2012 turned out not to be the end of the world, but it still was a year that many Big Tech companies would rather forget.

No one thought 2012 would be smooth sailing for Hewlett-Packard, but few expected the company to take a giant step backwards.

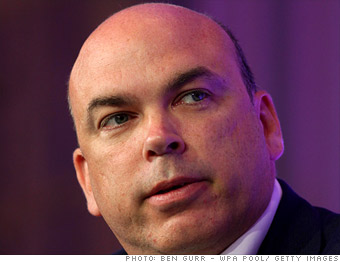

That's precisely what happened after CEO Meg Whitman announced in November that the tech giant would be writing down $8.8 billion of Autonomy -- a company HP bought just a year earlier. About $5 billion of that write-down was due to accounting fraud at the software business, Whitman claimed. (Autonomy founder Mike Lynch strongly denies the allegations.)

Once again, HP (HPQ) found itself fighting off allegations of mismanagement. Whitman was supposed to settle the mess that former CEO Leo Apotheker left; investors hoped that a decade filled with boardroom scandals and horrible decisions by executives was behind the company. Not so much.

HP shares have been on a sharp downward trajectory all year. Three multi-billion-dollar losses on write-downs in five quarters angered shareholders, and the Autonomy scandal sent the stock to a 10-year low.