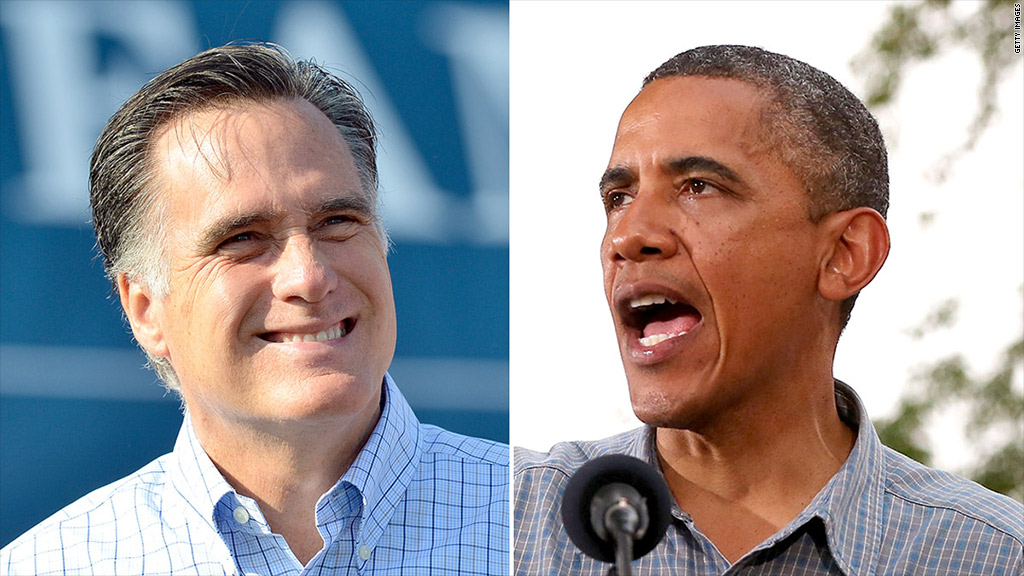

Both President Obama and Mitt Romney share a similar goal when it comes to the federal debt: They want to get it under control.

How they would do it differs greatly. Obama's goal is more restrained; he wants to keep deficits from growing faster than the economy. Romney's aim is to flat-out balance the federal budget in eight years. (Related: The candidates and the fiscal cliff)

Unfortunately, budget experts say, both candidates' plans fall short.

"Obama's numbers are more realistic, but they don't get us very far," said Robert Bixby, who runs the Concord Coalition, a deficit watchdog group. "Romney's numbers get us a long way, but they aren't very realistic."

Obama: Stop debt growing faster than GDP: The president's proposed budget for fiscal year 2013 would reduce annual deficits to below 3% of the size of the economy after a few years. The deficit this year is projected to be about 7%. Obama is trying to achieve what's called primary budget balance.

That means all federal spending -- except interest owed on the country's debt -- would be paid for by federal revenue. It also means annual deficits would no longer be growing faster than the economy.

From 2020 through 2022, Obama's budget proposals would stabilize the debt held by the public at 76% of GDP, according to an analysis by the Congressional Budget Office.

That's a necessary first step in making the budget sustainable, but independent fiscal hawks would prefer the debt be stabilized at a lower level.

Over the next decade, Obama's budget would rack up $6.4 trillion in deficits -- below the $10 trillion that would accrue if today's policies were extended.

Obama would achieve his deficit savings on both the spending and revenue sides of the ledger. He would also incorporate many of the spending caps established in the Budget Control Act, the 2011 compromise law that resolved the debt ceiling crisis.

As a result, discretionary spending as a share of the economy would fall to the lowest level in 50 years, but overall spending would average 22.5% over the next decade. That's below where it's been in the past few years but above the historical average of 20.8%.

After the first decade, however, the president's budget would not constrain the growth in debt because his budget does not include broad reforms to Medicare -- which is one of the biggest drivers of the country's debt over the long term.

"Beyond 2022 ... the fiscal position gradually deteriorates mainly because of the aging of the population and the high continuing cost of the government's health programs," the White House Budget Office noted.

Related: $3,500 fiscal cliff tax hit

Romney: Cut, cap and balance: Just how big of an effect Romney's economic proposals would have on deficits depend on details he has yet to offer and on how much economic growth his plans would generate.

Broadly, the GOP nominee wants to cut both tax rates and spending, while reforming the tax code and entitlement programs. That combination, his economic advisers and others say, could spur economic growth. That, in turn, could generate new revenue, which helps reduce deficits.

Specifically, Romney has promised to cap government spending at 20% of GDP and balance the budget by 2020.

He has ruled out raising taxes, so he would achieve these goals by cutting spending, although not on defense. Indeed, by some estimates, he would increase defense spending by more than $2 trillion over a decade -- an increase he has promised to pay for with other spending cuts.

At a minimum then, to balance the budget, he might need to cut funding nearly in half across many areas of government by 2020.

On the revenue side, Romney has promised to cut today's income tax rates by 20%, repeal the Alternative Minimum Tax and the estate tax, and make investment income tax free for those earning less than $200,000.

Romney has promised to pay for those changes through higher economic growth and by curbing tax breaks. This week he mentioned that one way to rein in tax breaks is to cap the amount in itemized deductions at no more than $17,000. It's unclear, without more details, how much revenue such a proposal would raise.

Without offsets, his tax plan could reduce revenue by $5 trillion over a decade, according to Tax Policy Center estimates. So that's the hole he would need to fill just to ensure his tax changes don't increase deficits.

The Committee for a Responsible Federal Budget estimates that even if Romney accomplishes that, his economic plan would still leave debt as a percentage of GDP around 85% at the end of the decade.