If you're a real estate agent, odds are you haven't been closing as many deals lately.

A slowdown in new construction and a short supply of existing homes for sale have pushed housing prices so high that would-be buyers are either finding themselves in bidding wars or sitting on the sidelines.

"We're hearing things from our real estate agents that we haven't heard in three years about homebuyers stepping back from high prices," said Redfin CEO Glenn Kelman on the real estate firm's second quarter earnings call this month.

What's eating the housing market, in the midst of what otherwise looks like upbeat growth? In part, it's a victim of the economy's success: The Federal Reserve is seeking to keep inflation in check by raising interest rates, making mortgages more expensive.

Related: How Washington could actually make housing more affordable

Meanwhile, a crackdown on immigration as well as tariffs on imported lumber have made it more difficult and expensive for builders to obtain the labor and materials they need to construct homes. That's especially true in hot urban markets, where land is expensive and zoning can be restrictive, according to the National Association of Home Builders.

Freddie Mac forecast on Monday that the housing market will stay slow for the rest of the year. But it doesn't see any real trouble on the horizon. "The healthy economy and robust labor market should support homebuyer demand," the mortgage giant wrote.

Here's what's happening in the housing market now.

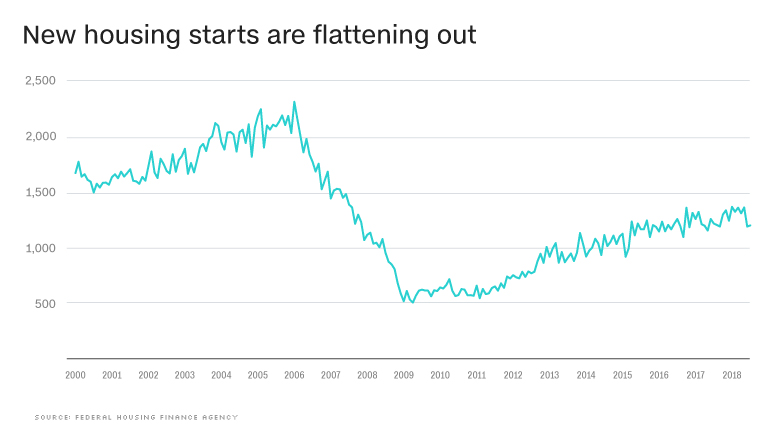

1. New home construction

New home construction surged following the recession, but has moderated in recent months. That has left many markets with a persistent lack of supply. That's not just true in the for-sale market — the rental vacancy rate is also nearly as low as it's been since the early 1990s.

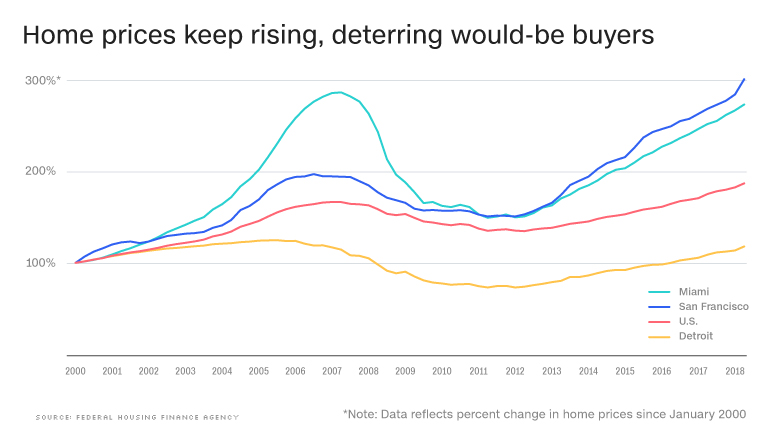

2. Housing prices

The slow growth of new housing stock has driven up home prices quickly, especially in hot markets like San Francisco and Miami. (Other markets, like Detroit, still haven't regained the value lost during the Great Recession, according to data collected by the Federal Housing Finance Agency.)

Although the closely-watched Case-Shiller Index showed on Tuesday that home price growth slowed slightly in June, the 20-city composite measure topped its pre-recession high at the beginning of 2018.

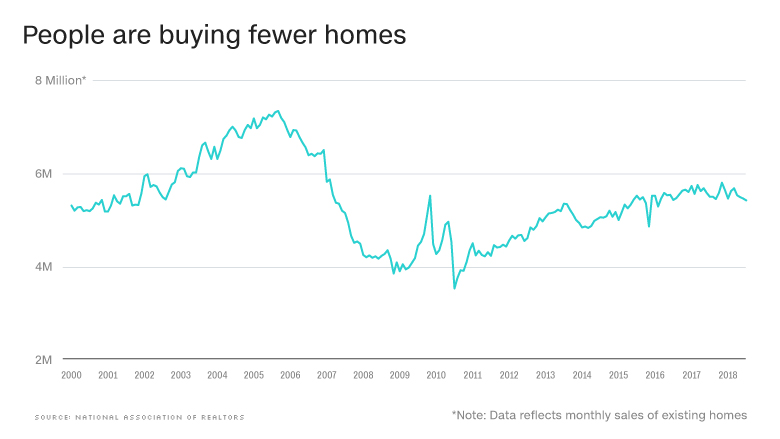

3. Existing home sales

Low inventory and high prices have slowed down the entire housing market, which is mostly made up of previously owned homes. Existing-home sales fell for the fourth straight month in July to their lowest level in over two years, the National Association of Realtors reported last week.

"Additional inventory will help contain rapid home price growth and open up the market to prospective homebuyers who are consequently — and increasingly — being priced out," National Association of Realtors Chief Economist Lawrence Yun wrote on Monday.

That creates a drag on the job market as well, since it makes it more difficult to pick up and move to a new city for better employment opportunities. Americans are already relocating far less than they used to.

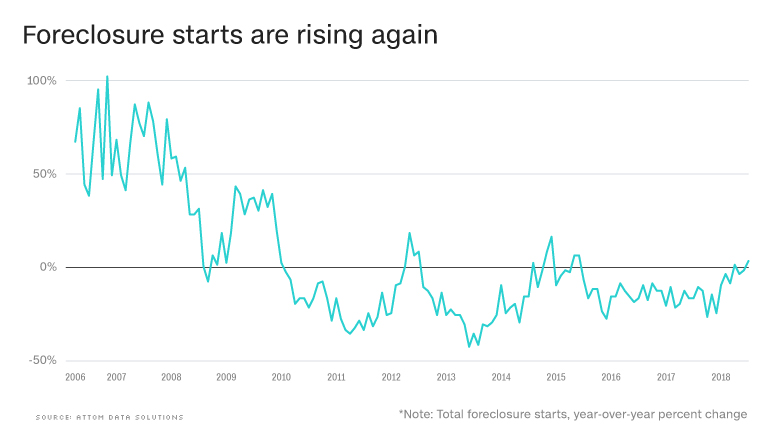

4. Foreclosures

Foreclosures plagued the housing market during the financial crisis as borrowers struggled with loans they couldn't afford and homes prices plunged. These days, borrowers are in much better shape, but there are signs that foreclosures are on the rise again.

The housing analytics firm Attom Data Solutions found that foreclosure starts are increasing again for the first time since 2015. The trend is particularly visible in hurricane-hit cities like Houston, but also increasingly expensive places like Los Angeles.

"We're seeing enough in these bellwether markets that I think it's an inflection point," says Daren Blomquist, senior vice president for communications at Attom.

Related: How America's foreclosure capital came back from the dead

But as with the rest of the housing market, that turn in the numbers likely isn't a sign of impending collapse. The loans having the most trouble are those that the Federal Housing Administration insured in 2014, when the agency was backing off on the very tight standards it had imposed during the great recession.

"In '14, what you begin to see is a loosening of the underwriting, but not an irresponsible loosening," says David Dworkin, a former Treasury Department and Fannie Mae official, who is now president of the National Housing Conference. "I think we're seeing a return to a more normal market."