|

Stock picks by the pros

|

|

September 27, 2000: 5:14 p.m. ET

Time Warner, Wells Fargo, and Fannie Mae, JDS Uniphase get picked

|

NEW YORK (CNNfn) - Market strategists and sector analysts reviewed stocks in the technology, Internet, banking and media sectors Wednesday, recommending companies such as AOL, Applied Materials and Corning.

While the markets fell in late trading, recent guests on CNNfn commented on the stocks they are buying and why.

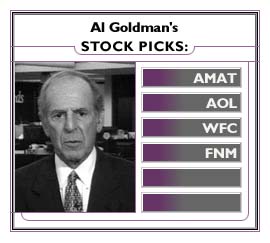

"I think the market is very close to getting back on the track. In September, we were hit, of course, with the euro and the price of oil. And those two 'E's really leaned on the market. And, you know, we really haven't had a big pickup in the pre-announcement. But there's been a high profile and the new full-disclosure laws are forcing people to come out and say whatever they need to say. But something like 69 percent of pre-announcements have been negative. And that's below the historic average. But the market was sensitive. Remember, while the Nasdaq was down 12 percent, it was up 13-1/2 percent in August. So we had a market that was overbought. We got hit primarily, in my opinion, by concern about the euro and the price of energy. But both of those are old news and ancient history," said Al Goldman, chief market strategist for A.G. Edwards. "I think the market is very close to getting back on the track. In September, we were hit, of course, with the euro and the price of oil. And those two 'E's really leaned on the market. And, you know, we really haven't had a big pickup in the pre-announcement. But there's been a high profile and the new full-disclosure laws are forcing people to come out and say whatever they need to say. But something like 69 percent of pre-announcements have been negative. And that's below the historic average. But the market was sensitive. Remember, while the Nasdaq was down 12 percent, it was up 13-1/2 percent in August. So we had a market that was overbought. We got hit primarily, in my opinion, by concern about the euro and the price of energy. But both of those are old news and ancient history," said Al Goldman, chief market strategist for A.G. Edwards.

"Buy growth stocks. And I would focus on the much-maligned technology group. Technology, in our opinion, is still the No. 1 one growth area. Because they do sell at high relative valuation levels, they go up big and down big. But looking out a couple of years, I can't think of any group that I'd rather buy," Goldman said. "One of our favorites is Applied Materials (AMAT: Research, Estimates), which is down sharply from its highs. Great company, the leading manufacturer of all the equipment that makes chips, very well managed. They report a steady growth of earnings. And this is an industry where I think you want to stick with the biggest and the best. And Applied Materials is one that satisfies that criteria.

"I also think it's a win-win situation for AOL (AOL: Research, Estimates)," Goldman continued. "Remember the stock, AOL was 92 before the proposed merger with Time Warner, and then dropped down in the mid-50s, where it's been churning between 50 and 60 now for five months. I think AOL is one of the quality ways to participate in the long-term growth of the Internet with or without Time Warner. I like the merger. I like the blending of the two cultures. But either way, I think AOL is a good gamble." [Time Warner is the parent of CNNfn.]

"Wells Fargo (WFC: Research, Estimates) looks attractive to us, Fannie Mae (FNM: Research, Estimates) in the mortgage area. Interest rates, in our opinion, topped out a long time ago and are going to go lower. In an economy that's going to slow down a bit, I think the steady eddy growth of most of your financial companies will attract money," Goldman said.

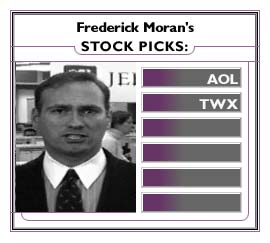

"We think the merger will most definitely happen. In fact all of the parties involved have indicated a willingness to allow the transaction to happen, but that's not to say that they won't have ongoing debate and controversy surrounding the various issues. [If] everything they asked for was unreasonable then they would step away from the deal, but so far, all the points that have been contested have been fairly reasonable. Things that would not interrupt AOL's competitive position and business potential. Things that actually AOL (AOL: Research, Estimates) has indicate a willingness to change over time anyway even prior to the Time Warner (TWX: Research, Estimates) merger," said Frederick Moran, head of Internet media at Jeffries and Co. "We think the merger will most definitely happen. In fact all of the parties involved have indicated a willingness to allow the transaction to happen, but that's not to say that they won't have ongoing debate and controversy surrounding the various issues. [If] everything they asked for was unreasonable then they would step away from the deal, but so far, all the points that have been contested have been fairly reasonable. Things that would not interrupt AOL's competitive position and business potential. Things that actually AOL (AOL: Research, Estimates) has indicate a willingness to change over time anyway even prior to the Time Warner (TWX: Research, Estimates) merger," said Frederick Moran, head of Internet media at Jeffries and Co.

"Open access is the biggest issue. The other one, we think, is interoperability for instant messenger and ICQ. The ability for other ISPs to have instant messaging with, and that is technologically resolvable at some point in the not too distant future and AOL has pledged that they will move towards making that happen. If these two completely different services can link together and interoperate without any security problems, junk mails bombarding the chat sessions, then it would be very easy to invite other ISP customers into what would be a global and complete instant messaging system for all Internet users," Moran said.

"We think now is the time to buy AOL and Time Warner. We have a difficult stock market as a backdrop, but hopefully that will get better soon. AOL and Time Warner have both held up reasonably well lately, which is a sign that as the deal comes to completion, there should be some meaningful upside. You also have the launch of the AOL 6.0 software in October and you have the upcoming holiday seasonality with big advertising and e-commerce sales potentially happening. So the fourth quarter fundamentally should be a very strong quarter for both AOL and Time Warner. As a result, we have buys on both stocks," he said.

"Right now neither stock reflects merger synergies. In fact, Time Warner, although it's getting taken over by AOL, reflects no takeover premium. We think as the deal comes together and they uncover some new business opportunities and synergies, they will drive valuation. I think AOL trades like a media company and in a way it really doesn't trade like an Internet company anymore. So either it's an undervalued media company relative to its growth prospects or it's a very cheap Internet company," Moran said.

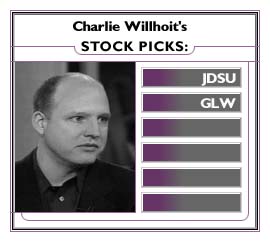

"If you look at the acquisitions that JDS Uniphase (JDSU: Research, Estimates) has made, it's been between 40 and 50 times next year's sales. So it seems like a fair price assuming the $100 million level can be reached," said Charlie Willhoit, communications component analyst at J.P. Morgan. "If you look at the acquisitions that JDS Uniphase (JDSU: Research, Estimates) has made, it's been between 40 and 50 times next year's sales. So it seems like a fair price assuming the $100 million level can be reached," said Charlie Willhoit, communications component analyst at J.P. Morgan.

"Corning (GLW: Research, Estimates) or Cisco Systems has its hands in lots of different companies and they don't have a controlling interest in this whatsoever. I think it means they'll be dedicated for getting components in the business, but Corning rules the roost here and I don't think they'd have problems with them," he said.

"Corning's had a shelf registration on file for several months now. Obviously anticipation of this deal. In Europe, a lot of times deals are done for cash and I think the choice was give stock to Pirelli and have them turn that into cash for their own restructuring and stuff that's going on.

"The acquisition will help incrementally next year. I think 2002 is when you can really see the capacity come online and the real ramp in the business. I think this is a good acquisition for Corning, but it -- I think there's more on the way. There's still some product holes that they need to fill in the component side. Certainly any chance to give them more capacity on the component side would be good as well. So I would expect more deals over the next 6 to 12 months.

"The biggest question in the sector is: When does the supply and demand space catch up? I would say it's two to three years before it catches up, and the reason is there's a ton of demand for optical networking boxes today, but when there's a lot of demand for the box, every time when you move up in number of channels and speeds that continue along that path, you have to increase the number of components that go into the boxes by two, three and four times as you move up the trail. The analogy is, there's not a lot of optical components today. There's a huge demand that's pulling at the space. So I don't see supply and demand catching up for quite some time.

"JDS Uniphase is the core portfolio holding. Broadest product line. Very deep management team, very strong company. If it can close the SDL deal, it's likely to close in December. I think it will be a great acquisition for them," Willhoit concluded.

-- compiled by Staff Writer Lucy Banduci

* Disclaimer

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|