Six German judges cast doubt Friday on the legality of one of Europe's main weapons in its battle to save the euro.

Germany's constitutional court, in a split ruling, said the European Central Bank's untested plan to buy government bonds -- known as Outright Monetary Transactions -- appeared to go beyond the bank's monetary policy mandate and could breach European Union law.

It has referred the issue to Europe's top court.

Related: ECB holds fire despite deflation risk

The bond-buying plan, announced at the peak of Europe's debt crisis in September 2012, followed ECB President Mario Draghi's pledge to do "whatever it takes" to prevent disintegration of the euro.

The OMT announcement helped restore confidence in the eurozone and buy time for governments to bring down borrowing. The eurozone has started to grow again. Ireland and Spain have successfully emerged from bailout programs.

Still, the recovery remains fragile and vulnerable to shocks. A prolonged period of low inflation could turn into deflation, and turmoil in emerging markets could make it harder for Europe to export its way back to health.

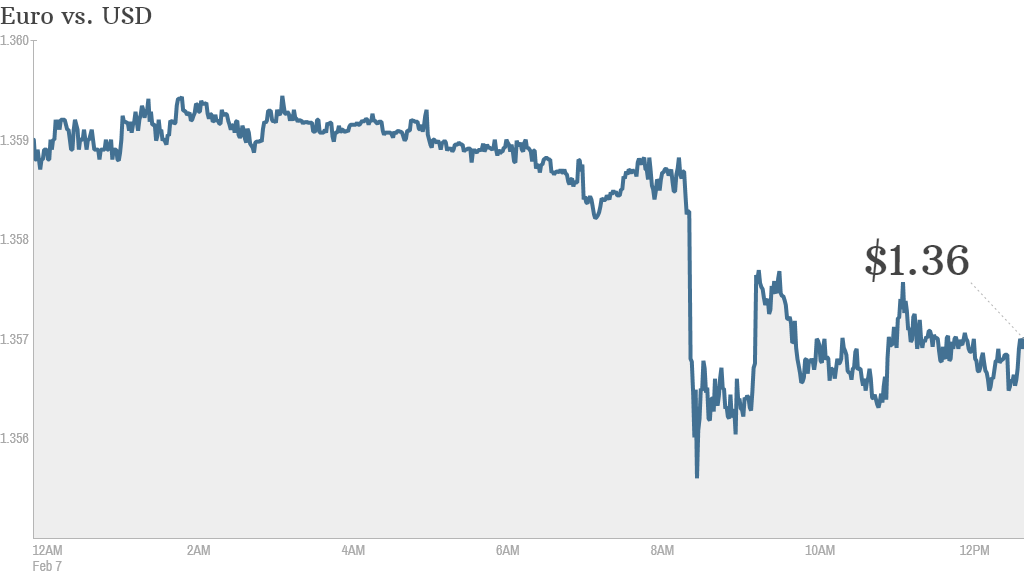

News of the German ruling briefly sent the euro plunging against the dollar, but yields on bonds issued by Greece and Portugal -- both still working through EU and IMF rescue programs -- barely budged. European stock markets were steady.

Europe's economy: What could go wrong?

"The doubts about the safety net leave the eurozone a bit more vulnerable to potential setbacks," said Holger Schmieding, chief economist at Berenberg. "But thanks to the major underlying progress made in the eurozone over the last 18 months or so, this should not be fatal."

The muted reaction reflects the reduced likelihood the ECB will need to activate the OMT program, because conditions in the eurozone are improving, and expectations that the European Court of Justice will rule in the bank's favor.

Indeed, the German court said that if OMT was "interpreted restrictively" it may be deemed legal.

The ECB reiterated Friday that it believed the program was consistent with its mandate.

Draghi said Thursday the bank was alert to the risks to the eurozone recovery and was ready to take further "decisive action" if necessary.