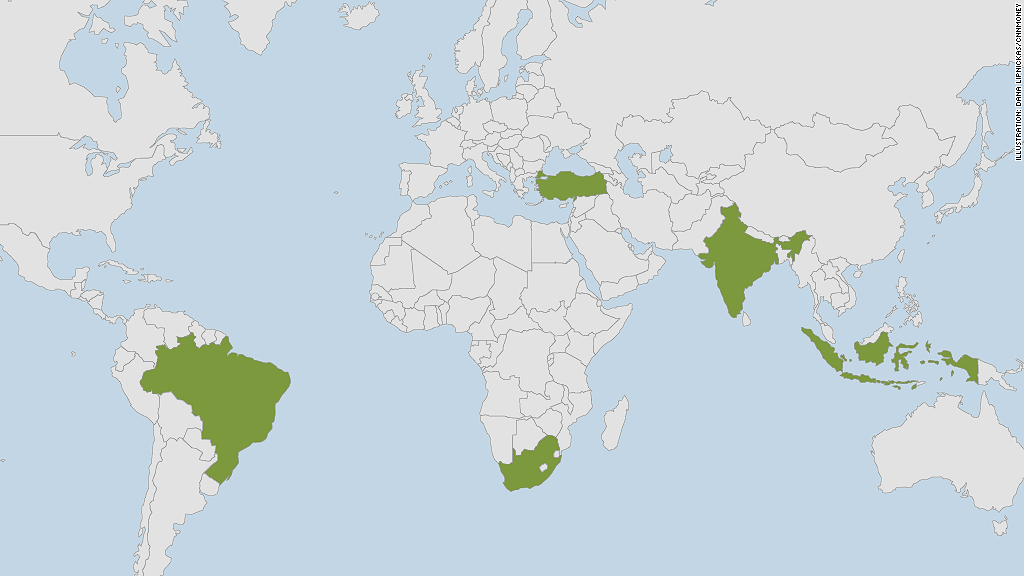

India, Turkey and now South Africa.

Central banks in three of the most fragile emerging markets have jacked up interest rates to try to shore up their currencies as cash flows back to recovering developed economies.

South Africa surprised investors with its decision Wednesday to raise interest rates, just hours after a dramatic hike in Turkey and a more modest move in India.

The central banks are reacting to developments in the U.S., where the economy and job market is improving. The recovery has prompted the Federal Reserve to start cutting back on its stimulus program, which has been flooding international markets with liquidity.

Now that the flow of cheap money has started to slow, investors are focusing once again on the underlying health of the emerging markets.

Related: Turkey's central bank hikes rates to combat sell-off

The South African central bank noted many nations were facing "sharply depreciating currencies, capital outflows, slowing growth, rising inflation, significant current account and/or fiscal deficits and deteriorating confidence."

"While the Fed action signals a recovery in the U.S., and the U.K. economic outlook is also improving, it does not mean that the global financial crisis is over," it said in a statement explaining the rate hike. "We are now entering a phase of the crisis that is creating new challenges for emerging market economies."

A tumbling currency can drive up inflation, but rate rises risk choking off already slowing growth.

The central bank action appeared to be backfiring Wednesday. The Turkish lira and the South African rand both fell by about 3% against the dollar. The rupee was also weaker.

Related: Is this an emerging markets crisis or not?

Morgan Stanley (MS) coined the term 'the fragile five' last year to describe South Africa, Turkey, India, Brazil and Indonesia, nations that it considered particularly vulnerable to a sudden flight of capital.

"This is clearly a new risk on the horizon, and it needs to be watched," said the head of the International Monetary Fund, Christine Lagarde, during a talk on Saturday in Davos, Switzerland.

Brazil and Indonesia have also been raising interest rates over the past few months. Brazil's latest rate hike came on January 15, while Indonesia's central bank announced a surprise increase in November.

But the flow of money back to the U.S. and other developed economies is unlikely to affect all emerging markets uniformly. Investors will take into account local factors such as political stability, commitment to reform, and signs of financial weakness.

Turmoil in emerging markets hit international stock markets this week, with the Dow Jones industrial average suffering a rare 5-day losing streak.