Walmart also acquired Parcel, a logistics startup that will allow it to provide same-day delivery for online purchases in New York.

It's working with the smart-lock company August Home on a test program that will let you order food from Walmart and have the delivery people put it away in your fridge.

And Jet recently launched a line of household products called Uniquely J, targeted at millennial shoppers.

Related: Sam's Club enters the same-day delivery war

Walmart also just unveiled four lines of private-label clothing that it will sell online and in stores. And the company's new tech incubator Store No. 8 bought the virtual reality startup Spatialand earlier this month.

If all that wasn't enough, Walmart's Sam's Club warehouse subsidiary just announced a partnership with Instacart for same-day grocery delivery in Austin, Dallas-Fort Worth and St. Louis.

Whew! Nobody can accuse Walmart CEO Doug McMillion and Jet founder Marc Lore, who now heads all of Walmart's online efforts, of sitting idly by as the retail landscape rapidly transforms.

But Walmart may need to do even more if it hopes to catch up to Amazon (AMZN).

Walmart did post an impressive increase in digital revenue last year, but the pace of its online sales growth has slowed. Digital revenue was up 23% from a year ago in the fourth quarter, down from a 50% increase in the third quarter.

That has Wall Street worried. Shares of Walmart soared more than 40% last year but have fallen more than 7% this year, even as the broader market has edged higher.

And Amazon remains a market darling. Its stock is up 30% already this year, on top of a jump of more than 55% last year.

So Walmart needs to prove to investors — and its customers — that all of its digital acquisitions can transform it into a true Amazon rival.