Investors will be keeping a close tab on Ukraine and China this week before turning their attention to the Federal Reserve.

Turmoil in Ukraine over the Crimean referendum could lead to more volatility in the markets.

Preliminary results showed the region voted overwhelmingly on Sunday to join Russia. The situation is causing growing tensions between the West and Moscow. The threat of sanctions and other action from the West against Russia means the crisis could further rattle investors as they worry about potential trade and energy disruptions.

Russia has paid a heavy price for the standoff so far. Its stock market and currency both tumbled since the unrest began. But it's not clear if Russia will back down.

"The logic now is that Russia is bracing for the next round of sanctions," said Brown Brothers Harriman analysts in a note Friday.

Related: Fallout of a 'yes' vote in Crimea

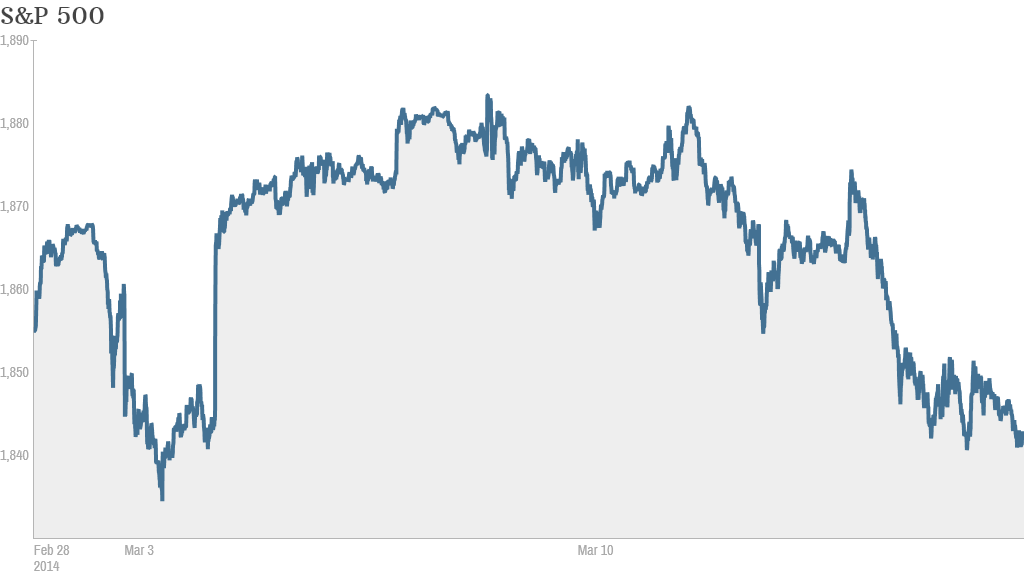

China could also weigh on market sentiment, as weak reports on the pace of growth in the world's second biggest economy put pressure on stocks last week. Japan's Nikkei suffered heavy losses last week, as investors sought safety in Japan's yen. Japanese stocks typically do better at times when the yen is weak.

Yellen's first press conference: Investors will focus on the Fed Wednesday. Janet Yellen is presiding over her first policy meeting at the helm of the central bank.

Afterward, she'll give a press conference updating the Fed's economic forecasts. The Fed said last month that it was still too early to tell what, if any, effects this winter's unusually harsh weather had on the economy. But a better-than-expected February jobs report supported the notion that the economy is sustaining its momentum.

Many economists expect Yellen to continue scaling back, or tapering, the Fed's stimulus program. The Fed is currently buying $65 billion of bonds each month to help keep interest rates low. It cut the size of its monthly bond purchases by $10 billion at its last two meetings and most expect another reduction of $10 billion to be announced Wednesday.

Investors will also be looking for clues as to when the Fed may raise interest rates. Though the central bank has maintained that it plans to keep its federal funds rate near zero for some time, minutes from its January meeting showed some internal debate about whether rates should be raised sooner rather than later.

And with the unemployment rate at 6.7%, many strategists think the Fed will officially abandon its previously-stated goal to raise rates once the unemployment rate hits 6.5%. It's possible that the Fed could set a lower threshold for unemployment.

Related: Yellen: 'Too many Americans remain unemployed'

But the Fed has a dual mandate to control inflation along with keeping unemployment low, so the Fed could also choose to focus even more on inflation targets as a gauge for interest rate adjustments.

To that end, the government will release key data on inflation -- the Consumer Price Index -- on Tuesday. In recent years, inflation has remained relatively low, held down by the Fed's interest rate policies and stagnant wages.

Banks too stressed? On Thursday, the Fed will release the results of its latest round of stress tests on the nation's biggest banks. The tests, introduced after the financial crisis, are designed to determine which banks have enough capital to weather catastrophic economic scenarios. Critics have charged that the tests do not go far enough.

Investors will be keeping an eye on the nation's largest institutions, including JPMorgan Chase (JPM), Goldman Sachs (GS), Wells Fargo (WFC), Bank of America (BAC), Morgan Stanley (MS) and Citigroup (C), to see how they hold up against the Fed's requirements. Some regional banks will also be the spotlight.

In other corporate news, the earnings calendar isn't too crowded this week. But some big names are set to report results. Software company Oracle (ORCL) will report after the closing bell Tuesday, followed by shipping giant and economic bellwether FedEx (FDX) on Wednesday. Nike (NKE), a member of the Dow, will release earnings Thursday. Its report could shed more light on consumer spending trends around the world.