Now that Congress has reached a deal to avert a debt crisis disaster, investors are turning their attention back to the broader economy and corporate earnings.

Early Friday, China reported its economy grew 7.8% during the third quarter, the strongest performance since the end of last year. That's helping ease fears of a hard landing and puts the world's second-largest economy on track to meet its official growth target for 2013.

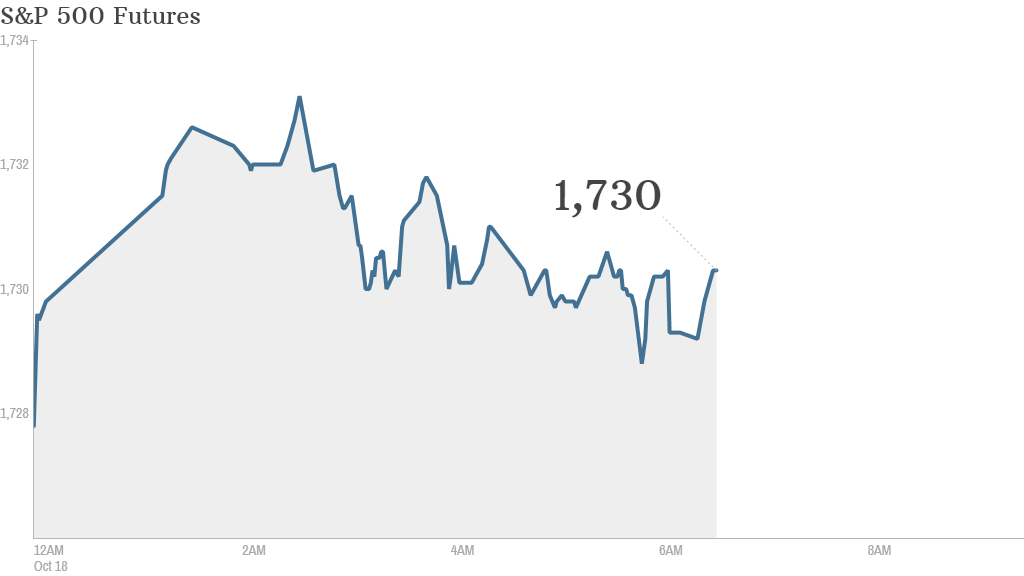

World markets were broadly firmer, while U.S. stock futures nudged higher.

Thursday was a good day for investors, with the S&P 500 hitting a new record after Congress agreed to a temporary deal to reopen the federal government and suspend the debt ceiling.

Google (GOOG) may give Nasdaq, and the broader tech sector, a boost Friday. A day after the search giant reported quarterly earnings and sales that beat expectations, shares were rallying.

In other earnings, Morgan Stanley (MS), the last of the big banks to report, posted earnings and revenue that topped forecasts.

General Electric (GE) reported a slide in quarterly earnings, dragged down by restructuring expenses.

Schlumberger (SLB) reported double-digit profit gains, fueled by offshore and Canadian drilling. Honeywell (HON) is also scheduled to report.

Related: Fear & Greed Index pulls back to neutral

Beyond earnings, HSBC said it will appeal after being ordered to pay at least $2.5 billion in damages after losing a U.S. class action case against Household International, a mortgage and credit card company that it bought in 2002.