|

Stock picks by the pros

|

|

June 26, 2000: 5:56 p.m. ET

Millennium, Helix Technology, Merck, Home Depot, Albertson's win mention

|

NEW YORK (CNNfn) - Analysts and market strategists favored the biotech, technology, semiconductor and financial sectors Monday, highlighting names such as Millenium, EMC, Apache Energy, Affymetrix, Helix Technology and Wal-Mart.

While the markets rose to a close in positive territory, recent guests on CNNfn commented on the stocks they are buying, and why.

"It's like landing at Plymouth Rock. The Pilgrims have landed at Plymouth Rock, but there will be many winners as this new field evolves," said Doug Lind, biotech analyst, Morgan Stanley Dean Witter, regarding today's announcement that Celera Genomics (CRA: Research, Estimates) and scientists from the government-funded Human Genome Project have unveiled a rough draft of the genetic code for human life. "It's like landing at Plymouth Rock. The Pilgrims have landed at Plymouth Rock, but there will be many winners as this new field evolves," said Doug Lind, biotech analyst, Morgan Stanley Dean Witter, regarding today's announcement that Celera Genomics (CRA: Research, Estimates) and scientists from the government-funded Human Genome Project have unveiled a rough draft of the genetic code for human life.

"We believe this will revolutionize the healthcare industry and the drug industry, and 30 to 50 percent of the drugs that are used in the year 2020 at a minimum, will be based on this genomic information," he said. "At the end of the day, it's really about drugs. But between here and there, we're going to have a flurry of genomic information that will help us diagnose diseases much more accurately than we can today."

"Millennium (MLNM: Research, Estimates) has emerged as the dominant drug company, so much so that we even hesitate to classify it as a 'genomics' company anymore," Lind said. "They really are going about creating the new drug targets and the new drugs for tomorrow. This has been validated not only by their own internal work, but also by collaborations already with some of the world's largest pharmaceutical companies. They did a major deal with Bayer last year, and just last week they announced a major $450 million deal for the next two years with Aventis (AVE: Research, Estimates). So they're really on the map at this point."

"Medarex (MEDX: Research, Estimates) is a very exciting state-of-the-art monoclonal antibody company. Genomics information will provide a flurry of new drug targets to treat these diseases," said Lind. "First thing you do is make a monoclonal antibody: that's Medarex."

"The other company, Sepracor (SEPR: Research, Estimates) is a very interesting situation where they make improvements on existing blockbuster medications and then partner them back to the original parent of the original compound," Lind said.

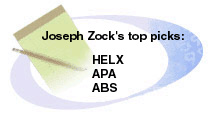

Joseph Zock, president and chief investment manager, Capital Management said that he likes Helix Technology (HELX: Research, Estimates). "They're the maker of cryogenic pumps. The reason that you should be interested in this company is that they have an 85 percent market share of worldwide cryogenic pump manufacturers. That's the pump that takes the air out of the technology pump process. They also have a system called Gold Link, which helps all manufacturers monitor their production line." Joseph Zock, president and chief investment manager, Capital Management said that he likes Helix Technology (HELX: Research, Estimates). "They're the maker of cryogenic pumps. The reason that you should be interested in this company is that they have an 85 percent market share of worldwide cryogenic pump manufacturers. That's the pump that takes the air out of the technology pump process. They also have a system called Gold Link, which helps all manufacturers monitor their production line."

His second pick is Apache Energy (APA: Research, Estimates), in the oil and gas sector. "It is very undervalued at this time," Zock said.

Zock's final pick is Albertson's (ABS: Research, Estimates). "They are a grocery store chain in the west with a dynamic new management, a tremendous market share and they're in a defensive industry, a non-cyclical industry which should do well regardless of what the economy or what the market does," he said.

"The data released over the past month show a moderation in the inflation on the PPI and CPI. They also show various measures of the economy, especially "The data released over the past month show a moderation in the inflation on the PPI and CPI. They also show various measures of the economy, especially

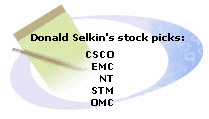

consumer spending and the retail sales, were down for two months in a row," said Donald Selkin, chief investment strategist at Joseph Gunnar. "I would think going forward, the second quarter earnings are going to be OK, not quite as good as the first quarter. But we're looking for S&P profit growth around 19 to 20 percent, and technology earnings almost 30 percent "

"I think a few areas people should stay away from would be the consumer cyclicals, which obviously do not benefit in the slowing economy. But as far as more on the positive side, I would look for some of the technology stocks that have been beaten down over the last couple of months, and also in the energy sector. These two have been the real strong performers this year. And the profit growth of both of these areas will be quite significant," Selkin said.

"I would say that Amazon (AMZN: Research, Estimates) is running out of steam, so to speak. I would avoid it," he said. "The ones that really should benefit are companies like Cisco (CSCO: Research, Estimates), EMC (EMC: Research, Estimates), Nortel Networks (NT: Research, Estimates). They're the second-largest producer of telecom equipment after Lucent Technologies (LU: Research, Estimates). They've expanded greatly through acquisitions. Despite all of the rockiness that we've seen in many stocks, this stock has held its own. And that shows that the fundamentals are very, very good for this company."

"We all know the semiconductor group is the second-best performing group this year after the energy services group. ST Microelectronics (STM: Research, Estimates) is a company that the CEO recently said will substantially exceed second-quarter revenue estimates. Their gross profit margins, he said, also will exceed 45 percent. It's another stock similar to Nortel, and it hung up there near its highs despite a lot of stocks that have weakened substantially," said Selkin. "Let's remember that later this year, advertising revenues will be very strong because of the upcoming Olympics, and also the presidential election campaign. Omnicom (OMC: Research, Estimates) is a stock that also acted well despite a lot of stocks coming down. So if the stock acts well in an atmosphere that has not been friendly toward equities, it shows that the underlying fundamentals are pretty strong."

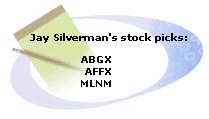

"The biotechs have had a very strong comeback the last couple of weeks in anticipation of today's announcement that scientist have completed a rough working draft deciphering the sequence of the human genome. So while it is incredibly positive, and we're probably going to see a lot of announcements by companies that are part of the genome research, I think some of this has been discounted already," Robertson Stephens biotech analyst Jay Silverman said. "The biotechs have had a very strong comeback the last couple of weeks in anticipation of today's announcement that scientist have completed a rough working draft deciphering the sequence of the human genome. So while it is incredibly positive, and we're probably going to see a lot of announcements by companies that are part of the genome research, I think some of this has been discounted already," Robertson Stephens biotech analyst Jay Silverman said.

"The drug companies are already big players, in partnerships with the lead genomics companies," said Silverman. "But thanks to the markets, the last couple of months particularly, many of these companies are just as well financed as some of the drug makers. So we're going to see a good mix of biotech-to-biotech announcements."

"Abgenix (ABGX: Research, Estimates) is the leader in monoclonal antibody technology for the next generation, and basically antibodies have been the dominant drug-driver of biotech stocks the last couple of years. And so far, Abgenix has deals with Human Genome Sciences and Millennium, two of the leading genomics companies. So the first genomic targets, or discoveries for commercial drugs, are going to be antibodies, and Abgenix is by far the best positioned."

Other stocks on Silverman's list included Affymetrix (AFFX: Research, Estimates) and Millennium Pharmaceuticals (MLNM: Research, Estimates).

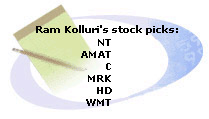

"Some sectors like retail are bracing themselves for a slowdown in the economy in the second half. So you can see some of the weakness in retail stocks. But corporate earnings are looking good. They are afraid of the Fed and that is still in the minds of people. Once burned, twice shy," GlobalValue chief investment officer Ram Kolluri said. "Some sectors like retail are bracing themselves for a slowdown in the economy in the second half. So you can see some of the weakness in retail stocks. But corporate earnings are looking good. They are afraid of the Fed and that is still in the minds of people. Once burned, twice shy," GlobalValue chief investment officer Ram Kolluri said.

"The market is looking for earnings," he continued. "If you don't come up with earnings you are really going to get punished. So, of course, the volatility is here to stay. And the market is looking at that next 12 months and is nervous. That's why you can't make any headway. Investors will have to diversify because you just can't go with technology alone and say that is my savior. You have to diversify."

"Optical is huge," Kolluri asserted. "The demand for capacity is doubling almost every 90 days. And NorTel Networks (NT: Research, Estimates) provides entrant solutions, and also manufactures wireless equipment. Everyone is transitioning to this third generation standard. NorTel is the leader there. Applied Material (AMAT: Research, Estimates) increased its revenues 50 percent in the last two years. We're seeing globalization and Citigroup (C: Research, Estimates) is right there wherever you go."

Kolluri's other picks were Merck (MRK: Research, Estimates), Home Depot (HD: Research, Estimates) and Wal-Mart (WMT: Research, Estimates) in the consumer area.

-- compiled by Parija Bhatnagar and Alexandra Twin

* Disclaimer

|

|

|

|

|

|

|