Supporters of the Keystone XL Pipeline argue it will create cheap energy for American consumers.

But oil prices have already dropped dramatically, even as the controversial pipeline remains in limbo. Oil is down about 60% since June to its lowest level in six years. Some analysts believe it could even sink to $30 a barrel.

U.S. gasoline prices -- normally a hot-button topic with voters -- tumbled for a record 123 straight days until late last month. They're down by about a third from a year ago with the national average at $2.15.

"It's harder to make the argument we need this pipeline so that American drivers benefit when we have such low gas prices," said Tamar Essner, an energy analyst at Nasdaq Advisory Services.

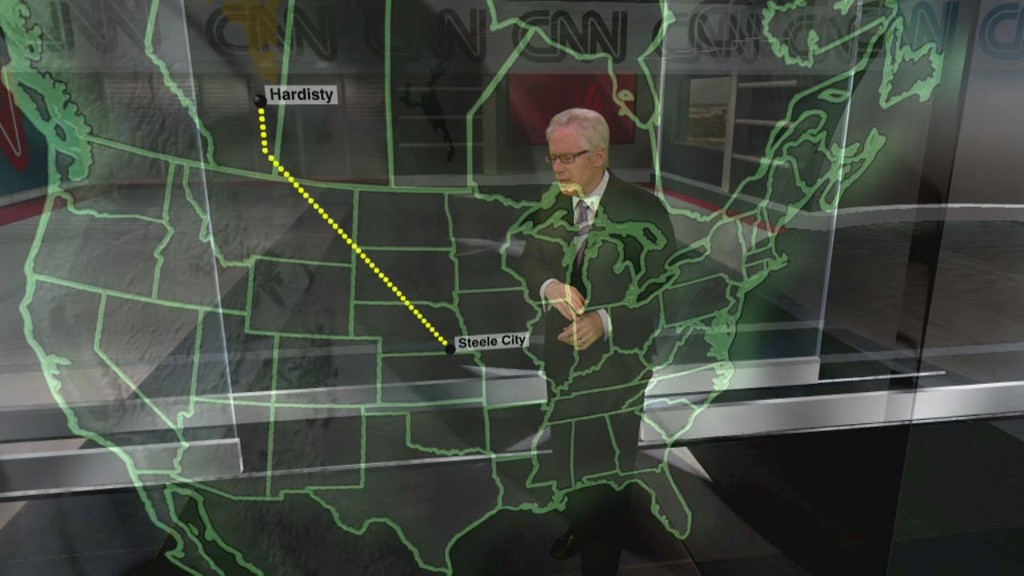

Even before prices plunged, Essner was skeptical Keystone XL would cut prices for U.S. consumers. She points to the fact that the pipeline would carry oil from Canada to the Gulf of Mexico where it would be refined and sold on the global market.

"I don't think that argument was ever true to begin with," she said.

Related: Fact checking Keystone job claims

Gas fades as hot-button issue: True or not, there is less political pressure on Washington today than when oil traded above $100 last summer.

Next week Congress is expected to send the White House a bill calling for the approval of Keystone XL, but President Obama has signaled he'll veto the measure.

"For most Americans, gasoline prices are simply not on the radar screen right now as a major issue. There doesn't seem as much urgency for Keystone as there was a few months ago," said Greg Valliere, chief political strategist at Potomac Research Group.

Related: Sex, drugs and murder in oil country

Canadian oil needs high prices: Given the price plunge, there's also less urgency to ramp up production of the Canadian oil that Keystone XL would transport.

That's because it's very expensive to extract and clean the black stuff emerging from the oil sands of Alberta.

Oil producers in Calgary may decide to shelve new investment plans if oil stays this cheap, although overall production will still likely increase this year.

Then again, there may now be even more demand for Keystone XL from an infrastructure perspective. Calgary-based Suncor Energy told analysts this week that with prices so low, it's no longer economic to ship crude by rail to the U.S. Gulf Coast.

"They need this pipeline more than ever because transporting oil via rail is more expensive," said Essner.

North American production is already surging: The oil price meltdown also highlights progress in America's efforts to gain energy independence, one of the goals supporters of Keystone XL often cite.

Surging North American production has been the catalyst behind the steep drop in prices. The U.S. now produces more oil than any country on the planet, and Canada isn't far behind.

"Now people are talking about U.S. energy exports. That certainly diminishes the fear of dependence on foreign oil," said Valliere.

Related: How the oil boom changed North Dakota

Unemployment is down, too: Supporters of Keystone also trumpet the project's job-creating abilities. Some have estimated the development would create as many as 119,000 jobs.

But as CNNMoney has previously reported, only 3,900 workers will actually be required to build Keystone -- and those jobs will only last for a year. Just 35 permanent positions will be created.

The jobs argument looks a bit less urgent now given the sharp decline in the U.S. unemployment rate.

Related: OPEC leader says oil could shoot back to $200

What if oil surges again? Of course, the dramatic nature of the oil price drop shows that energy prices can turn on a dime. Prices could jump again and Americans could be asking for relief.

"We've seen how the price of oil can skyrocket in the matter of a week. I wouldn't bet it will stay this low for too long," said Sheila Hollis, a partner at Duane Morris specializing in energy policy.