Stocks have surged this year thanks to a slowly recovering economy and continued attention by the Federal Reserve. But there are worries about how long the big market run up will last.

Chief among the concerns is when the Fed will begin to pull back on its stimulus program. The central bank was expected to begin tapering the $85 billion-per-month bond buying program this fall, but held off amid the debt limit crisis and government shutdown.

This week, investors will be watching for clues about the coming taper when Janet Yellen testifies Thursday at her confirmation hearing on Capitol Hill.

Yellen is vice chair of the Fed and President Obama's nominee to replace Ben Bernanke, whose term as chairman expires in January. She was the favorite pick of many economists, who don't expect her leadership to be radically different from Bernanke's. She also has the support of Senate Democratic leaders.

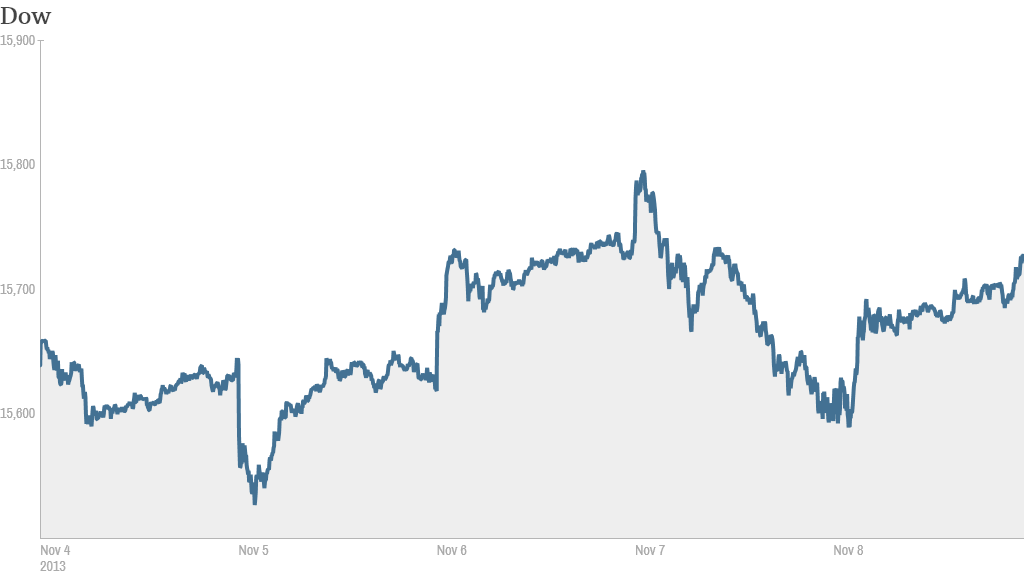

Stocks ended last week higher, their fifth consecutive week up. Stocks surged Friday, bouncing back from losses on Thursday, thanks to a much better-than-expected jobs report.

Related: Twitter stock already downgraded

Earnings season winds down: Most major companies have already reported their third quarter earnings, but several major retailers and technology firms report this week.

Wal-Mart (WMT) reports earnings Thursday. Last quarter, it fell short of expectations, but has focused on prices, and launched a new discount store brand.

Macy's (M) reports Wednesday morning, followed by Kohl's (KSS) on Thursday and Nordstrom (JWN) on Friday. Their earnings reports will likely provide some clues about the holiday shopping season, which the National Retail Federation expects will see 3.9% growth over last year.

Black Friday is two weeks away and Ellen Davis, NRF senior vice president, said on CNN Saturday retailers "know that consumers want good deals and they're out to give them some this Thanksgiving weekend."

Tech giant Cisco (CSCO) reports Thursday. Cisco's most recent earnings were on par with Wall Street expectations. But it also said growth should be stronger and announced a 5% workforce cut in the coming year. The stock is up nearly 20% this year.

Related: CNNMoney's Fear & Greed Index

China could see course adjustment: The world's second-largest economy could see its first economic shifts under new President Xi Jinping this week.

A multi-day meeting of China's ruling Communist Party wraps up Tuesday. Among the policy details economists say may come out of the meeting involve the shift from relying heavily on exports to domestic consumption.

The gross domestic product reports for Japan and the eurozone will be released Thursday.

One report will reflect on Japanese Prime Minister Shinzo Abe's ambitious plan to grow the Japanese economy. The second will show insight into Europe's recovery from six quarters of recession that ended earlier this year. Last week, the European Central Bank cut interest rates in an effort to keep the economy moving.

Veterans Day: Stock and commodity markets are open on Monday, though some banks and the U.S. Treasury market are closed for the federal holiday.