The Federal Reserve's most recent stimulus is expected to boost home prices and the stock market, but what if you're too poor to invest in either?

The Fed unveiled its third round of stimulus last week. The massive bond-buying initiative, called quantitative easing, aims to prop up the economy through a few key channels -- namely the housing market and the stock market.

Both of those channels skew in favor of Americans who are already in solid financial standing, and it seems the wealthier you are, the more you have to gain.

"Quantitative easing is a blunt tool and cannot really target specific areas of the economy, aside from mortgage rates. Even then, it tends to help the wealthy spectrum of the income distribution," said Sung Won Sohn, economics professor at Cal State Channel Islands.

Related: Federal Reserve launches QE3

First, by lowering mortgage rates, the Fed hopes to encourage more home sales and ultimately boost home prices. More home equity and less expensive home loans also put more money in consumers' pockets.

But with banks still skittish about lending, only borrowers with the highest credit scores and large down payments can qualify for the lowest rates. That's limited the effects of lower rates on the housing market.

"Because of ongoing restrictions in the supply of mortgage credit to customers with less than perfect credit records, the impact of lower mortgage rates on housing is probably less powerful than normal," said William Dudley, president of the Federal Reserve Bank of New York, in a speech Tuesday.

Only 67% of Americans own their homes, and the number is heavily skewed toward the wealthy. Among the poorest fifth of American households, most are renters. Only 37% own homes, according to Fed data from 2010.

Related: Mortgage rates at record low again

Second, the Fed's low interest rate policies also tend to encourage investors to search for higher yields in stocks or riskier assets, leading to big gains in the stock market. The S&P 500 rallied 25% in the six months after the Fed's previous stimulus plan was announced.

That's been a boon for those who have most of their wealth in investments. But only 50% of Americans have stock holdings. Of those earning less than $20,000 a year, only 13% own stocks.

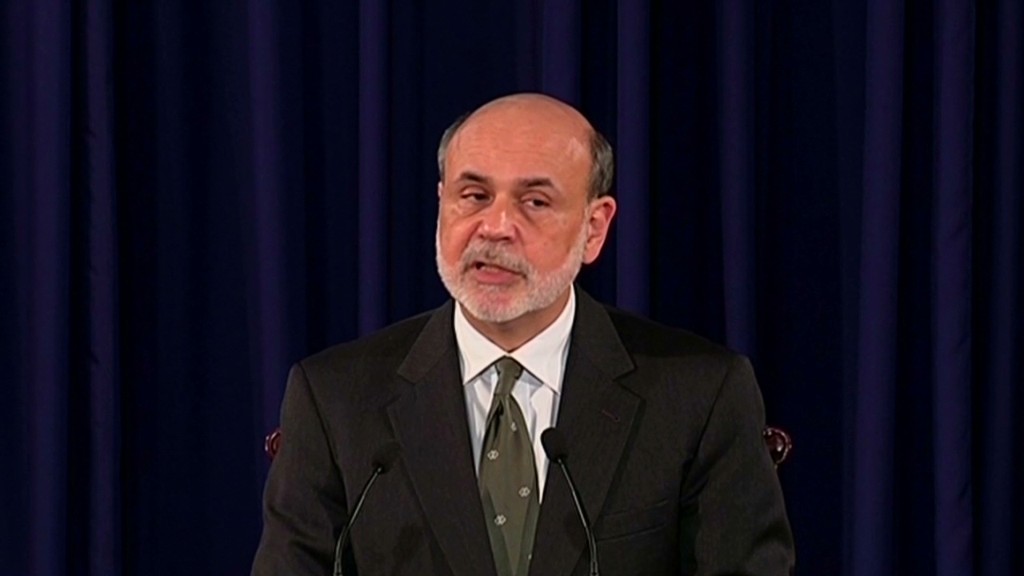

But the Fed's intention isn't to help the rich get richer. The main goal, according to Fed chief Ben Bernanke, is to help the middle class by creating more jobs.

"This is a Main Street policy because what we are about here is trying to get jobs going," Bernanke said at a press conference last week.

"If people feel that their financial situation is better because their 401(k) looks better for whatever reason, their house is worth more, they are more willing to go out and spend, and that's going to provide the demand that firms need in order to be willing to hire and to invest," he said.