Oil prices fell early Monday after a groundbreaking agreement aimed at curbing Iran's nuclear program eased tensions in the region and raised the prospect of more oil exports from the country.

The preliminary accord, which was struck between Iran and six world powers, offers the Middle East nation $7 billion in immediate relief from economic sanctions.

The U.S. government estimates that Iran has lost about $80 billion in revenue as oil sales slumped by 60% since the start of 2012 as a result of the sanctions.

Iran sits on about 9% of the world's proven oil reserves. But its crude oil output is languishing at 20-year lows, the International Energy Agency said in a recent report.

Related: What the deal means for Iran's oil sector

The preliminary deal suspends certain sanctions on gold and precious metals, Iran's auto sector, and petrochemical exports, but won't allow Iran to increase oil sales above one million barrels per day for six months.

Still, some analysts reckon Iranian exports could climb in the near term because sales have fallen short of that limit in recent months. And if the deal goes well, and sanctions are relaxed further, Iran could be pumping much more oil into world markets by the end of next year.

"From a big picture perspective, the deal... opens up the possibility of at least one million barrels per day of Iranian crude returning to world markets by the fourth quarter of 2014," said ClearView Energy Partners analyst Kevin Book.

Reduced political risk and the prospect of rising Iranian oil supplies weighed on energy prices in Monday trading.

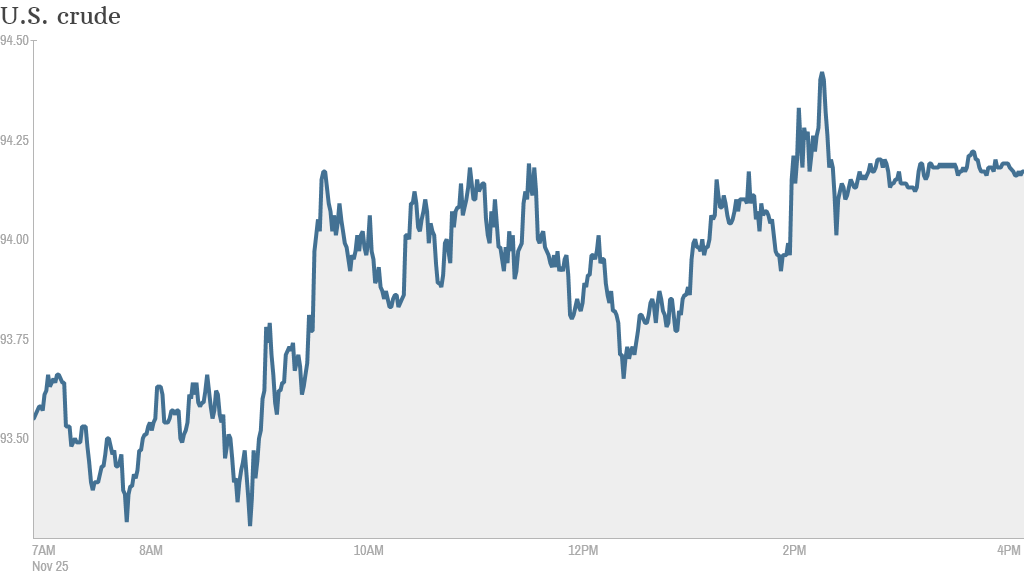

Brent crude for January delivery fell 2% in early London trading before recovering to around $111 Monday evening. Light crude in New York also dipped Monday before recovering somewhat, finishing down $0.75 to $94.09 a barrel.

Book said the impact of the Iranian deal on oil prices would have been greater were it not for the loss of most Libyan production in recent months. Oil exports from the north African state have dwindled due to ongoing political turmoil.

Related story: U.S. to seize Manhattan skyscraper secretly owned by Iran

World stock markets were also buoyed by the Iran deal, as cheaper energy prices could give a much-needed boost to economic growth.

Germany's DAX index rose 0.95% in European trading, while the CAC added 0.6% in France.

In Asia, Japan's Nikkei closed up 1.5% and Australia's ASX All Ordinaries put on 0.3%. The major U.S. indexes finished essentially flat.