|

Stock picks by the pros

|

|

June 15, 2000: 4:11 p.m. ET

PMC-Sierra, Amgen, Juniper, AOL, Yahoo!, Motorola, Heinz win mention

|

NEW YORK (CNNfn) - Market analysts and portfolio managers picked a few semiconductor, tech, retail, Internet, and food stocks Thursday for investors to pop into their shopping baskets.

While the markets made gains Thursday, recent guests on CNNfn commented on the stocks they are buying, and why.

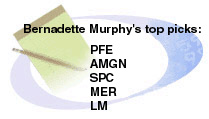

"Corporate profits are what drive the stock market," said Bernadette Murphy, telecom analyst, Kimelman & Baird. "On the economic front, we have been seeing a slowdown in some industries like housing. And so that could be a positive but may be, may not be, enough for the Fed. But corporate profits are always what drive a market and why investors buy the stocks of companies." "Corporate profits are what drive the stock market," said Bernadette Murphy, telecom analyst, Kimelman & Baird. "On the economic front, we have been seeing a slowdown in some industries like housing. And so that could be a positive but may be, may not be, enough for the Fed. But corporate profits are always what drive a market and why investors buy the stocks of companies."

"The areas that have been attracting the money have been financials and pharmaceuticals," she said. "Pfizer (PFE: Research, Estimates) has a great weighting in the drug index and it had gone through the confusion with the Warner-Lambert merger and it now seems to have absorbed all of that. And I think investors are looking for bargains now."

She also said she likes biotechs. "I think that the biotech index is stabilizing and it's starting to lift. It's actually looking better than the Internet index. Those were two of the players earlier in the year. Amgen (AMGN: Research, Estimates) has the heaviest weighting in that index and is trading very nicely."

In financials, she said she likes St. Paul Cos. (SPC: Research, Estimates). "It's a property and casualty. And it is a stock that has not participated in a while, that is what I look for. I look for a stock that's been trading sideways to start getting an increase in volume and start moving out of a trading range. That's been in effect for a long time. St. Paul has been doing that the last couple of weeks and it's showing in the corporate property and casualty index itself."

Her final picks are Merrill Lynch (MER: Research, Estimates) and Legg Mason (LM: Research, Estimates).

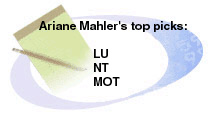

"Frankly, I think Lucent (LU: Research, Estimates) is the most undervalued stock in my universe. It's trading at half the multiple of Nortel (NT: Research, Estimates)," said Ariane Mahler, telecom analyst, Dresdner Kleinwort Benson. "If you unlock all of those businesses that they have -- in wireless, in optical electronics, in optical networking, voice data -- you can easily end up with $120 as a sum of the parts valuation and it's trading at half that." "Frankly, I think Lucent (LU: Research, Estimates) is the most undervalued stock in my universe. It's trading at half the multiple of Nortel (NT: Research, Estimates)," said Ariane Mahler, telecom analyst, Dresdner Kleinwort Benson. "If you unlock all of those businesses that they have -- in wireless, in optical electronics, in optical networking, voice data -- you can easily end up with $120 as a sum of the parts valuation and it's trading at half that."

She also said she likes Nortel. "It has the biggest market share in optical. It's 40 percent of their revenues."

Her final pick is Motorola (MOT: Research, Estimates). "It's my No. 2 or 3 on my list. It's another story that's been totally beaten down by my other analyst colleagues. And it is a big 2-1/2 or 3G wireless play. There are many legs in the story, not just wireless infrastructure but also handsets. You'll see some fantastic handsets this year in the United States -- I've seen them in Europe already and they are fantastic. They have microelectronics as well. And they have broadband."

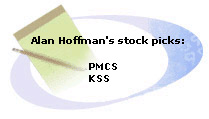

"I'd use the market dips as an opportunity to get into quality companies. There are a lot of good stocks, some in the technology arena, some elsewhere that are down 20 to 40 percent from their 52-week high as established just a few months ago. On days when stocks are trading off, I'd use that as a very compelling rationale for a fishing expedition," said Alan Hoffman, stock market strategist, Value Line Asset Management. "I'd use the market dips as an opportunity to get into quality companies. There are a lot of good stocks, some in the technology arena, some elsewhere that are down 20 to 40 percent from their 52-week high as established just a few months ago. On days when stocks are trading off, I'd use that as a very compelling rationale for a fishing expedition," said Alan Hoffman, stock market strategist, Value Line Asset Management.

"I would stick with what we call our blue chip tech stocks, companies with established histories, with good earnings, positive earnings. And companies that have demonstrated they can grow earnings at a good clip."

"In the tech sector, I like PMC-Sierra (PMCS: Research, Estimates). It's a semiconductor manufacturer, but they have relatively little exposure to the computer market. We like a couple of retail stocks. They have stumbled a bit in the last few weeks. One of my favorites is a company called Kohl's (KSS: Research, Estimates). They inhabit a middle niche between the discounters and the department stores.

"Technology's had a major rebound in the last three weeks. Remember that technology was down for the month of February and March. It was just awful. But in the last three weeks, the Nasdaq actually has recovered quite nicely. Yesterday was a little bumpy. But we feel kind of positive on the group," said Abel Garcia, senior portfolio manager, AIM Funds. "Technology's had a major rebound in the last three weeks. Remember that technology was down for the month of February and March. It was just awful. But in the last three weeks, the Nasdaq actually has recovered quite nicely. Yesterday was a little bumpy. But we feel kind of positive on the group," said Abel Garcia, senior portfolio manager, AIM Funds.

"We like the semiconductor devices, but specifically the fastest growing area, the ones that provide circuits to the broadband infrastructure growth. We believe that as the Internet grows out and builds out, they'll be massive demands for more storage. So names in those areas are: JDS Uniphase (JDSU: Research, Estimates); CIENA (CIEN: Research, Estimates); Cisco Systems (CSCO: Research, Estimates); and Juniper Networks (JNPR: Research, Estimates). And in the second area, Brocade Communications (BRCD]: Research, Estimates) and Veritas Software (VRTS: Research, Estimates). As content will become more and more important in companies, AOL (AOL: Research, Estimates), Yahoo!, (YHOO: Research, Estimates), Amazon (AMZN: Research, Estimates), and eBay (EBAY: Research, Estimates) will grow very rapidly."

"I think if we enter a soft landing period, that's a good position for tech stocks generally to be in because our companies will show a higher earnings growth, both in sales and earnings. And if the economy does slow, people will rush out of cyclical stocks because that's basically their markets. And the consumer stocks have their problems with pricing. Toothpaste is toothpaste and soap is soap. In my opinion, there is a lot of marketing associated with it. But in my opinion, technology has to be the leader again for this market to continue."

"We're seeing some evidence of some slowing in the economy, which is a good thing, but we need a little longer time to call it a trend. And I think that is what the Fed is watching too," said Bob Dickey, Technical Market Analyst, Dain Rauscher Wessels. "We're seeing some evidence of some slowing in the economy, which is a good thing, but we need a little longer time to call it a trend. And I think that is what the Fed is watching too," said Bob Dickey, Technical Market Analyst, Dain Rauscher Wessels.

"We had retail sales numbers which were a little on the weak side. The CPI which was very good this week, and yet the market has not been able to react for more than about 20 minutes. And so maybe we're looking for something bigger, maybe something to do with the presidential election coming up might be enough to drive the market through these areas."

"And no matter what the market does there's always some rotation going on within the market. And what I am seeing more recently here is some good strength in some of the food stocks, which are traditionally defensive. Investors are starting to warm up to these stocks after one to two years of pressure in that food group. I think food stocks like Hershey (HSY: Research, Estimates) and Heinz (HNZ: Research, Estimates), look very good here. Nice values with relatively low risk. Of course, you have the oils, which have been very strong. The price of oil hitting new highs recently and still no top in sight on oil. And I think oil stocks still have not reflected that.

--Compiled by Parija Bhatnagar and Alexandra Twin

* Disclaimer

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|