|

Stock picks by the pros

|

|

June 27, 2000: 4:15 p.m. ET

Novoste, Broadwing, Safeway, Alcoa, International Paper, Xilinx win mention

|

NEW YORK (CNNfn) - Market analysts and portfolio managers pulled Tuesday's picks from a diverse array of stocks spanning the financial, Internet infrastructure, telecom and entertainment sectors, with such names as American General, Lucent, Dow Chemical, Walgreen, Disney and GTE.

While the markets painted a mixed picture toward closing, recent guests on CNNfn commented on the stocks they are buying, and why.

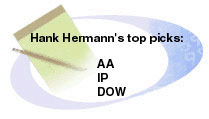

"The idea is that [following the Federal Reserve's move] the economy slows, but stays at a pretty high level, and that there are a lot of companies around that haven't had pricing power for a long time, because there's been excess capacity in the world," said Hank Herrman, president and chief investment officer, Waddell & Reed. "These companies might be good places to look, especially if they're cheap." "The idea is that [following the Federal Reserve's move] the economy slows, but stays at a pretty high level, and that there are a lot of companies around that haven't had pricing power for a long time, because there's been excess capacity in the world," said Hank Herrman, president and chief investment officer, Waddell & Reed. "These companies might be good places to look, especially if they're cheap."

His picks include: Alcoa (AA: Research, Estimates), International Paper (IP: Research, Estimates) and Dow Chemical (DOW: Research, Estimates).

"After the Fed cools, people may look at these companies and say 'they look good, they've got earnings on their side, and they're starting to have earnings power for the future.'"

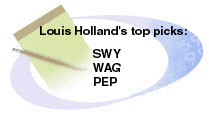

"I think that what we have to understand now is that interest rates had been rising for a year and a half, and now there is this fear that the economy will slow down, and it has," said Louis Holland, chief investment officer, Holland Capital Management. "Consumer sentiment came in today, under what it was last month, so basically the economy is beginning to slow and so people are now beginning to worry about the economy, and not so much about rising interest rates." "I think that what we have to understand now is that interest rates had been rising for a year and a half, and now there is this fear that the economy will slow down, and it has," said Louis Holland, chief investment officer, Holland Capital Management. "Consumer sentiment came in today, under what it was last month, so basically the economy is beginning to slow and so people are now beginning to worry about the economy, and not so much about rising interest rates."

Within this environment, he said that, "the staples are probably going to do well and the financials stocks. When I say 'staples,' I'm talking about Safeway (SWY: Research, Estimates), Walgreen (WAG: Research, Estimates) and Pepsi Cola (PEP: Research, Estimates), those kinds of companies."

"I would be buying Sprint (FON: Research, Estimates) as of today," said Anthony Ferrugia, telecom analyst, A.G. Edwards, "because our contention on this deal from the very outset has been that if you want to play this deal, you play it Sprint. We have Sprint rated 'buy.' We have WorldCom (WCOM: Research, Estimates) rated 'accumulate' because if this deal doesn't happen, Sprint is a strategic asset in play." "I would be buying Sprint (FON: Research, Estimates) as of today," said Anthony Ferrugia, telecom analyst, A.G. Edwards, "because our contention on this deal from the very outset has been that if you want to play this deal, you play it Sprint. We have Sprint rated 'buy.' We have WorldCom (WCOM: Research, Estimates) rated 'accumulate' because if this deal doesn't happen, Sprint is a strategic asset in play."

"Bell Atlantic (BEL: Research, Estimates) - GTE (GTE: Research, Estimates), we like that a lot. We've been playing that through GTE because of the discount," he said.

"In the smaller cap area, we like Broadwing (BRW: Research, Estimates). That's a company that is creating lots of bandwidth out there, along with companies like Level 3 (LVLT: Research, Estimates), Williams Communications Group (WCG: Research, Estimates) and Qwest (Q: Research, Estimates)," he said. "Sprint and WorldCom will have maybe 6 percent of the bandwidth share out there at the end of 2001. Broadwing is a very significant competitor. It's not horizontally integrated. It's potentially a takeout candidate. So we like Broadwing very much."

"The economy, no question, slowed down in May and late April in terms of the employment numbers and a lot of the sales numbers that came out. But that's happened every April and May for the last two or three years. This may be a normal seasonal slowdown. So the Fed is not going to raise rates now, I think a big part of it because of the upcoming election, but it doesn't in any way, shape or form mean that the Fed is out of the picture," said Alan Kral, portfolio manager at Trevor Stewart Burton & Jacobsen. "The economy, no question, slowed down in May and late April in terms of the employment numbers and a lot of the sales numbers that came out. But that's happened every April and May for the last two or three years. This may be a normal seasonal slowdown. So the Fed is not going to raise rates now, I think a big part of it because of the upcoming election, but it doesn't in any way, shape or form mean that the Fed is out of the picture," said Alan Kral, portfolio manager at Trevor Stewart Burton & Jacobsen.

"We think that there are some opportunities out there in the marketplace. If the Fed is in fact done with interest rates for a while, some of the stocks that are associated with the Bank and Finance Reform Act of 1999, specifically American International Group (AIG: Research, Estimates), which is probably the strongest insurance company, ought to be in a position to do pretty well going forward. There's been a lot of negative ideas associated with the finance stocks because the Fed has been active. But we think that if the Fed calms down, that these stocks, especially AIG, can do well."

"Lucent (LU: Research, Estimates) is one of the largest players in the Internet infrastructure industry, an industry that supports valuations that are gargantuan compared to many others at the moment. It's fallen into trouble because it had problems with its first-quarter report. But if the business really is growing at the rate that some of the other companies say that it is, this is a stock that will do pretty well going forward. It's a way to get into the industry at a relatively low valuation. Disney (DIS: Research, Estimates) -- everybody likes Disney. It's summertime, movies are out, the company appears to have turned around its entertainment division, and its theme park division is doing very well since a price hike late last year."

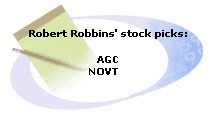

"The Fed rarely surprises the markets, and the consensus of private economists is clearly that the Fed will not do much. We really had slowing data on the economy and slowing inflation pressure. And I'm hopeful that this is close to the end of the Fed rate hikes," said Robert Robbins, chief investment strategist at Robertson Humphrey. "The Fed rarely surprises the markets, and the consensus of private economists is clearly that the Fed will not do much. We really had slowing data on the economy and slowing inflation pressure. And I'm hopeful that this is close to the end of the Fed rate hikes," said Robert Robbins, chief investment strategist at Robertson Humphrey.

"I think we have a broadening of the market. It used to be concentrated very heavily in techs. So, I would still be in tech. But I would be underweighted in tech, perhaps 20 percent of total stock holdings, if you're in secondary stocks, 25 percent, if you're in big cap instead of about the 37 percent market weighting. And I would especially cautious about tech right now, since we're close to a summer rally high. I'd sort of hold what you've got in that area, rather than add to your holdings now. Because typically this is the worst seasonal time of the year to be buying aggressive growth names in general. So you know concentrate more and spread out more into finance. Finance looks great."

"American General (AGC: Research, Estimates) is a good play in this super bull market for stocks and bonds. I think stocks are going to double over the next five years, in terms of the S&P 500. This company sells annuities. It's what you call an asset accumulator. It's involved directly with stocks and bonds. Bonds have been in a super bull market too, and I expect interest rates to go down below the 1998 lows on the long Treasury within a couple of years, below that 4-3/4. Novoste Corp. (NOVT: Research, Estimates) is a very speculative special situation. And I'd say if you want to speculate on a takeover, here's one that on the charts as well as in terms of strategic fit, probably in the very near term. But that's the market's speculation. We like it from a fundamental viewpoint because they've got a wonderful improvement to coronary heart problems, where you do the angioplasty. And they have a beta radiation technique, which tends to prevent re-blockage of coronary arteries."

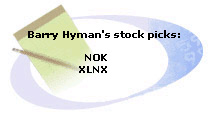

"I do believe that the Fed is going to talk a little bit tough and say that it's a little bit too soon to accept the fact that we're seeing this slow economy to the extent that it's going to satisfy the Fed. And I believe that is what is going to keep the market in check. And it's another situation the Fed wants to try to control. They do want to keep this market in check. And we're going to have a slowing economy, and it's going to have dramatic effects on how investors look at the investment horizon going forward, at least for the next half of the year as we adjust to this slowing economy and the eventual peak in interest rates," said Barry Hyman, chief market strategist for Ehrenkrantz King & Nussbaum. "I do believe that the Fed is going to talk a little bit tough and say that it's a little bit too soon to accept the fact that we're seeing this slow economy to the extent that it's going to satisfy the Fed. And I believe that is what is going to keep the market in check. And it's another situation the Fed wants to try to control. They do want to keep this market in check. And we're going to have a slowing economy, and it's going to have dramatic effects on how investors look at the investment horizon going forward, at least for the next half of the year as we adjust to this slowing economy and the eventual peak in interest rates," said Barry Hyman, chief market strategist for Ehrenkrantz King & Nussbaum.

"You have to be careful. There are not many sectors that are doing well out there. This is a slowing economy. People are looking for security of earnings. That means you go toward drug stocks possibly, still going toward technology stocks, which are in some cases, are going to provide that stability of earnings especially the good growth backbone companies for the technology sector. Avoid cyclical stocks, avoid retail stocks. Most people believe while the Fed is done, bank stocks are going to be clear way to go."

"How I look at technology is I want to buy growth at a reasonable valuation and I think two or three stocks in technology look fairly decent. One is Nokia (NOK: Research, Estimates), the leader in cellular phone making. And the stock is holding up very well on a technical basis. Has not really pulled back that much, which shows that future earnings will most likely be good. Second one is Xilinx (XLNX: Research, Estimates), which we recently mentioned also. It's a programmable chip company in a very hot semiconductor sector. This is another one trading at 60 times earnings but growing over the next two years on an average of about 40 percent.

--Compiled by Parija Bhatnagar and Alexandra Twin

* Disclaimer

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|