Hedge fund manager John Paulson has been a huge gold bull for years, but the billionaire may be starting to lose faith in the metal. And he's not alone.

Paulson slashed his position in the SPDR Gold Trust ETF (GLD), one of the most popular funds for investors seeking exposure to physical gold, by more than half in the second quarter "due to a reduced need for hedging," the firm said in an e-mailed statement. That's the largest chunk he has sold since he first announced his big bet on gold in early 2009.

Meanwhile, fellow billionaire investor George Soros, who has been lowering his exposure to gold for some time, completely dumped his stake in the gold ETF in the second quarter. So did Dan Loeb's Third Point Capital.

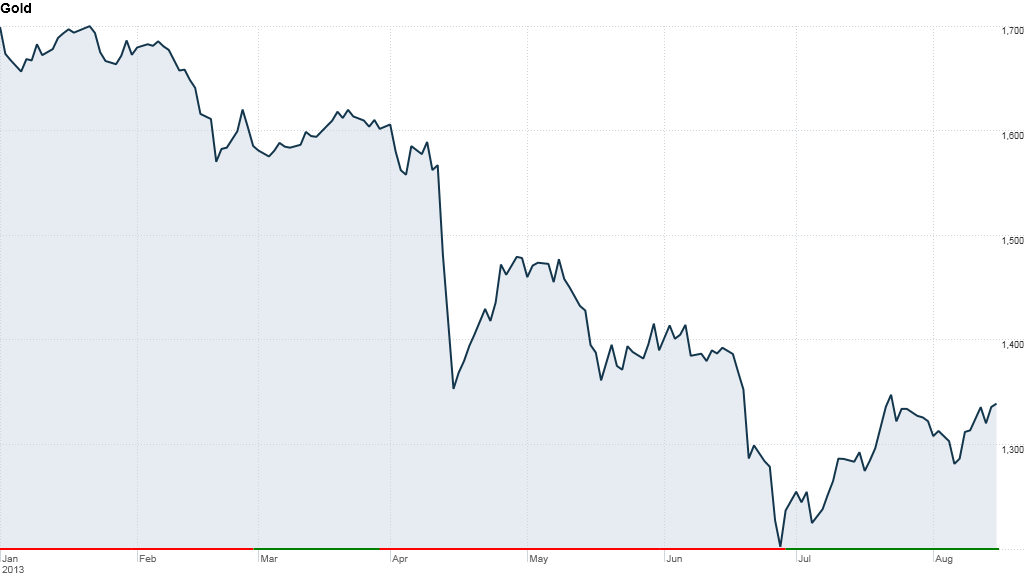

These hedge fund managers sold as gold prices plunged 23% during the second quarter to a nearly 3-year low around $1,200 an ounce. The sell-off was driven by worries that the Federal Reserve would scale back, or taper, its bond buying program sooner rather than later, which in turn would take away gold's value as a hedge against inflation.

But with fears about the impact of tapering dissipating, gold prices have begun to recover. Some analysts have even suggested that the precious metal's price has bottomed.

Related: Consumer demand for gold hits record high

So has the so-called smart money made a dumb move with gold? For what it's worth, the gold ETF is still the biggest holding in Paulson's fund, making up nearly 9% of his portfolio.

But Paulson's big step back is still curious since the 57-year-old billionaire spoke just last month about how he thinks gold is a winning bet over the long term since inflation is bound to pick up eventually.

"The rationale for owning gold has not gone away," he said at CNBC's Delivering Alpha conference in Manhattan in July. "The consequences of printing money over time will be inflation. It's difficult to predict when."

And even though he cut is exposure to physical gold, Paulson did increase his stake in miner Freeport-McMoRan Copper & Gold (FCX) by more than 70%.