|

Stock picks by the pros

|

|

June 19, 2000: 4:28 p.m. ET

RealNetworks, Advanced Fibre, Hilton Hotels, Ciena, MediaOne make list

|

NEW YORK (CNNfn) - Market analysts and portfolio managers concentrated on the technology, telecom, pharmaceutical, Internet and leisure sectors Monday, picking Ciena, AT&T, RealNetworks, American Home Products and Hilton Hotels as some of the top stocks to feature in their A-lists.

As techs and financials in the late afternoon pushed the Dow and the Nasdaq into positive territory, recent guests on CNNfn commented on the stocks they are buying, and why.

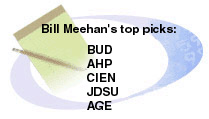

"The drug stocks have been behaving very well recently," said Bill Meehan, senior market analyst, Cantor Fitzgerald & Co. "We eked out a new 52-week high on the Drug Index, on Friday, and you know, I'd use some weakness to buy stocks in that sector, in some of the beverage stocks such as Anheuser-Busch (BUD: Research, Estimates) or American Home Products (AHP: Research, Estimates)." "The drug stocks have been behaving very well recently," said Bill Meehan, senior market analyst, Cantor Fitzgerald & Co. "We eked out a new 52-week high on the Drug Index, on Friday, and you know, I'd use some weakness to buy stocks in that sector, in some of the beverage stocks such as Anheuser-Busch (BUD: Research, Estimates) or American Home Products (AHP: Research, Estimates)."

"AHP is up against resistance and the momentum indicators lead me to conclude that we could go further, and as people look for a little bit more defensive and consistent type earnings; I think AHP looks attractive here," Meehan said.

His picks also include Ciena (CIEN: Research, Estimates) and JDS Uniphase (JDSU: Research, Estimates). "People are very enamored with the potential for telecommunications and these stocks look very attractive right here. You can see Ciena has come down, is bouncing off the recent low and retest of that low, and I think there's good potential near-term," said Meehan.

Meehan's final pick is A.G. Edwards (AGE: Research, Estimates): "A.G. Edwards is one of the brokerage stocks - although the banks got beaten up pretty severely and I think that they may have some loan quality problems, the brokerage stocks have held up very well. A.G. Edwards reported this morning better than expected, and it looks very good; we should see new highs fairly soon."

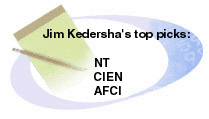

Jim Kedersha, telecom analyst, SG Cowen, said that today's announcement of Nortel (NT: Research, Estimates) teaming up with Hewlett-Packard (HWP: Research, Estimates) is "potentially very important." Jim Kedersha, telecom analyst, SG Cowen, said that today's announcement of Nortel (NT: Research, Estimates) teaming up with Hewlett-Packard (HWP: Research, Estimates) is "potentially very important."

"They're teaming up with Hewlett-Packard to integrate some of Nortel's wireless technology and high-speed wireless technology with Hewlett- Packard's high-speed computing platforms," Kedersha said.

"What Nortel is telling us today is, we're already the 'king of optical technology' right now, number one worldwide market share," he said. "We're going to leverage that into more winds in the wireless world, going forward. That requires some teaming up with other players, such as Hewlett-Packard. It implies having more sites and more presence in Europe where Nortel is already an optical leader, along with Ciena (CIEN: Research, Estimates), but also where most of the wireless activity is today."

Kedersha's final pick is Advanced Fibre (AFCI: Research, Estimates). "It sells a system into the access part of the network. So this is voice and high-speed DSL integrated system onto one platform. We think this is going to be an increasing area of carrier focus over the next few years."

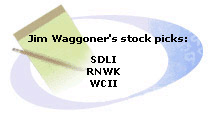

"More and more productivity will take on a center stage role in the economy as the economy slows, as profit margins begin to squeeze, as pricing flexibility -- which is not really high right now -- diminishes yet further. Productivity is a really important issue, and that's where technology should be very much at the center stage," said Jim Waggoner, technology and market strategist at Sands Brothers & Co. "More and more productivity will take on a center stage role in the economy as the economy slows, as profit margins begin to squeeze, as pricing flexibility -- which is not really high right now -- diminishes yet further. Productivity is a really important issue, and that's where technology should be very much at the center stage," said Jim Waggoner, technology and market strategist at Sands Brothers & Co.

"We like SDL Inc. (SDLI: Research, Estimates) a lot," said Waggoner. "We initiated coverage of the stock with a strong buy last week. It's one of the optical network component companies. That sector of the market is growing at 50 percent annually. SDL is a company that is less diversified than rival JDS Uniphase (JDSU: Research, Estimates), but it has a leg up in the integration, putting all of these components on a silicon circuit, and that's one of the reasons why we like it very much."

"With regard to RealNetworks (RNWK: Research, Estimates), everybody's talking about streaming media. RealNetworks came out with their new Version 8 recently; that's going to revolutionize their whole approach to that area. Winstar (WCII: Research, Estimates) is a company we just began coverage of last week with a buy. That's that last-mile -- wireless area for small- to medium-size business companies. So we like both of those areas very strongly," he said.

"The hotel industry is having a phenomenal second quarter after probably the best first quarter we've seen in five years. The companies that are best positioned in the hotel industry own full-service urban hotels, particularly in the markets of New York, Boston, San Francisco and Los Angeles. And the two companies that would fit that description best are Starwood Hotels (HOT: Research, Estimates) first, and then Hilton Hotels (HLT: Research, Estimates) second," said Jason Ader, leisure analyst at Bear Stearns. "The hotel industry is having a phenomenal second quarter after probably the best first quarter we've seen in five years. The companies that are best positioned in the hotel industry own full-service urban hotels, particularly in the markets of New York, Boston, San Francisco and Los Angeles. And the two companies that would fit that description best are Starwood Hotels (HOT: Research, Estimates) first, and then Hilton Hotels (HLT: Research, Estimates) second," said Jason Ader, leisure analyst at Bear Stearns.

"What's happening in the cities right now is that there really hasn't been a whole lot of supply, and consumer demand is just well in excess of what we saw last year. And in most of the major cities, we're seeing high single-digit, low double-digit pricing over last year, and occupancy rates in some cases are actually up. Those are the two companies that are real estate owners, owners of full-service urban hotels. And for investors in the lodging industry, that's really where you get the most leverage, and where you should have the most exciting earnings growth as well," Adler observed.

"All year long, it's been a tale of two markets. The momentum on the Dow is declining, and the Dow last week failed at its 200-day moving average, which is declining, two things that are negative for the Dow and for 'old economy' stocks. Whereas on the Nasdaq, since the big correction that we had, the Nasdaq momentum is now rising, and it traded back above its 200-day moving average, which is still rising. Therefore, we think investors are selling strength in Dow old economy stocks and buying weakness in the new economy stocks," said Richard Suttmeier, chief financial strategist at Joseph Stephens. "All year long, it's been a tale of two markets. The momentum on the Dow is declining, and the Dow last week failed at its 200-day moving average, which is declining, two things that are negative for the Dow and for 'old economy' stocks. Whereas on the Nasdaq, since the big correction that we had, the Nasdaq momentum is now rising, and it traded back above its 200-day moving average, which is still rising. Therefore, we think investors are selling strength in Dow old economy stocks and buying weakness in the new economy stocks," said Richard Suttmeier, chief financial strategist at Joseph Stephens.

"I am optimistic about most of the stocks in the market because I think it's only the Dow and the transports that have a negative profile right now. We've evaluated and came up with 10 sectors that we thought were positioned the best in the year 2000, and moving forward in terms of providing leadership in the economy. And then in that "Leaders for the New Millennium" list, we've selected five stocks for each one that we thought would be the leading stocks in each group," Suttmeier said.

"If you are going to start with picking one out of the leaders, it's going to be Cisco Systems (CSCO: Research, Estimates). AT&T (T: Research, Estimates) is an 'old economy' stock. It's a Dow stock, but it certainly has a lot of 'new economy' assets with MediaOne (UMG: Research, Estimates) and AT&T Wireless (AWE: Research, Estimates). Applied Materials (AMAT: Research, Estimates) is another industry leader. Simple as that," he said.

"As we get closer to the quarter-end, if the Federal Reserve does not raise rates, and even indicates a neutral bias after that, you will have a quarter-ending window-dressing rally like you've never seen before," he said. "I think 4,140 is very easy as a target. Texas Instruments (TXN: Research, Estimates), Oracle (ORCL: Research, Estimates), all of these are leaders, great names. I think the equity fund managers who have a lot of cash on hand are going to want to own these stocks in their portfolios," said Suttmeier. "If Oracle does not have a negative earnings surprise, which we do not believe to be the case, that will provide a psychological boost to the other brand names in the tech sector."

-- compiled by Parija Bhatnagar and Alexandra Twin

* Disclaimer

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|