Wall Street analysts are an opinionated bunch, but occasionally they agree on what's a good deal and what isn't.

Bespoke Investment Group took a look at companies in the S&P 500 that research analysts overwhelmingly recommend investing in and those they suggest dumping.

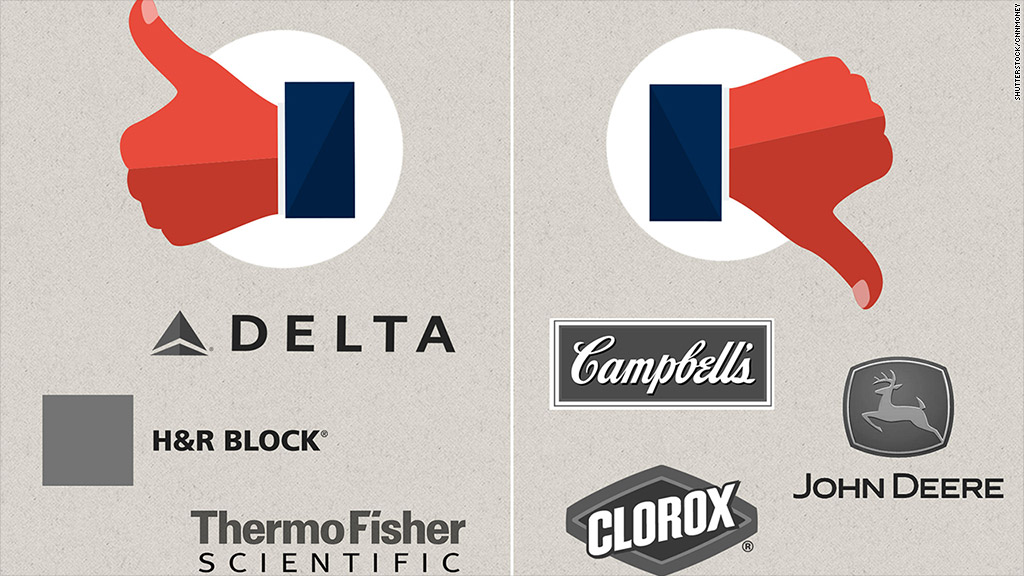

Here are the top and bottom ranked stocks:

The ones to buy, baby!: Wall Street is over the moon for Delta (DAL), with a whopping 100% of analysts currently rating it a "buy." Shares have already taken off 44% this year as investors bet on continued healthy demand for air travel in the U.S. Delta has also been lifted by higher fares, good relationships with its unions, and consolidation in the airline business.

Almost as beloved is Thermo Fisher Scientific (TMO), a maker of products and equipment for the biotechnology industry. Nine out of ten analysts who cover it label it a "buy." The stock has performed well as activity in the drug sector has picked up rapidly in recent years.

Also with a 90% buy rate is H&R Block. (HRB) The tax preparation firm is up 12% this year.

Stocks to think twice about: It's actually pretty rare for Wall Street analysts to flat out say to sell a stock since it's their job to find investments that will make money. Around 50% of all ratings are "buy," while only 6% are "sell" (the rest are "neutral" or "hold"), according to Bespoke Investment Group. Still, a few notable companies are clearly despised.

A third of analysts urge investors to sell Clorox (CLX), which is already swimming in the red this year. The company said in its latest earnings report that sales ticked down in its cleaning division, which includes its laundry products, as well as in its household segment, which is comprised of trash bags, charcoal, and cat litter.

Related: Make a shipping container your home for less than $185K

Deere and Company (DE) is also falling out of favor with analysts, with 31% slapping it with a "sell." The agricultural construction conglomerate has suffered as low crop prices have put a crimp on farmers' spending power.

Campbell Soup (CPB) isn't looking too appetizing either, with a quarter of analysts recommending that investors to sell it. The food manufacturer's most recently quarterly earnings report showed that soup sales aren't heating up, and the company acknowledged that its overall turnaround effort is taking longer than expected.

Related: Kellogg's echoes rival in green initiative

Things can change quickly: Just because Wall Street is down on a stock one day doesn't mean that same company won't be a hot investment the next. Earnings results, the economy, and even the weather, can all change the way analysts view a particular corporation.

For example, only 13% of analysts rated E*Trade (ETFC) a "buy" at the beginning of the year, whereas 56% do now. And Netflix (NFLX)has experienced a 25% surge in analyst "buy" ratings in 2014 as the video service has demonstrated impressive subscriber growth.

Of course, analysts also reserve the right to change their minds in the other direction.

Citigroup (C) has been the biggest loser in that regard this year. The bank kicked off 2014 with an 80% "buy" rate, but that number has since dropped to 56% as the firm has suffered from a mortgage crisis settlement, failed its stress test, and revealed fraud in its Mexican subsidiary.