The European Central Bank surprised markets Thursday by cutting interest rates to a record low, trying to prevent the eurozone from sinking into a period of stagnation and deflation.

Reducing interest rates for the second time this year, the central bank cut the main refinancing rate to 0.25% from 0.5%.

ECB President Mario Draghi said the bank was ready to take further measures, including another rate cut, if Thursday's move fails to have the desired effect.

A few economists had predicted the ECB would cut interest rates this month, after a surprise decline in inflation. But most expected the central bank to wait until December, when it will have third-quarter GDP data to consider and a better idea of the trend in inflation.

"By and large, we don't see deflation," Draghi said, rejecting comparisons with Japan, which is just beginning to recover from years of falling prices. But he acknowledged a significant change in the eurozone's inflation outlook in recent weeks.

Eurozone prices rose just 0.7% in October, after a 1.1% increase in September, with food prices and the cost of services coming under the most pressure.

Related: Eurozone crisis not over yet, warns EU

Holger Schmieding at Berenberg bank said the ECB's prediction that price rises would remain low for a prolonged period implied a risk of mild deflation.

"To some extent, the ECB move today can be seen as taking out insurance against that hypothetical risk," he said.

Eurozone unemployment is stuck at record levels above 12% and the economy is failing to generate momentum after emerging from recession earlier this year.

Unemployment won't start falling until 2015 at the earliest, according to EU forecasts published this week. The European Commission trimmed its estimate of GDP growth next year to 1.1%, and said it was too early to declare an end to the region's crisis.

With 19 million out of work and wages barely rising, domestic demand remains very weak.

And the euro's rally in recent months against major currencies has made life more difficult for Europe's exporters, and slower growth in emerging markets hasn't helped.

Industrial production in Germany, Europe's export powerhouse, suffered a surprisingly large fall of 0.9% in September, showing that manufacturing companies are still very cautious about the economic outlook.

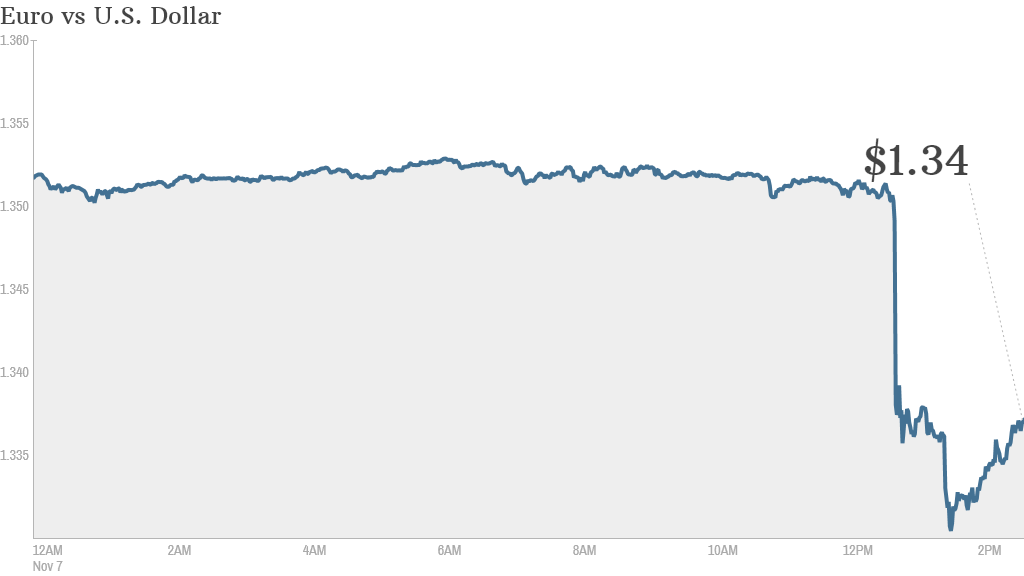

The euro fell by more than 1% against the dollar on news of the rate cut, and European stocks posted gains, led by Germany's DAX index.

Related: Year of Abenomics delivers Japan revival

Data released Wednesday confirmed the fragility of the recovery, with retail sales across the 17-nation eurozone falling by 0.6% in September, compared with August. Sharp declines were recorded in Spain and Portugal, countries that had recently shown signs of putting the crisis behind them.

Deflation, or a general fall in prices, can tip economies into a downward spiral as consumers and businesses delay purchases in anticipation of further falls to come. It also increases the value of debt, a big risk for the eurozone where government debt is expected to hit 96% of GDP next year.

Meanwhile, the Bank of England kept interest rates unchanged, as expected. Growth in the U.K. is picking up strongly, but the bank's governor Mark Carney has made clear he won't raise rates until unemployment falls to 7%.