1. Tower of debt: Corporate America is drunk on easy money.

US companies, encouraged by a decade of unbelievably low borrowing costs, are sitting on $6.3 trillion of debt, according to S&P Global Ratings. That sum, which excludes banks, is more than before the Great Recession — or any other time in history.

Companies have used that debt to invest in the future, make splashy acquisitions and reward shareholders with a bonanza of stock buybacks.

But this is a dicey time to owe a bunch of money.

After years of extraordinarily low interest rates, borrowing costs are finally on the rise. That makes it more expensive for companies to refinance their debt when it comes due. Those costs will only rise further if inflation heats up, forcing the Federal Reserve to raise rates more rapidly.

The US economy is cruising. The economic expansion is already the second-longest in history. But another recession will come eventually. In previous downturns, companies with too much debt have found it difficult to repay their loans, forcing some into bankruptcy.

The "massive amount of debt" that American companies have piled on "should concern investors as we enter the late innings of a credit cycle in a rising rate environment," S&P analyst Andrew Chang wrote in a report last week.

Related: Why the ride for global markets got so bumpy

Of course, Corporate America has more firepower than ever to pay down debt. The strengthening economy and the Republican corporate tax cut have combined to unlock vast amounts of money for companies.

Indeed, S&P found that by the end of 2017, the 1,900 US companies that it rates, excluding banks, had accumulated a whopping $2.1 trillion in cash. That's up 9% from the year before — and more than double what they were sitting on in 2009.

However, that pile of money is not evenly divided. In fact, the richest 1% of US companies control more than half of the cash, S&P said.

As of the end of 2017, just seven companies claimed $800 billion of cash: Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Cisco (CSCO), Oracle (ORCL), AT&T (T) and Amgen (AMGN).

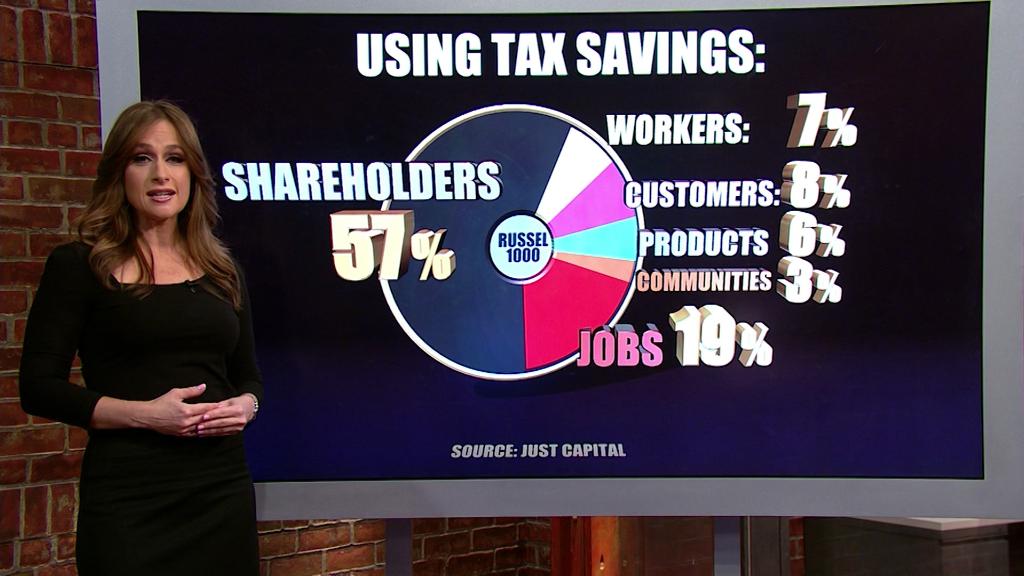

Although the tax law has improved corporate balance sheets, it's also sparked a record-setting wave of share buybacks and debt-fueled acquisitions.

S&P said it believes Corporate America has reached its peak for cash hoarding. That's because companies are rewarding shareholders while adding debt because of the "lure of cheap money."

"We believe we are now entering the era of the Great Unwinding," Chang wrote.

Companies that have strong balance sheets can afford to return a bunch of cash to shareholders. The rest? Not so much.

S&P found that the riskiest category of borrowers — with a rating known as junk — have never been more leveraged than they are right now. They're holding $8 of debt for every $1 of cash.

What could possibly go wrong?

2. Jobs report: How much tighter can the US labor market get? We'll find out Friday, when the Labor Department releases the June jobs report.

Unemployment is already 3.8%, the lowest since 2000. If it drops again, it will be the lowest in half a century. Analysts surveyed by Thomson Reuters are expecting a solid gain of 200,000 jobs.

3. Trade showdown: This is the week when President Donald Trump's trade fight with China gets real.

On Friday, US customs agents will begin collecting a 25% tariff on about 800 Chinese goods worth $34 billion, the first wave of a $50 billion round of trade penalties. Those goods include jet engines, batteries and industrial dryers. On the same day, China will impose a tariff on $34 billion of American exports, including cars and beef.

For investors, the big risk is escalation. Trump has threatened tariffs on hundreds of billions of dollars of additional goods. And China has vowed to fight a trade war "to the end."

4. Why the Fed is hiking rates: When the Fed reports its meeting minutes Thursday, we'll get a closer look at why the central bank is more optimistic about the economy — and eager to raise rates faster than it initially planned.

Last month, the Federal Reserve lifted its benchmark rate by a quarter of a percentage point, the second hike this year.

A majority of the Fed's Board of Governors said they now expect a total of four interest rate increases this year. Fed officials had been split about whether to raise rates three times this year or four.

5. Xiaomi prices its IPO: Once the most valuable startup on the planet, Chinese smartphone maker Xiaomi is about to go public.

The company plans to raise $4.7 billion in its IPO, a person familiar with the IPO told CNNMoney. That's at the bottom of its planned range. Earlier this year, Xiaomi was reported to seek as much as $10 billion from the listing.

The IPO, which is scheduled to price on Friday, would values Xiaomi at about $54 billion -- not a huge leap from the $45 billion at which Xiaomi was valued in a private funding round in late 2014. Xiaomi's shine dimmed because investors worry about its potential to grow its profit, because it caters the lower end of the increasingly saturated smartphone market.

6. Coming this week:

Monday — Facebook (FB) COO Sheryl Sandberg scheduled to testify before European Parliament

Tuesday — American automakers report June sales; US markets close early

Wednesday — US markets are closed for Independence Day

Thursday — US Federal Reserve reports its Board of Governors meeting minutes

Friday — US jobs report; tariffs on the first $34 billion of Chinese goods go into effect