Stocks have had a year to forget so far but U.S. markets may be due a bounce Tuesday.

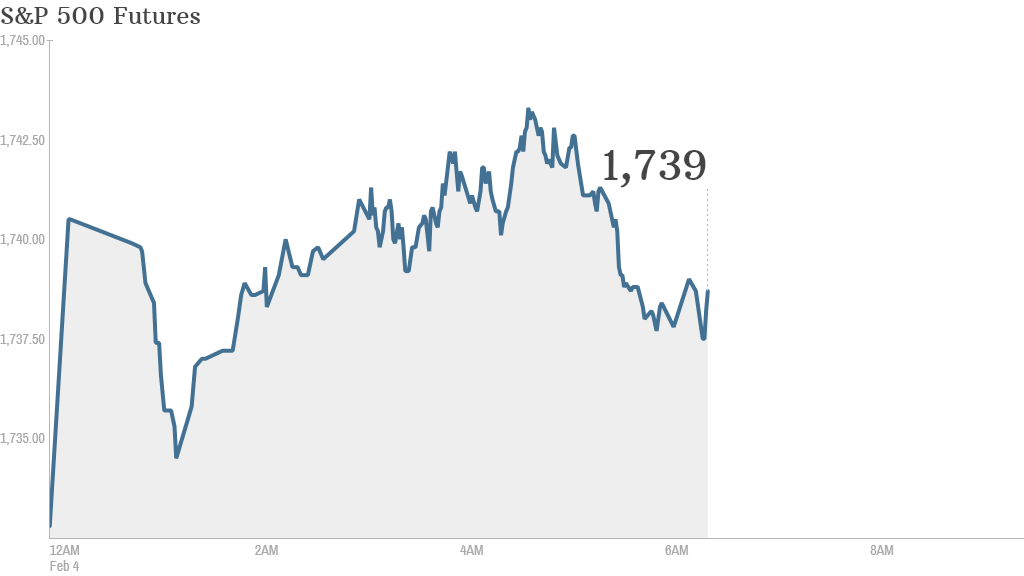

U.S. stock futures were nudging higher ahead of the opening bell as investors try to recover from last month, when the Dow tumbled more than 5% to log its worst January since 2009.

Meanwhile, world markets suffered another battering Tuesday, taking their cue from Monday's sharp sell-off in U.S. stocks.

Japan's Nikkei index fell 4.2%, extending its losses this year to just over 14%. The slide has put the index well into correction territory, and erased a chunk of last year's stunning 57% gain. Hong Kong's Hang Seng also pushed into a correction, dropping nearly 3%.

"The nature of the sell-off has been sharp and appears to be overdone in the near-term, suggesting that the market could be due a technical bounce, especially if there is a whiff of upbeat macro news flow," said Gerard Lane, an investment strategist at Shore Capital.

Related: Fear & Greed Index still in extreme fear

Looking ahead, the U.S. Census Bureau is scheduled to release its monthly report on factory orders at 10 a.m. ET. This could give cause for renewed anxiety after a weak U.S. manufacturing report fueled Monday's market plunge.

On the corporate side, BP (BP) shares declined after the oil and gas firm reported a drop in fourth-quarter earnings.

Shares of UBS (UBS) jumped after the Swiss bank reported better-than-expected quarterly earnings.

ARM Holdings (ARMH)' fourth quarter earnings disappointed some investors, sending shares lower in early trading.

Shares of KFC-owner Yum! Brands (YUM) jumped after it reported better-than-expected earnings.

And Michael Kors (KORS) was a standout. The retailer's stock rallied nearly 13% in premarket trading after a stellar earnings report and upbeat outlook.