Wall Street is smiling. Although the economy is getting better, the Federal Reserve is probably not going to raise interest rates until the summer of 2015 at the earliest.

The Fed said Wednesday that it continues to believe rates should remain low for a "considerable time" after its bond buying program is complete -- which should happen following its next meeting.

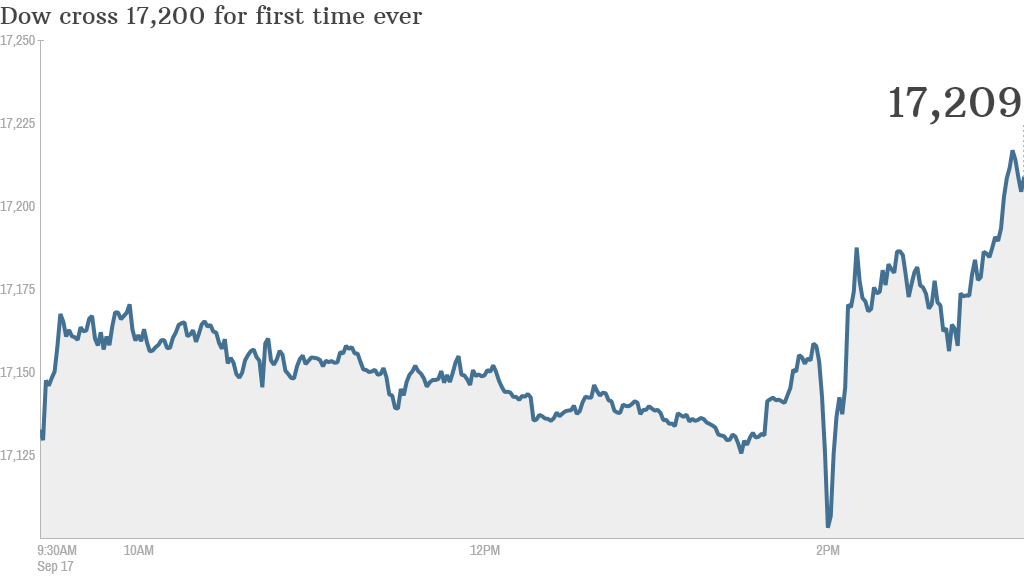

Investors were pleased. They sent the Dow to a record level in the afternoon -- crossing 17,200 for the first time ever. The index closed at a new high of 17,157.

Matthew Whitbread, portfolio manager at Barings Asset Management, said investors seem to be relieved that the Fed did not make any significant changes to its policy plans. But he said that the upcoming Scottish independence vote could inject some uncertainty into the markets if Scotland votes to break its ties to the U.K.

Fed chair Janet Yellen declined to comment about the potential market impact from Scotland when she was asked about it during a press conference.

Related: The big money behind Scotland's independence vote

The Fed also gave more details about its "exit strategy" to end the stimulus efforts it has had in place since the 2008 credit crisis and return interest rates to more normal levels.

As expected, the Fed said it is reducing, or "tapering," its asset purchases by $10 billion a month to just $15 billion. So it is widely expected to announce one final taper when it meets again in October.

Investors and economists had been debating whether the Fed would keep the "considerable time" language in its statement. If the Fed had dropped those two words, it could have been a signal from the central bank that it might look to hike interest rates in the spring of next year ... earlier than expected.

Related: Why the Fed language matters so much

The Fed has kept its key short-term rate near zero since December 2008. That rate influences how much interest consumers and businesses pay on many different types of loans.

But an improving job market has put some pressure on the Fed to begin unwinding its stimulus efforts and consider raising rates to keep the economy in check.

Fed's exit strategy: To that end, the Fed released details about an exit strategy, a blueprint for how to raise rates and reduce the amount of bonds it is currently holding in its portfolio. According to new interest rate targets from individual Fed members, the median forecast for where rates will be at the end of 2015 is 1.375%.

Still, there are no significant signs of inflation yet. Consumer prices even fell in August. And it appears that the Fed may be a little less bullish on the economy's prospects for the remainder of this year and next year.

Related: Judging by inflation, it's good to be American

At the end of the day, Yellen once again proved that she, much like her predecessor Ben Bernanke, has no interest in hurting the economy by raising rates too quickly.

"She is going to err on the side of leaving rates low for a longer period of time. She does not want to do anything to risk jeopardizing the recovery," said Chris Gaffney, senior market strategist with EverBank Wealth Management. "There is no reason for the Fed to jump in here and do anything just yet."

The Fed's best estimates: The Fed released new economic projections Wednesday and cut its forecast for gross domestic product (GDP) growth slightly for 2014. The change to its 2015 outlook was more dramatic. The midpoint of its forecast is for 2.8% growth in GDP next year, down from 3.1% in June.

The central bank tightened the range of its forecasts for the unemployment rate and inflation for this year and next but the midpoints are roughly the same.

Yellen said during the press conference that although she is concerned about the rebound in the economy, the job market has not fully recovered.

She added that all monetary policy decisions will depend on the data. In other words, future rate hikes could come sooner and be more rapid if the economy strengthens further. And if the economy loses steam, rate hikes would happen later and be more gradual.

The decision was not unanimous, an indication that there is disagreement amongst Fed officials about the direction of the economy. Two members of the Fed's policy committee voted against the Fed's actions.

Dallas Fed president Richard Fisher indicated that continued strength in the economy and "continued signs of financial market excess" -- i.e a surging stock market -- may make it necessary for the Fed to start raising rates sooner.

Philadelphia Fed president Charles Plosser objected to keeping the "considerable time" language because he thinks the Fed should not make any of its decisions dependent on the calendar.