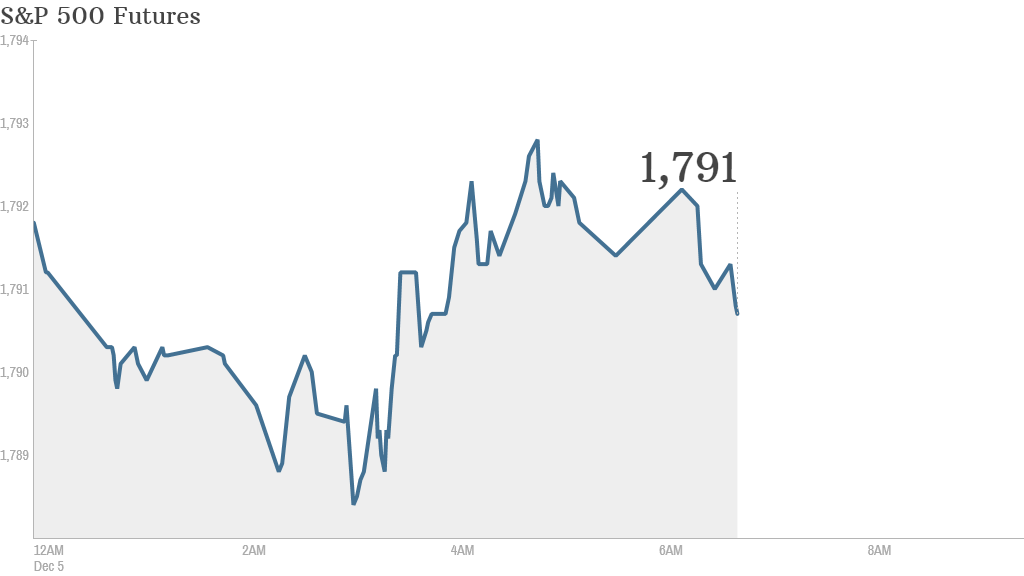

Stocks were treading water Thursday ahead of a busy day of global economic news.

U.S. futures were little changed, following four straight days of losses on the Dow Jones Industrial Average and S&P 500.

AT 8:30 a.m. ET, the U.S. government will release its weekly report on initial jobless claims as well as its second estimate of third-quarter GDP. At 10 a.m;, the Census Bureau will publish its monthly report on factory orders.

The government's November jobs report is due Friday. An estimate by economists surveyed by CNNMoney expect that report to show 183,00 jobs were added last month.

Trading has been choppy as investors try to gauge when the Federal Reserve will begin pulling back on its stimulus.

Related: Where should you put your money now?

Alastair McCaig, market analyst for IG in London, said the holiday shopping season would be "a fragile time of year" for the Fed to pull back on its bond purchasing.

"Trying to squeeze something in before the end of the year would start a little bit of panic, the tale end of December being just an incredibly important retail period," he said. "It would be a little bit dangerous to do something this year."

On the corporate front, Jos. A Bank (JOSB) reported a decline in quarterly net sales and net income, compared with the prior year. The clothing retailer has been in a tug-of-war of sorts with Men's Wearhouse (MW), which rebuffed a hostile bid from Jos. A Bank. Most recently, Men's Wearhouse offered to buy its smaller rival.

Related: Fear & Greed Index, still greedy

European markets inched higher as traders waited for interest rate decisions from the European Central Bank and the Bank of England. The ECB decision, due at 7:45 a.m. ET, will be followed by a press conference with the central bank's president Mario Draghi.

Asian markets ended mostly lower, with Japan's Nikkei slumping 1.5% and Hong Kong's Hang Seng down 0.1%.