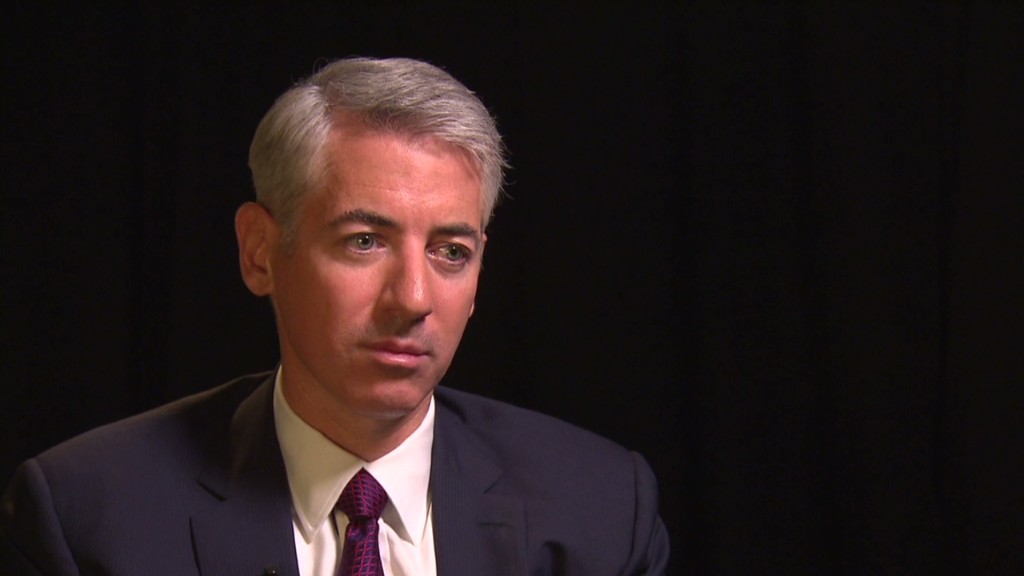

Hedge fund manager Bill Ackman has finally ended his disastrous $1 billion bet against Herbalife.

In December 2012, Ackman famously made a short bet against Herbalife, an investment that makes money when the stock price falls.

Ackman called the nutritional supplements company a pyramid scheme that he thought would eventually go to zero. He spelled it all out in a three-hour presentation at an investment conference.

The stock was trading at about $45 when Ackman first disclosed that his Pershing Square Capital Management firm was shorting Herbalife (HLF) to the tune of $1 billion.

Shares are now trading around $92. The stock surged 35% this year alone. And Ackman conceded in an interview with CNBC Wednesday that he's now completely exited the bearish bet against Herballfe.

Meanwhile, rival hedge fund manager Carl Icahn told CNBC in an interview Thursday that he has now made $1 billion from his huge purchase of Herbalife stock a few years ago.

Icahn's firm owns more than a quarter of Herbalife, making it the company's top shareholder.

Related: Icahn and Ackman duked it out over Herbalife in epic battle

Icahn and Ackman even had a famous (for financial nerds at least) argument on CNBC about Herbalife in 2013.

The two traded personal barbs, with Ackman saying that "Carl Icahn unfortunately does not have a good reputation for being a handshake guy" and Icahn telling Ackman "I wouldn't invest with you if you were the last man on Earth!"

Ackman and Icahn buried the hatchet a year later, with both men agreeing to let bygones be bygones during an investment conference in 2014.

But their battle about Herbalife wound up becoming the subject of a 2016 documentary called "Betting on Zero."

To the chagrin of Ackman and delight of Icahn and anyone else who took the opposite side of Ackman's trade, it seems "Betting on $100" may be a more apt title given Herbalife's current price.