It seems U.S. investors and traders may have already entered holiday mode, with markets drifting along as Americans prepare for Thanksgiving.

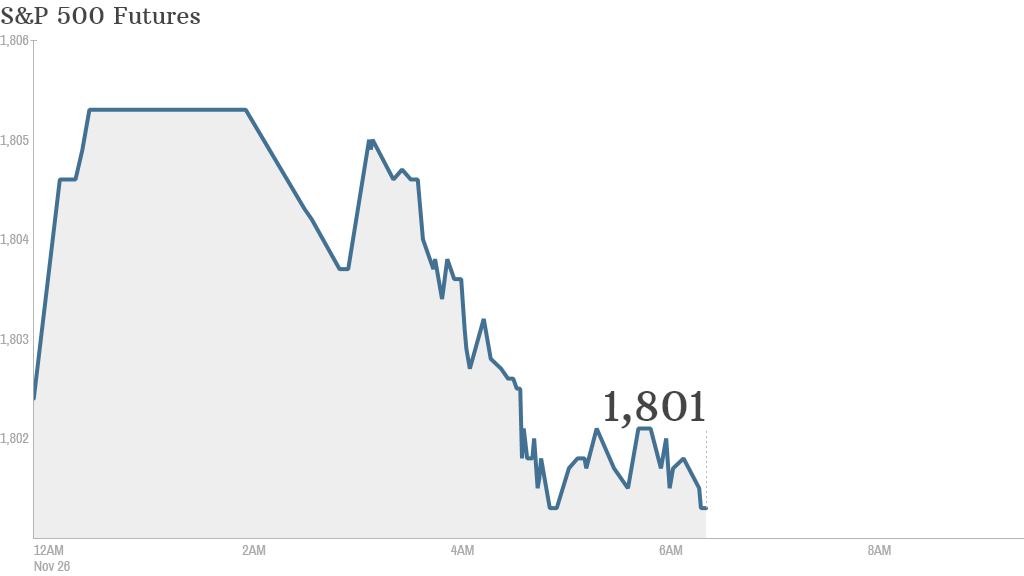

U.S. stock futures were little changed Tuesday, while world markets were mostly weaker.

Trading volumes are expected to remain low this week as investors gear up for Thursday's U.S. Thanksgiving holiday.

U.S. stocks had initially pushed higher Monday after diplomats forged a landmark deal with Iran over the weekend, but the move lacked conviction and stocks ended little changed.

"If you spent yesterday in bed, ignoring the market reaction to the Iranian sanctions-lifting deal, you made the right choice," said Societe Generale strategist Kit Juckes of London in his market report.

Despite the lackluster action, the Dow managed to eke out a record close, and the Nasdaq crossed 4,000 for the first time in more than 13 years.

Related: Fear & Greed Index, still greedy

Looking ahead to Tuesday's economic reports, the U.S. Census Bureau will release data on housing starts and building permits at 8:30 a.m. ET. The Case-Shiller index of house prices in 20 cities will be released at 9 a.m. ET and the Conference Board will release its monthly consumer confidence report at 10 a.m. ET.

In corporate news, Tiffany (TIF) reported earnings that blew past expectation, and raised its guidance. Barnes & Noble (BKS) is also scheduled to report quarterly results before the opening bell, while Hewlett-Packard (HPQ) is up in the afternoon.

Related: Qualcomm faces antitrust scrutiny in China

Shares of Carnival (CCL) fell roughly 2% after the firm's vice chairman and chief operating officer, Howard Frank, sold roughly 30% of his holdings in the cruise ship company. Shares of J.C. Penney (JCP) rose after CEO Mike Ullman spent $1 million to buy 112,000 shares of the troubled retailer, according to a regulatory filing.