America's energy industry is battling OPEC with a ferocity not seen since the 1980s. So far, it's not backing down.

The oil cartel's decision last week not scale back on production was widely seen as an attempt to choke off the U.S. shale boom. OPEC figures that by driving down oil prices, North American producers will collapse.

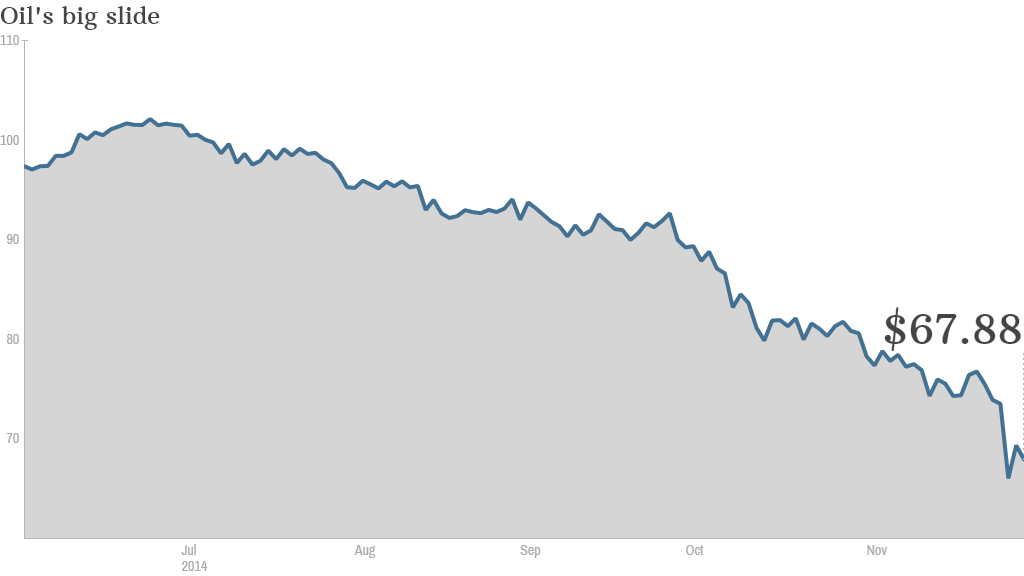

Both sides are feeling the heat as oil prices stay below $70. Oil rich nations are losing out on much-needed revenue to bankroll their budgets, and many domestic energy players are feeling the pressure as well.

But those who came to get rich in America's 21st Century oil rush shouldn't start packing their bags just yet. The U.S. is producing the most crude oil in 30 years, and prices would need to get much worse before the shale boom dies off.

Related: Oil and gas stocks aren't dead yet

How low can you go? Unlike many OPEC nations that are continuing to sell oil at prices below what they've budgeted for, U.S. shale companies can keep making money even if oil falls further.

According to a report by the International Energy Agency last month, most producers in North Dakota's Bakken formation, an area that's been a key contributor to the shale revolution, can remain profitable even if oil falls to $42 per barrel (it's currently at $68).

"U.S. shale producers are surprising resilient. They will drill as long as they have cash flow from their operations," said Per Magnus Nysveen of Rystad Energy.

To be sure, some energy companies will run into trouble. Those that borrowed heavily for exploration are particularly vulnerable to bankruptcy or being taken over by a larger player.

But many analysts predict that the industry will continue to grow next year, albeit at a more moderate pace.

Party like it's 1986? OPEC appears to be taking a page out of its 1986 playbook, when Saudi Arabia abruptly ramped up production and sent prices tumbling. The strategy worked, forcing many oil drillers in Texas, Oklahoma, and Louisiana out of business and allowing the Saudis to clinch more market share.

But this time around, it's different, according to Phil Flynn, an analyst at the Price Futures Group in Chicago.

That's because technological advances in oil extraction such as fracking have led to an unprecedented period of U.S. energy production.

"This isn't the 1980's, and this isn't the 1980s oil market," said Flynn. OPEC is "going to have a difficult time burying it," he added.

Trouble in OPEC-land? What's good for some in OPEC might not be good for others. As the largest and most powerful producer by far, Saudi Arabia can withstand a period of weaker oil prices.

Related: Ouch! Cheap oil is squeezing these countries

The situation is starkly different for Iran, whose economy is already reeling from sanctions over its nuclear program.

And in oil-rich Venezuela, where rampant inflation and economic stagnation were taking a toll even before the black stuff began to tumble, socialist President Nicholas Maduro was quoted by Reuters last week saying that he would push OPEC to cut production until oil bounces back to $100.

But the days of $100 oil might be a thing of the past for now, even though it was in triple digit territory as recently as July. Nysveen estimates it will take around five years to get back to that level.

"There are a lot of OPEC countries that won't be able to sustain the lower energy price," said Flynn."It's going to be hard to maintain unity."