Dick Evans isn't losing sleep over the turmoil rippling through the U.S. oil industry.

The Texas banker -- who defiantly rejected bailout money during the financial crisis -- is a firm believer in free-market capitalism where survival of the fittest rules.

Sure, some oil companies have piled on too much debt and won't be able to survive sub-$50 prices. But in the long run, that's probably a good thing for the industry at large.

"It's been too hot for too long. There's been too much money chasing too few deals. This is going to clean it up," Evans, the CEO of San Antonio-based bank Cullen/Frost (CFR), told CNNMoney.

Thanks to easy-money policies from the Federal Reserve, energy producers have feasted on $550 billion of bonds and loans since early 2010, according to Deutsche Bank.

Some of the smaller, more speculative U.S. shale companies could go bust if oil prices stay at these depressed levels, analysts now warn. These riskier players aren't generating enough revenue to offset the heavy investments they're making.

Related: Cheap oil is killing my job

More job cuts ahead: Yet Evans said the industry shouldn't fear this looming shakeout.

"That's good. That's healthy. Even the good companies got sloppy. And others were in the business who shouldn't have been," he said.

Evans acknowledges that the slowdown will result in painful job cuts. Companies like Schlumberger (SLB) and Baker Hughes (BHI) have already announced thousands of layoffs. More are expected.

But the banker is relieved the energy industry isn't in denial. It's making the tough decisions now, not waiting for sunnier days.

"To the person who gets fired, yes, that's horrible and I wish that wouldn't happen. From an industry standpoint, it is very healthy to deal with the truth," Evans said. "The quicker you get back to reality, the faster you solve this problem."

Related: Oil boomtown could see 20K layoffs

Banks tally potential losses: Of course, oil company defaults and bankruptcies aren't good for the financial firms that have fed the industry's addiction to cheap credit. And layoffs that slow economic growth aren't good for the banks in the region either.

But Evans, CEO since 1993, insists Cullen/Frost isn't staring at steep losses, even if prices stay low.

The bank conducted a stress test -- Evans emphasized this was an internal stress test, not one mandated by the federal government -- that revealed potential losses of less than 1% on its oil production loans. The test, which factored in customers' hedges, cash and equivalents, assumed prices drop to $37 in 2015 and stay below $50 through 2018.

Related: Banks are falling oil's next victims

Has Texas diversified enough? Yet Wall Street does seem a bit concerned. Cullen/Frost shares have fallen 12% so far this year.

A recent Morgan Stanley report named Cullen/Frost as one of the most exposed U.S. banks to the oil trouble. The report found that nearly 36% of the bank's assets are located in shale regions. That exposure rises to 78% if Houston and Dallas are included.

Evans strongly disagreed with the analyst who wrote the report, saying Morgan Stanley "ought to help that person get into a home and get some medical help."

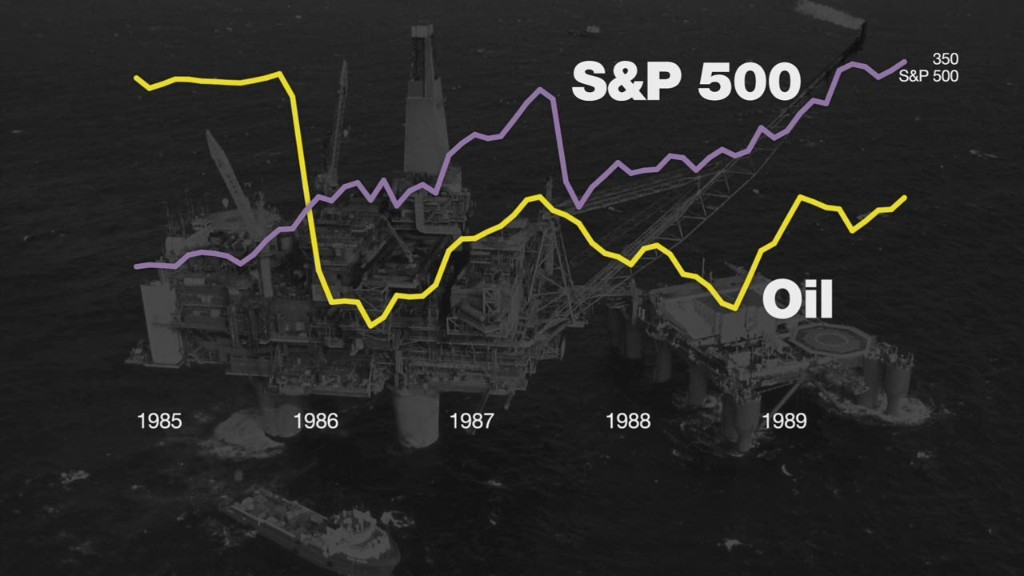

He said people don't realize it's not just about oil in Texas. Unlike during the 1980s when falling oil prices sparked a recession in Texas, today the state can lean on its diversification into other fast-growing industries like medicine.

"We haven't fallen off into the Gulf of Mexico like everyone thinks we have," Evans said.