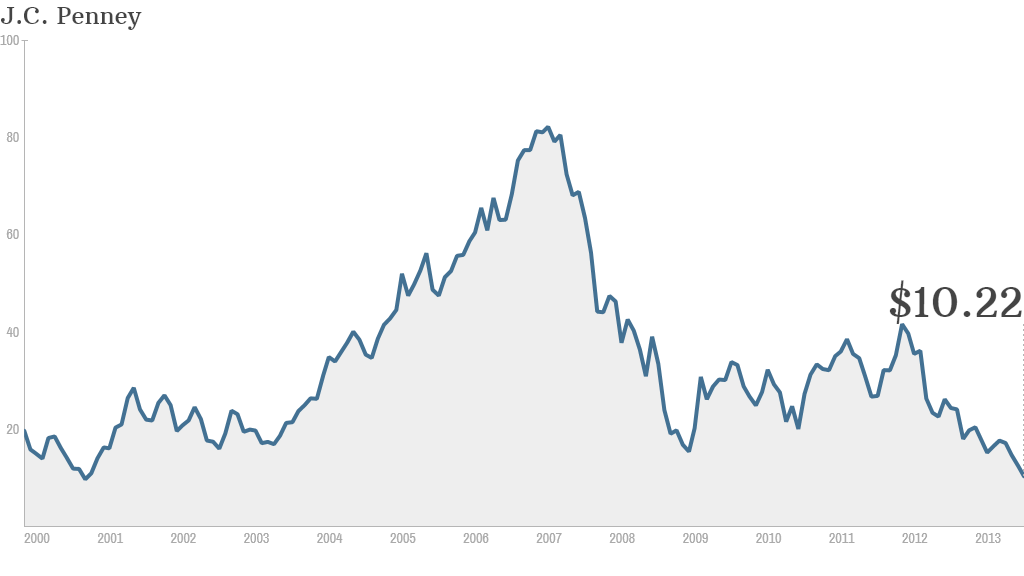

J.C. Penney's stock hit a 13-year low Wednesday as investors grow increasingly concerned about the future of the 112 year old iconic American retailer.

Shares plunged more than 15% at one point, briefly dipped below $10 a share -- a level they have not touched since November 2000 -- and finally settled just above $10.

Several analysts are predicting that J.C. Penney (JCP) did not have a good back to school shopping season, and that sales continued to plummet in late August and early September.

Related: J.C. Penney posts big loss but CEO upbeat

Investors had already been spooked by reports that J.C. Penney might be seeking to raise more cash through the sale of new stock or bonds.

In a conference call with analysts last month, J.C. Penney executives said they would not need to raise more cash anytime soon. They expected to have $1.5 billion in cash by year-end.

But JPMorgan analyst Carla Casella recently estimated that the retailer could run out of cash by the third quarter of 2014 if J.C. Penney's sales and profits failed to improve.

And Goldman Sachs analysts warned bond investors Wednesday to buy protection in case J.C. Penney defaults on its debt.

Noting that it is still premature to bet on bankruptcy for J.C. Penney, Goldman suggested that any investor who holds J.C. Penney credit should buy credit default swaps-- securities that would offer payments if the retailer couldn't pay its debts.

Related: Bill Ackman takes huge loss on J.C. Penney

J.C. Penney did not return requests for comment.

The company already pledged most of its real estate as collateral when it secured a $1.75 billion term loan in April.

But the Goldman Sachs analysts said there's more that J.C. Penney could sell if things get even more dire:

- 240 acres of vacant land around its Plano, Tex. headquarters valued at roughly $150 million

- 30 tire, battery, and automotive locations valued between $115 million and $135 million

- 8 partnerships in regional malls valued between $100 million and $150 million

The retailer's fall from grace during the past decade has been dramatic.

Hedge fund manager Bill Ackman had been betting on a turnaround of J.C. Penney for the past several years. To make that happen, in 2011, he brought in Ron Johnson, the former retail chief of Apple (AAPL), as CEO.

But Johnson's promises to transform to remake J.C. Penney by eliminating discounts and bringing in new brands failed miserably. Johnson alienated the retailer's longtime customers. Sales plummeted. And the added expenses of remaking the stores led to steep losses.

Johnson was pushed out in April, and former J.C. Penney CEO Myron Ullman returned to take the helm. By August, Ackman sold his J.C. Penney shares and departed the company's board. He ultimately wound up losing hundreds of millions of dollars on his J.C. Penney stake.

After Ackman's exit, several hedge funds bought stakes in J.C. Penney, including George Soros and Hayman Capital's Kyle Bass. Their interest initially drove up the stock. The enthusiasm clearly did not last.