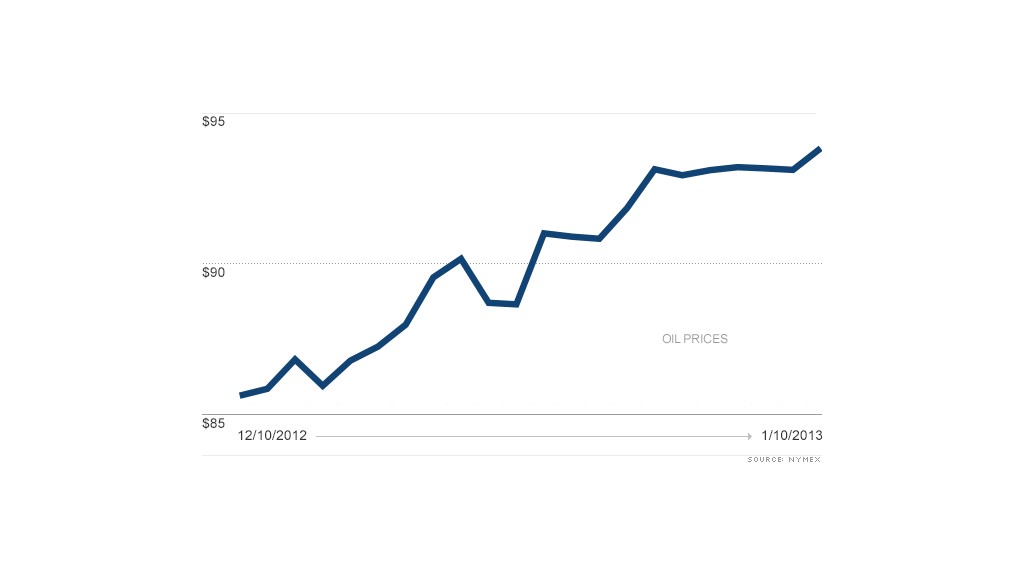

Oil prices jumped 10% over the last month on several factors including a Saudi production cut, the fiscal cliff resolution and the reversal of a key pipeline, but analysts expect the gains will be short lived.

U.S. oil prices rose from about $85 a barrel in early December to nearly $94 a barrel late this week. Among the factors pushing up crude:

-- Saudi Arabia has cut production by almost a million barrels this year, including a 400,000 barrel cut in December made public this week.

-- The Seaway pipeline running between Cushing, Okla., and the Gulf Coast was reversed this week to carry crude out of Cushing. A surge in domestic production has caused a glut of oil at the hub of pipelines and storage tanks, a key delivery point for U.S. crude. The reversal should ease that glut.

-- Strong economic data out of China, including robust export numbers this week and strong manufacturing data in December.

-- The possibility that a showdown with Iran over its nuclear program will happen in 2013.

-- The aversion, at least temporarily, of the so-called fiscal cliff -- tax increases and spending cuts in the United States that many feared would send the country back into recession.

Related: Asian oil companies make record buys in 2012

Taking oil's lead, gasoline prices have begun to rise too. Prices at the pump are up almost a dime a gallon from December lows, according to AAA, reversing a trend that brought gas prices to two-year lows last month.

Fortunately for motorists, analyst don't expect the recent gains to continue.

'"The economics of the market are such where prices should be much lower," said Mike Fitzpatrick, editor-in-chief of Kilduff Report's Energy Overview. "It's a rally that's going to be short lived."

The economics Fitzpatrick is referring to include sluggish global economic growth and rising oil production, especially in the United States.

Other analysts agreed, and said that even on the geopolitical front, a showdown with Iran isn't likely soon.

"The increasingly bearish evolution of oil market fundamentals will likely result in a substantial correction [to prices] unless there is some form of support from heightened perceptions of geopolitical risk or an actual disruption," Greg Priddy, a global energy analyst at the Eurasia Group, wrote in a note Friday. Such a disruption, said Priddy, "is not probable in the short-term."

Oil prices have been fairly stable over the last two years, generally trading in the $80 to $100 range. This is sharp contrast to previous years, which have seen huge spikes and falls. In 2008, oil went from a record high of over $147 a barrel to the low $30s in just a few months as the global financial crisis roiled markets. In 2007, crude fluctuated between $50 and $100 a barrel.