|

Stock picks by the pros

|

|

June 20, 2000: 4:58 p.m. ET

Xilinx, MedImmune, Transocean, Mylan Labs, AIG, among favored issues

|

NEW YORK (CNNfn) - Market analysts were upbeat about technology stocks Tuesday, with names such as Compaq, Analog Devices and Xilinx among those on their "buy" lists. Stocks in the biotech and gas and oil sectors were also mentioned.

While a blue chip sell-off continued to drag the Dow lower at midday, recent guests on CNNfn commented on the stocks they are buying, and why.

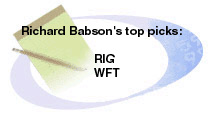

"It's always nice to keep some of your powder dry," said Richard Babson, analyst, Babson United Investment Advisor. "We like to buy and hold for the long term. So we'll make a specific judgment about the quality of a company, and we'll be buying it over time." "It's always nice to keep some of your powder dry," said Richard Babson, analyst, Babson United Investment Advisor. "We like to buy and hold for the long term. So we'll make a specific judgment about the quality of a company, and we'll be buying it over time."

He said that he likes "exploration production, particularly Transocean Sedco Forex Inc. (RIG: Research, Estimates) and Weatherford International (WFT: Research, Estimates). Oil prices are going to stabilize between $26 and $29 a barrel and global growth is expanding."

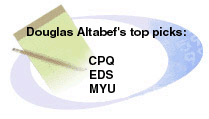

Douglas Altabef, analyst, Matrix Asset Advisors, said that he likes Compaq (CPQ: Research, Estimates): "It's the world's largest maker of PC's. It's a stock that has been out of favor of late, but they are turning their business around and at the mid-20s, it is a very compelling buy." Douglas Altabef, analyst, Matrix Asset Advisors, said that he likes Compaq (CPQ: Research, Estimates): "It's the world's largest maker of PC's. It's a stock that has been out of favor of late, but they are turning their business around and at the mid-20s, it is a very compelling buy."

His second pick is Electronic Data Systems (EDS: Research, Estimates). "It has been hammered on an earnings warnings very recently, but their long-term earnings are very much intact; it is a compelling price in the low 40s."

His final choice is Mylan Labs (MYU: Research, Estimates). "It has also been hammered recently on short-term earnings disappointments, or the fear thereof, but it's the largest generic drug manufacturer. It's a very cyclical company, a very cyclical industry and at 17, 18 is a great point of entry."

"The semiconductor sector in general is in very good shape; the industry hasn't invested enough in capacity and that is actually very good for chip makers," said Joe Osha, semiconductor analyst at Merrill Lynch. "Intel is often treated as a proxy for the chip sector, so the chip sector is doing well and so is Intel." "The semiconductor sector in general is in very good shape; the industry hasn't invested enough in capacity and that is actually very good for chip makers," said Joe Osha, semiconductor analyst at Merrill Lynch. "Intel is often treated as a proxy for the chip sector, so the chip sector is doing well and so is Intel."

"I believe that the really interesting growth in the sector over the next several years will come from communications, portable devices, infrastructure, routers, things like that," he said. "I'm less interested in the growth in the desktop as a source of semiconductor demand."

"LSI Logic (LSI: Research, Estimates), Analog Devices (ADI: Research, Estimates) and Vitesse Semiconductor (VTSS: Research, Estimates), these companies are all geared to sources of end demand," Osha added. "LSI Logic sells circuits into routers, networking equipment, and also increasingly cell phones and information appliances. That's a great market."

"Analog Devices -- we're still all analog, we talk analog, we see analog, and the process of moving information back and forth between that and the digital world takes a lot of expertise. Analog is very good that," the Merrill analyst said. "And then the last one, Vitesse Semiconductor, they make very high-speed semiconductors that go in the core of the network on the end of optical fiber, and that market is exploding."

"We've been very, very upbeat on AMD (AMD: Research, Estimates)," Osha said, referring to Advanced Micro Devices. "We've see them gaining real market share not just in sub-$1,000, but also in higher-value machines for the first time ever. They've really stepped into this breach that Intel has left in the market."

"I am willing to make the bet that given the global recovery we've seen in Asia and Europe, South and Central America, and here in the U.S. in a big way, despite the slowdown, the tech infrastructure, Web infrastructure, and e-commerce software names still have a tremendous earnings potential going forward," said Ash Rajan, senior vice president, Prudential Securities. "I am willing to make the bet that given the global recovery we've seen in Asia and Europe, South and Central America, and here in the U.S. in a big way, despite the slowdown, the tech infrastructure, Web infrastructure, and e-commerce software names still have a tremendous earnings potential going forward," said Ash Rajan, senior vice president, Prudential Securities.

"I like the entire semiconductor/technology environment, and IDTI (IDTI: Research, Estimates) is a quintessential example of a company that sort of migrated to where the action is and where the earnings are," he said. "And certainly, they're getting the multiple. They execute well, they have excellent management, and they're right in the sweet spot of the semiconductor space, and I like that name."

"MedImmune (MEDI: Research, Estimates) in many ways is kind of like the Cisco Systems (CSCO: Research, Estimates) of the biotechnology arena," Rajan said. "It's a large cap, well-established franchise and it tends to attract that kind of money flow."

"AIG (AIG: Research, Estimates) to me, is a proxy on the international arena. And two, more importantly, it's insurance," the Prudential vice president said. "And insurance once again, is in the sweet spot of rising prices, which is a rare phenomenon in a very inflation sensitive environment. So AIG will benefit from price increases, premium increases and that will, of course, help the bottom line and certainly, the multiple."

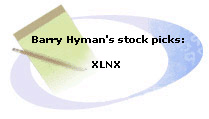

"The economy is already slowing down without the impact of that 50 basis point hike last month, and I think what you have to look at here is the ending of the interest rate cycle," said Barry Hyman, chief market analyst, Ehrenkrantz, King & Nussbaum. "The growth stocks are technology stocks. And at this time it's a very seasonal thing as well. We are coming to the end of the quarter, so you are going to just get the great stock into the portfolios and sell the weak ones." "The economy is already slowing down without the impact of that 50 basis point hike last month, and I think what you have to look at here is the ending of the interest rate cycle," said Barry Hyman, chief market analyst, Ehrenkrantz, King & Nussbaum. "The growth stocks are technology stocks. And at this time it's a very seasonal thing as well. We are coming to the end of the quarter, so you are going to just get the great stock into the portfolios and sell the weak ones."

"Xilinx (XLNX: Research, Estimates) is a semiconductor stock, right at its high of the year," Hyman added. "Stay with the strong stocks. The semiconductor index has some great future plans going forward. Some great book-to-bill revenues, and I think this stock, with a chart like that, looks like it's going higher."

--compiled by Parija Bhatnagar and Alexandra Twin

* Disclaimer

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|