|

Stock picks by the pros

|

|

June 30, 2000: 1:08 p.m. ET

Alpharma, WCOM, CNET, Ariba, Yahoo, Philip Morris make the list

|

NEW YORK (CNNfn) - Sector and market analysts made their value picks mostly from the telecom and Internet sectors, choosing GenesisIntermedia.com, Alpha Microsystems, and AOL to feature on their list. Two medical supplies companies, Barr Labs and Alpharma, and tobacco giant Philip Morris also made the cut.

While the Nasdaq gains continued into midday trading, recent guests on CNNfn commented on the stocks they are buying, and why.

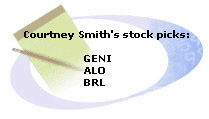

"I think that the telecommunications sector is a good sector to be in, not the old Baby Bells and that sort of stuff, but in the telecommunication equipment area, semiconductor, capital equipment. For example, medical devices, and places where you can see transformations of 'old economy' companies into 'new economy' companies. There are a lot of interesting areas," said Courtney Smith, president and chief investment officer, Courtney Smith & Co. "I think that the telecommunications sector is a good sector to be in, not the old Baby Bells and that sort of stuff, but in the telecommunication equipment area, semiconductor, capital equipment. For example, medical devices, and places where you can see transformations of 'old economy' companies into 'new economy' companies. There are a lot of interesting areas," said Courtney Smith, president and chief investment officer, Courtney Smith & Co.

"A company that I own a lot of stock on is GenesisIntermedia.com (GENI: Research, Estimates)," Smith said. "This is a company that's trying to be the next CMGI. It's a company that was in the marketing business. With the Internet, the interesting thing is that most of the big failures we've seen have been from companies that don't understand direct marketing to consumers. It's companies that want to do brand marketing. GenesisIntermedia understand direct marketing.

"The whole other area, medical supplies -- Alpharma (ALO: Research, Estimates), Barr Labs (BRL: Research, Estimates) -- these are companies that I like. A lot of the things that people are talking about in terms of political problems with drug pricing helps generic drug manufacturers because they will be the ones that will profit from them," said Smith.

"I'm quite bullish. I think the market will do quite well, and I believe what will propel a higher market here is the economic numbers in July, which are going to confirm the weakness that we saw in June. And also strong earnings for the second quarter. So I think those two combinations are going to lead us to a very strong summer rally. Right now we're in the midst of a summer rally, but it's very tepid, as you know," said Peter Cardillo, director of research, Westfalia Investments. "And if I am right about the economic numbers in July being equally as weak as they were in June, I think there is a good possibility that perhaps the Fed has already finished raising interest rates. "I'm quite bullish. I think the market will do quite well, and I believe what will propel a higher market here is the economic numbers in July, which are going to confirm the weakness that we saw in June. And also strong earnings for the second quarter. So I think those two combinations are going to lead us to a very strong summer rally. Right now we're in the midst of a summer rally, but it's very tepid, as you know," said Peter Cardillo, director of research, Westfalia Investments. "And if I am right about the economic numbers in July being equally as weak as they were in June, I think there is a good possibility that perhaps the Fed has already finished raising interest rates.

"Technology, telecommunication stocks and probably the financial stocks will lead the market higher. WCOM (WCOM: Research, Estimates) are probably going to sell off their long-distance operation, and I think the stock is very cheap down here, and I would not be a bit surprised to see someone come in and bid for the long-distance operations. Philip Morris (MO: Research, Estimates) I think is cheap. This is a stock that has a lot of value there. Now they're involved with Nabisco (NGH: Research, Estimates) and, I mean of course there are a lot of legal problems out there, but I think this stock is very cheap. Going forward you will see a double and possibly even a triple - there is a lot of value there," Cardillo said.

"CNET (CNET: Research, Estimates) is an Internet company, basically a great company, selling at a very low multiple, about 6-, 5-to-1 right now. The stock has been trashed along with all the other Internet companies, and it's trading just around its yearly low. I think it's a great buy down here. And I believe that the stock could double within the next 12-to-18 months," said Cardillo. "Flour City International (FCIN: Research, Estimates): They construct iron curtains for high-rises; a great little company, actually selling under book value here. Problem is it's not really known to the Street. I think they could do somewhere between 65 and 70 cents this year. Alpha Microsystems (ALMI: Research, Estimates), favorite little Internet company of mine; I've mentioned it time and time again. Basically it's an old company that's been transformed into a new company.

"Again, I think we're going to see a lot of revenue growth coming within the next quarter or so, and I believe that it's basically an infrastructure B2B for the Internet, where you can research engines, where you can create your own agents and what not, and management is doing a great job," Cardillo said. "I'm looking for this stock to really do quite nicely over the next six-to-18 months."

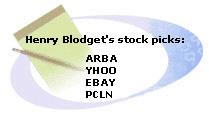

"We think the Internet is tremendously profound. It will continue to have an effect on the global economy over the next five-to-10 years. But there's no way that it is a large enough opportunity to support the 400 companies that have gone public. And I think if you look back in history at different emerging industries, we've often had this feeling that the PCs for example are going to change the world. All you have to do is buy a PC company and you're safe. And actually out of the PC industry, only a few companies emerged to do very well, and we think the same thing will be out of the Internet industry," said Henry Blodget, Internet commerce analyst, Merrill Lynch. "We think the Internet is tremendously profound. It will continue to have an effect on the global economy over the next five-to-10 years. But there's no way that it is a large enough opportunity to support the 400 companies that have gone public. And I think if you look back in history at different emerging industries, we've often had this feeling that the PCs for example are going to change the world. All you have to do is buy a PC company and you're safe. And actually out of the PC industry, only a few companies emerged to do very well, and we think the same thing will be out of the Internet industry," said Henry Blodget, Internet commerce analyst, Merrill Lynch.

"So one of the things that we've always tried to recommend is: do try to buy the companies with underlying fundamentals that are very strong, and even that unfortunately in recent weeks has not protected you at all; you're still down quite a bit. There are certainly different sectors of the Internet, B2C, B2B, there's infrastructure as well," Blodget said. "And now we're starting to see wireless and optics and so forth. And each sector has sort of gone through a period where it's been very hot. All you had to do was buy a company in the sector and the stock would go up. I think now, investors are really looking through all of that, in every sector, and trying to find the best companies, and those are the only ones that are doing well.

"If you looking in B2B, Ariba (ARBA: Research, Estimates) is doing very well. That's a leading company; it's very strong. That stock has come back. In B2C, AOL (AOL: Research, Estimates) and Yahoo! (YHOO: Research, Estimates) are hanging in there. They are some of the strongest companies. Ebay (EBAY: Research, Estimates) is also a profitable company. Has a great business model. If you think about commerce, you have two pieces to commerce: you have the matching of buyer and seller and then you have the actual fulfillment. EBay does not have to deal with fulfillment; they just do a matching of buyer and seller, and that is very value-added. Ultimately, it's why it is a profitable company and we think long-term they could start to capture some of the revenue from the classified advertisement that drive newspapers, and that could be a big opportunity," he said.

"Priceline (PCLN:Research, Estimates) is a little bit more of a long shot at this point, but it's one of the companies that just focuses on commerce, on matching buyer and seller. They have a unique model, which is the "Name Your Own Price" model. We think they will turn profitable at the end of this year, which will be big vote of confidence," said Blodget.

-- compiled by Parija Bhatnagar

* Disclaimer

|

|

|

|

|

|

|