|

Stock picks by the pros

|

|

June 23, 2000: 1:46 p.m. ET

Argonaut, Vector, AOL, Time-Warner, RCN, Centex win favor

|

NEW YORK (CNNfn) - Sector analysts and portfolio managers favored technology, housing, Internet, and communications stocks Friday, including names such as Stratus Services, GMH and AOL.

While the Dow cruised into midday trading on solid gains, recent guests on CNNfn commented on the stocks they are buying, and why.

"The Fed may raise rates another notch, then maybe that will be it for the rest of the year. Or they may not raise rates this time and wait until their August meeting to see how the economy is coming back. It might be better in a way if they get it over with this next week. But I think right now, there's some concern about interest rates still notching up a little bit. But I am optimistic because we are in an election year and we are very near the end of this long rise in interest rates," said Ray Dirks, senior analyst, Dirks & Company. "The Fed may raise rates another notch, then maybe that will be it for the rest of the year. Or they may not raise rates this time and wait until their August meeting to see how the economy is coming back. It might be better in a way if they get it over with this next week. But I think right now, there's some concern about interest rates still notching up a little bit. But I am optimistic because we are in an election year and we are very near the end of this long rise in interest rates," said Ray Dirks, senior analyst, Dirks & Company.

"I like a couple of stocks, like Stratus Services (SERV: Research, Estimates). These are small cap. I like the small caps because they have been overlooked and of course in this rally we had over the last month, the small caps didn't participate as much as the big ones. Two of these stocks though, Argonaut (AGII: Research, Estimates) and Vector (VGR: Research, Estimates), pay very good dividends. Argonaut pays over 9 percent, and it is a pretty good-sized insurance company in the Workers' Comp area. It has been overlooked in the rally of insurance stocks in the last several months. And Vector is a cigarette stock.

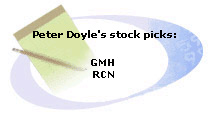

"The big thing about the Internet is really the distribution capabilities, and a lot of what goes on in the Internet is not about technology. It's really about having a proprietary good or service that you can deliver over the technology. And we're trying to focus on those companies that we think have something proprietary that will likely bring people back repeatedly," said Peter Doyle, chief investment strategist, The Internet Fund. "The big thing about the Internet is really the distribution capabilities, and a lot of what goes on in the Internet is not about technology. It's really about having a proprietary good or service that you can deliver over the technology. And we're trying to focus on those companies that we think have something proprietary that will likely bring people back repeatedly," said Peter Doyle, chief investment strategist, The Internet Fund.

"There are really three technologies that are going to provide broadband. It's going to be cable, satellite and DSL, which is coming over the phone lines. And I believe it's one of the legs that is going to be the likely winner. Believe it or not, GMH (GMH: Research, Estimates) actually is the third largest in subscribers, behind AOL (AOL: Research, Estimates) and Time Warner (TWX: Research, Estimates)." Time Warner is the parent company of CNNfn.

"RCN (RCNC: Research, Estimates), they're laying fiber optics in 6 percent of the country. But within that 6 percent of the country, they cover about 40 percent of all telecommunication calls. They're going to provide high-speed Internet access and other bundled services, and they have $3.6 billion in cash on the balance sheet. They're well capitalized and able to execute their business strategy without worrying about what's going on in the capital markets."

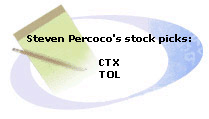

"I think it's clear that the Fed wants housing to slow down. I think it's also clear that it's having an impact at this point in time. I would expect rates would moderate from here unless there is some shock to the system, something from the outside. I guess my concern, which I think is the Fed's as well, is with the value of the dollar because if the dollar declines significantly, then inflation in rates could go up no matter what happens to the economy," said Stephen P. Percoco, housing analyst at Lark Research. "I think it's clear that the Fed wants housing to slow down. I think it's also clear that it's having an impact at this point in time. I would expect rates would moderate from here unless there is some shock to the system, something from the outside. I guess my concern, which I think is the Fed's as well, is with the value of the dollar because if the dollar declines significantly, then inflation in rates could go up no matter what happens to the economy," said Stephen P. Percoco, housing analyst at Lark Research.

"Centex (CTX: Research, Estimates) is one of the largest housing companies in the United States. It is in all aspects of the housing market it. It has a very strong balance sheet and is diversified in its operations. What I'm looking for, the criteria include strong balance sheets in companies that I think are well positioned for a potential downturn. Centex has a number of businesses that can offer some growth potential, or counter-cyclical earnings potential that can offset the weakness in its core housing business. It can also improve its market share, take advantage of some of the weakness in the market, and merge as a stronger company."

"Toll Brothers (TOL: Research, Estimates) is a luxury builder. I think the thing to keep in mind here is that it has a valuable land bank. It's proven that it can benefit from the down side of the cycle. It has a low cost operating model, and those things should serve it well, even though I think, if we do see weakness, say in the financial markets, it is exposed because of its strength in the Northeast. A lot of its core operations are out there."

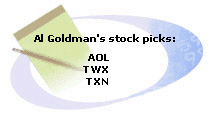

"I think the main thing that's going right for the market is that we still have a very healthy economy, with rising earnings and benign inflation. On a technical side, I think the correction ended three weeks ago. The market has been slowly recovering its sea legs. We had five days up in a row on the Nasdaq composite, and that is the reason why the profit taking yesterday. But the big picture still remains very positive," said Al Goldman, chief market strategist, A.G. Edwards. "I think the main thing that's going right for the market is that we still have a very healthy economy, with rising earnings and benign inflation. On a technical side, I think the correction ended three weeks ago. The market has been slowly recovering its sea legs. We had five days up in a row on the Nasdaq composite, and that is the reason why the profit taking yesterday. But the big picture still remains very positive," said Al Goldman, chief market strategist, A.G. Edwards.

"The market hates surprises. But we believe the odds substantially favor that the Fed will not raise interest rates next week, and that the market will take that as some degree of relief, unless they say something nasty. But basically we think we're into a good summer rally."

"AOL (AOL: Research, Estimates) has been way behind the market since they announced the merger 10 months ago with Time Warner (TWX: Research, Estimates), as people are trying to figure out whether these two cultures can, in fact, marry each other in a synergistic fashion. But the shares technically have made what I believe is a triple bottom. Short-term trend is turning up. Momentum is positive. And I like the marriage of the 'old economy/new economy.' So the shares I think represent good value here, and are finally starting to act better finally."

"Texas Instruments (TXN: Research, Estimates), I think is a great company. It represents very good value here in the technology area."

--Compiled by Parija Bhatnagar

* Disclaimer

|

|

|

|

|

|

|