Investors are learning the hard way this year that stocks don't always go up. But experts are stressing that last week's big sell-off is not the end of the world.

"I like to remind people that investing is a 'two steps forward and one step back' kind of process," said John Foxworthy, an adviser at Phillips Financial in Fort Wayne, Ind. "Anytime markets have a good run, like we saw last year, it's not a surprise when we see a bit of a pullback."

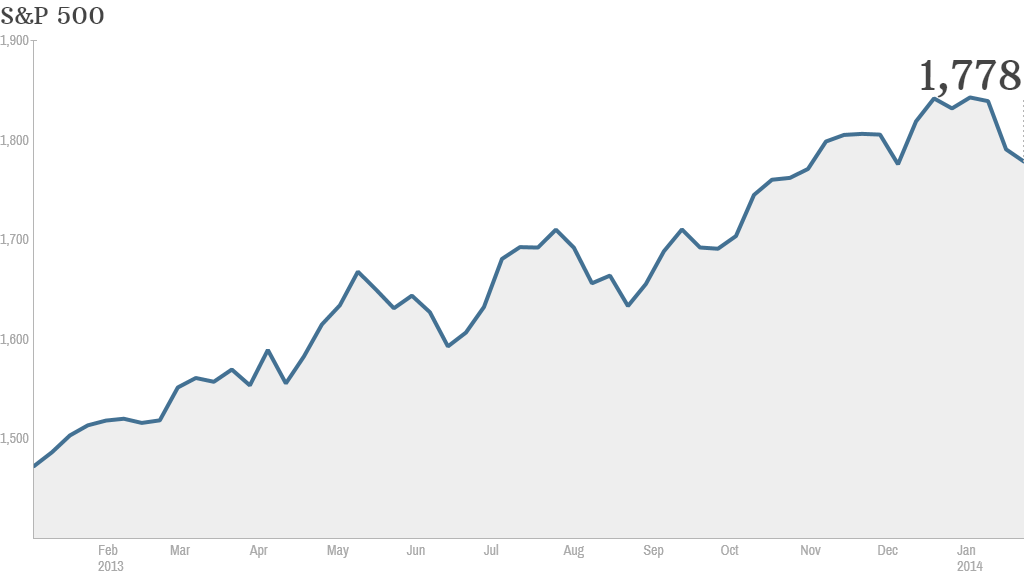

So far, the Dow and S&P 500 are down 4% from their recent all-time highs. While that's fairly mild, the losses have certainly spooked investors. CNMMoney's Fear & Greed index, which measures seven indicators of market sentiment, fell into "Extreme Fear" mode Monday.

Many financial planners expect that the market could be in for more volatility in the near-term.

In fact, Rob Fross, co-founder and adviser at Fross & Fross Wealth Management, is telling his clients to not to be surprised if stocks end up losing about 10% from their peak.

Experts have been warning for some time that stocks may be due for correction, usually defined as a decline of 10% or more.

A correction could be necessary following last year's fairly smooth 30% run-up in the S&P 500. On average, this blue chip index has gone through a correction every 18 months since 1945, according to S&P Capital IQ's chief equity strategist Sam Stovall. But this time, it's been more than two years since stocks have had that big of a breather.

Related: Emerging markets rattled as anxiety rises

Given that, Fross said last week's slide is particularly healthy. But that doesn't mean it's time to bail on stocks. He said that investors now have to look closely at their portfolios and decide if they want to pare back a bit on riskier assets like stocks.

Foxworthy also said he is using the recent volatility to review what his clients own. When necessary, some may have to rebalance their portfolios. After all, any investor who had a big portion in stocks before the beginning of last year is now likely to have an even larger percentage of their portfolio weighted toward stocks -- even if they didn't buy anything last year.

In 2013, a $100,000 portfolio beginning the year with 60% in stocks stock and 40% in bonds would have ended up being worth around $118,600. But because of how well stocks did and how poorly bonds fared, stocks would have represented 67% of the portfolio by year's end, according to Stovall. That's why he thinks some investors still should consider selling some of their stocks to lock in profits.

But Fross said his main message to clients is to not get too worried about how the market does any given day or week. He conceded that there could be "some short-term anxiety."

Still, Fross expects stocks to shrug off the current worries and go on to post modest gains of about 6% for the year. He notes that a lot of investors still have money in cash or in bonds that could be put into stocks as long as the economy continues to chug along.

"There are still trillions of dollars on the sidelines," said Fross.

And while some experts often worry that increased buying from individual investors is a sign of a market top, historical data shows this is not always the case. Fross adds that it could be some time before stocks hit their peak.