|

Stock picks by the pros

|

|

June 21, 2000: 5:54 p.m. ET

American Express, Amgen, Biogen, MSFT, Ariba, Forefront selected

|

NEW YORK (CNNfn) - Some financial, biotech and Internet services stocks, including Biogen, Commerce One and Computer Associates, won favor with market analysts Wednesday.

While the markets continued to flounder at midday, recent guests on CNNfn commented on the stocks they are buying, and why.

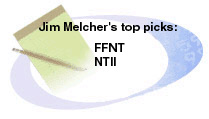

Jim Melcher, founder and president, Balestra Capital, said that "the market is, and has been, for the last five years driven by about the same 100 companies, but if you could see money moving down to the broader market, we've got some real values, a lot of good companies selling really cheap." Jim Melcher, founder and president, Balestra Capital, said that "the market is, and has been, for the last five years driven by about the same 100 companies, but if you could see money moving down to the broader market, we've got some real values, a lot of good companies selling really cheap."

Forefront Inc. (FFNT: Research, Estimates) subsidiary "Forefront Technology is way down off of its high, but in the next three to five years, it should perform beautifully; right now, it's a very cheap stock."

"Neurobiological Technologies (NTII : Research, Estimates) is a biotech that is largely ignored, but they have probably the best drug for treating Alzheimer's that there is; it's not a cure, but it's a very effective treatment. It's a cheap stock, which is hard to find in the biotechnology area."

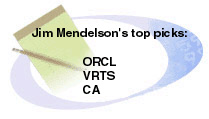

"Right now, the primary driver of demand in the software sector as a whole is clearly that everybody's trying to build out an e-business infrastructure and to leverage the Internet as a basis for doing business," said Jim Mendelson, technology analyst, Wit SoundView. "Today, we see a lot of momentum and strength in the companies providing the core building blocks from a technology perspective in supporting this e-business infrastructure." "Right now, the primary driver of demand in the software sector as a whole is clearly that everybody's trying to build out an e-business infrastructure and to leverage the Internet as a basis for doing business," said Jim Mendelson, technology analyst, Wit SoundView. "Today, we see a lot of momentum and strength in the companies providing the core building blocks from a technology perspective in supporting this e-business infrastructure."

One of his top picks is Oracle (ORCL: Research, Estimates). "The key thing is that Oracle is the leading database player in the marketplace, and that leadership position has been further solidified over the last year and a half as the computing architecture has shifted to being more of a centralized approach to running IT and focusing more on performance and scalability as a means to leverage the Internet. That has helped them competitively, relative to Microsoft (MSFT: Research, Estimates), and it has reduced the risk of price as a big competitive factor in the marketplace."

He also said that he likes "Veritas (VRTS: Research, Estimates) very much from the standpoint of another strong, strategic momentum player, like Oracle."

His final pick is Computer Associates (CA: Research, Estimates). "It's a more controversial stock - it's a 'strong buy' rated stock at WIT SoundView. It's more of a value play, but I believe that we're in a period that's very reminiscent of the early 90s where the marketplace at large thinks that the large mainframe data center computing environments are effectively dead, and that CA won't be relevant in supporting the e-business infrastructure opportunities that are out there. I believe that later this year, we will see strong evidence to the contrary, and that this stock could go through a dramatic revaluation."

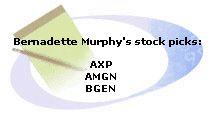

"I think that when investors gain confidence, they tend to move out of some of the Dow stocks, and into technology and biotech, and the more exotic areas of the market. That's why we've been having that swing back and forth," said Bernadette Murphy, market analyst with Kimelman & Baird. "I think that when investors gain confidence, they tend to move out of some of the Dow stocks, and into technology and biotech, and the more exotic areas of the market. That's why we've been having that swing back and forth," said Bernadette Murphy, market analyst with Kimelman & Baird.

"The realization now is that the economy really is starting to slow down. And we've had figures from certain industries that would indicate that. And so therefore, investors are trying to put their money where gains in growth and earnings will take place, even in a slower economy. The areas that I think have been benefiting, and I think will continue to benefit, are the financial and health care sectors because that has been a traditional growth area. But not at the percentage gains that some of the technology companies have experienced."

"There are a number of stocks I like. In the financial services I like American Express (AXP: Research, Estimates). In biotech there's Amgen (AMGN: Research, Estimates). Then you have Biogen (BGEN: Research, Estimates) that's just starting to move."

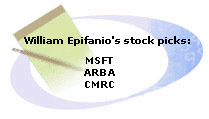

"I'd buy Microsoft. I think it's a great, a great value right now. I mean, if you're looking at forward P/E, Microsoft, under 40 and at that level, I believe this company has terrific fundamentals and things will start to come together. Again though, my 'buy' on the stock assumes the company will not be broken up, because I continue to maintain that if the company is split up, some way or other, it's going to be bad for shareholder value; it's going to be really destructive," said William Epifanio, enterprise software analyst at JP Morgan. "I'd buy Microsoft. I think it's a great, a great value right now. I mean, if you're looking at forward P/E, Microsoft, under 40 and at that level, I believe this company has terrific fundamentals and things will start to come together. Again though, my 'buy' on the stock assumes the company will not be broken up, because I continue to maintain that if the company is split up, some way or other, it's going to be bad for shareholder value; it's going to be really destructive," said William Epifanio, enterprise software analyst at JP Morgan.

"I think the next big catalyst for the stock is going to be Microsoft delivering some terrific Windows 2000 results, and I'm frankly not expecting that until the December quarter. So we have some time. Anything before that will be a nice upside surprise from my perspective."

"Well, I like Microsoft (MSFT: Research, Estimates) especially. I like Ariba (ARBA: Research, Estimates) and I like Commerce One (CMRC: Research, Estimates) quite a bit. I cover both of those stocks. And I think both of those stocks represent terrific upside potential moving forward. Investors are understandably uncertain about their business models, but I think that moving forward, as investors get more comfortable, these stocks are really going to take off. So I would be investing in both Ariba and Commerce One."

--Compiled by Parija Bhatnagar and Alexandra Twin

* Disclaimer

|

|

|

|

|

|

|