Could markets finally get a lift Tuesday?

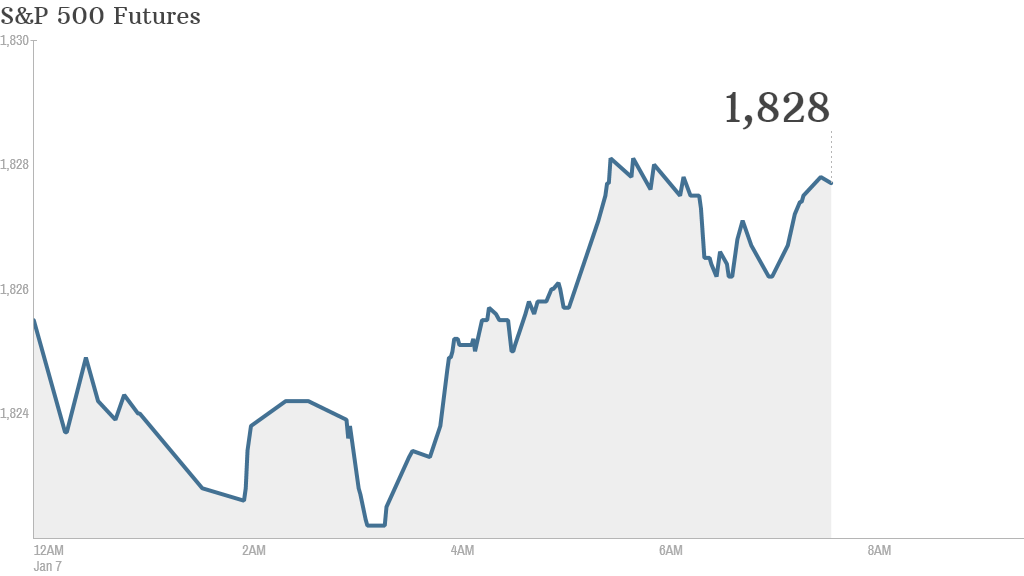

After last year's runaway gains, stocks have started 2014 with modest losses. U.S. stock futures were pointing higher Tuesday, although the gains were slim and traders are likely to remain cautious before key economic reports due later this week.

The U.S. Census Bureau will release its monthly report on the nation's trade balance at 8:30 a.m. ET Tuesday. But the bigger releases are coming Wednesday and Friday, when investors will see the latest monthly jobs report and minutes from the Federal Reserve's last meeting of 2013.

The health of the labor market will likely determine the pace of further reductions in bond buying by the Federal Reserve under new chair Janet Yellen.

Nearly 60% of the 30 investment strategists and money managers surveyed by CNNMoney believe the central bank will continue to gradually cut back on the bond purchases throughout this year so it can completely wind down its quantitative easing program by the end of 2014.

Related: Fear & Greed Index, still greedy

On the corporate side, shares of Palo Alto Networks (PANW) jumped in premarket trading after the security company on Monday announced its acquisition of Morta Security, a cybersecurity company.

Netflix (NFLX) dropped 4% in premarket trading amid reports that the video rental company was downgraded by analysts.

Shares in Samsung Electronics (SSNLF) edged lower after the South Korean company announced its operating profits will take a hit amid increased competition in the smartphone market.

U.S. stocks fell Monday. Market performance has been generally lackluster since the start of 2014.

Related: Here comes the end of QE

European markets were all moving up by at least 0.4% in afternoon trading.

There were no dramatic moves on any of the Asian indexes Tuesday, with markets posting mixed results.