If you need some good news in your life, look no further than the stock market. U.S. stocks have staged an epic comeback in recent days with the S&P 500 now up over 10% for the year.

If the gains hold, it will be the third straight year of double-digit stock market returns. That hasn't happened since the late 1990s.

But wise investors are always looking ahead, and the inevitable question now is: are stocks overvalued?

A look at the numbers: The classic way to measure whether stocks are cheap or not is to look at the price-to-earnings ratio for the S&P 500. It's a gauge of whether corporate earnings actually justify the stock market level.

The PE ratio is currently at 19, according to S&P Capital IQ. That's above the historic average of 15, although not too far off from the average of the last decade, which is nearly 17.

To put it bluntly, the PE certainly isn't in Black Friday discount territory, but it doesn't exactly scream swindled, either.

Related: The best investment I ever made

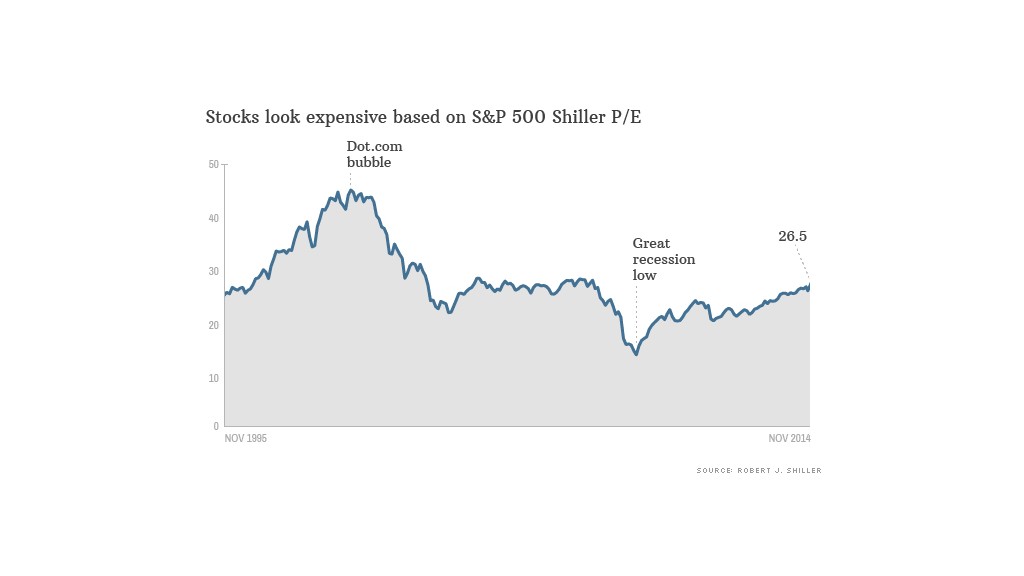

The bearish case: Market pessimists often point to what is known as the Shiller PE after Nobel Prize winning economist Robert Shiller.

He takes the PE ratio and makes some adjustments for inflation and average earnings for the past decade. It's akin to looking at calories from fat instead of just calories.

According to the Shiller PE, stocks are pricey. We're now at 26.5 by his measure compared to the historical average of 16.

The height of the dotcom bubble saw the Shiller PE shoot up to 44, while the worst of the Great Recession saw the ratio bottom out at 13. Shiller himself has warned that we might be in another bubble.

Related: Billionaire Michael Bloomberg's advice: become a plumber

Other considerations: But there are two other key factors to think about when judging stock prices: First, how fast is the economy growing and second, is the Federal Reserve likely to make a mess?

Optimists admit that U.S. stocks aren't cheap right now, but they see that shares are pushing higher for a logical reason: American companies and the economy are clearly expanding.

The latest corporate earnings came in strong despite headwinds from Europe, Ebola and ISIS, among others. All 10 S&P 500 sectors are growing and about 75% of companies beat expectations.

"Earnings growth in the current bull market has been 20% above the average level of growth for all bull markets," according to Bespoke Investment Group, which analyzed stock market expansions going back to the 1950s.

The U.S. economy is still chugging along with this year's GDP expected to be a bit above 2%.

All of that points to a pretty solid state of affairs. As a recent Goldman Sachs (GS) research note put it, "Macro and micro forces align to lift stocks to a new high; trend should extend till year-end."

Related: Liberals and conservatives blast the Fed

The big question mark: Stocks typically go into a tailspin because there is some gigantic mistake. Inflation gets out of control or the Federal Reserve moves too quickly to raise interest rates, for example.

"Policy mistakes are what led to recessions in the past," reminds Chris Hyzy, chief investment officer for U.S. Trust.

At the moment, inflation is 1.7% -- lower than the Fed's target of 2%. The market is certainly fearful of the central bank's intended interest rate increase in 2015, but Fed Chair Janet Yellen and her fellow board members are giving as many signals as they can about what's going to happen and when.

Stocks are certainly on the expensive side, but as Shiller said about the stock market on CNBC recently, "It's not a bad investment, all things considered."